Shakespeare Property Group to take Reservoir on Crown in $115m deal

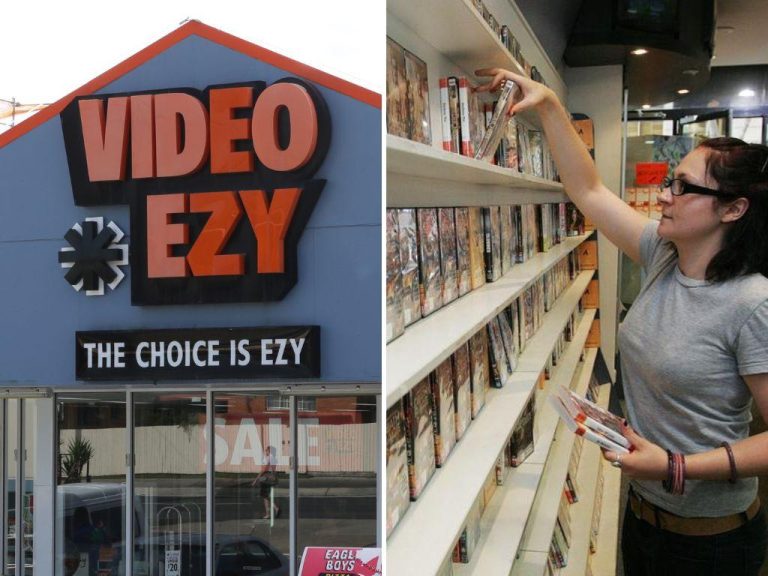

The Winery by Gazebo, one of the tenants at Reservoir on Crown. Picture: NCA NewsWire / Gaye Gerard

Shakespeare Property Group has swooped on a major Surry Hills mixed use holding in a deal worth about $115m in a sign that Sydney’s fringe office market will hold up.

The company is buying the three-level property on the corner of Crown and Campbell Streets known as Reservoir on Crown from LaSalle Investment Management.

The move is in keeping with strong expectations for the site and points to ongoing demand for assets which have additional income streams.

Shakespeare is a well known office trader and was also reported this year to be close to signing off on the purchase of the Palazzo Versace on the Gold Coast. The Melbourne-based company had an exclusivity agreement to buy the trophy asset for about $114m. Shakespeare is the commercial property arm of Prime Value – founded by Yak Yong Quek in 1998 – which manages a $1bn portfolio comprising Australian equities, cash-like instruments, retail, office and hotel properties, and agricultural assets.

The 285a Crown St asset was taken to the market via Knight Frank agents Paul Roberts, Jonathan Vaughan, Tim Holtsbaum and Dominic Ong and JLL agents Mitch Noonan, Luke Billiau, Sophie Tieman and James Aroney.

Reservoir on Crown, which was built in 1960 and redeveloped by Mirvac in 2009, has a net lettable area of 4,727sq m and sits on a 3,058sq m site, one of the largest in Surry Hills.

The office component totals 3,671sq m over two floors, with tenants including The Commons and Intercom Software, while the retail component, occupied by tenants including The Winery by Gazebo, totals 1,056sq m. There are 15 car parks.

The property is multi-let to 11 high-quality tenants across a diverse range of industries, with annual fixed increases to provide growth in the income.

The building has been future proofed, having undergone a recent capital expenditure program minimising expenditure requirements.

It offers value-add options, including the potential for further rental reversion or the opportunity to subdivide the existing winery and cafe from the main building to sell off.

With historically tight supply and a limited development pipeline in Surry Hills, there may also be an opportunity to strata subdivide the entire property, or take advantage of tangible development potential for a further two floors with an estimated 1,500sq m of additional space.

Reservoir on Crown is also well positioned to leverage the recent council-led planning proposal on nearby Oxford St, with the immediate area also featuring buildings with greater heights and floor space ratios on smaller land parcels.

JLL Research data shows Sydney’s fringe market among the strongest in Australia, with an annual net face rental growth rate average of 5.9 per cent between 2012 and 2022.

Agents and parties refused to comment.