Lendlease looks to better returns as home projects fire

Lendlease will balance big projects like One Circular Quay with smaller developments.

Lendlease chairman John Gillam spent two decades at Wesfarmers turning Bunnings and Officeworks into category killers and believes that the faded construction and development icon can be the scene of a corporate revival.

While Mr Gillam has only chaired Lendlease for just over a year, it will take a big turnaround over the remainder of the decade for the market to be convinced that it is truly back.

“The company has a storied history and what we’re determined to do is to re-establish the company’s reputation as an outstanding participant across development and construction and investment,” he said. “But also an outstanding investment in terms of our performance for our security holders.”

Mr Gillam’s induction to the company has been tumultuous. Activist investors and super funds pushed for his long-serving predecessor Michael Ullmer to swiftly depart.

The new chairman has since overseen the return of billions of dollars of capital back to the high-performing Australian operations but the company still has its work cut out fully defining and delivering on its new strategy.

“At our best we can play an important role across every sector in Australia,” he said. “Lendlease, at its best, is a really important part of modern Australia.” But there is a catch.

“What we have to do is restore our financial reputation and I think we’ve worked very hard to do that so far but we’ve got more down payments to make.”

Mr Gillam believes that the company can succeed as a slimmed-down developer and funds manager focused on Australia with an active investment arm that can succeed globally. After years of offshore writedowns, he believes the company can take on the kind of financial discipline that marked out Bunnings and the broader Wesfarmers empire.

Since its strategy reset in May last year, Lendlease has exited businesses in the US and Britain, unloading building companies and cutting its exposure to mega projects, while also keeping an enviable roster of funds and mandates under its wing.

“So much of our future has international flavour to it,” Mr Gillam said, citing the company’s capital partners, position in Britain alongside the Crown Estate, and its Japan and Singapore operations.

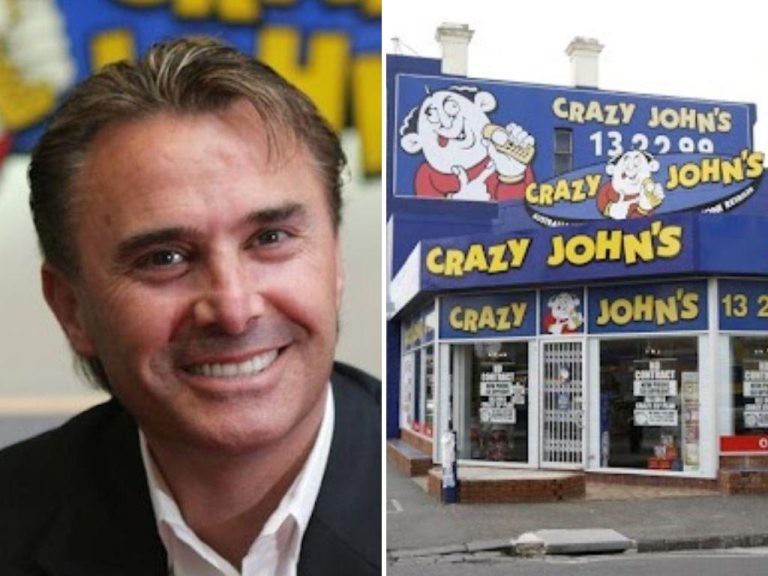

Lendlease chairman John Gillam

But the company is now far more focused on Australia and profitable projects including luxury residential towers in Sydney and large-scale precincts like the planned Olympics Village in Brisbane. More will come in data centres and the next generation of office towers.

“We have brought a very strong domestic flavour to the portfolio,” he said, noting this was not it’s only edge. “We think the balance is emerging in the right way and particularly the de-risking of the company, with the international construction businesses being exited.”

Lendlease still counts activist shareholders on its register – most of whom appear satisfied for now – and needs to get over a bruising battle with big superannuation funds after it fought to keep its flagship $10bn local property funds empire in one piece. This stoush left it on bad terms with agitated super fund investors led by Hostplus.

Mr Gillam believes there is a solution. “We’re disappointed that we have a unit holder that’s dissatisfied. We’re working very sincerely and proactively to address that … we are determined to find a pathway forward for all unit holders.”

The company has a three-pronged strategy. First, last year’s reset is to be completed, with exits from retirement living and some offshore projects to come. Then there is improving governance to avoid the pitfalls that hurt the company in its rockiest period.

The final element is laying out how it will generate double digit equity returns from its investment, development and construction units, with an emphasis on transparency. The company is seeking to translate its award-winning projects into a much better financial performance.

“What we need to do is to get more velocity on our capital, and that comes about by finding ways to invite capital partners in earlier, finding ways to create better opportunities to move projects through phases faster,” he said. “That’s all part of really challenging ourselves to be a more high performing, strong returning business.”