Melbourne launches Australia’s first Ben & Jerry’s Sundae Shack

Melbourne has been chosen to launch Ben & Jerry’s first in-line Sundae Shack in Australia, as global brands pivot to smaller, lower-cost store formats.

Melbourne’s famed laneways have landed the first Ben & Jerry’s in-line Sundae Shack in Australia, as the global ice-cream brand quietly rolls out a smaller, cheaper store model designed to fuel national expansion.

The Hardware Lane opening marks the first bricks-and-mortar, non-kiosk Sundae Shack to launch in the country, with the Melbourne CBD chosen as the proving ground for the new format amid renewed confidence in high-foot-traffic food precincts.

While a kiosk version opened in Western Australia earlier this year, the Hardware Lane store is the first fully in-line Sundae Shack nationally, a move industry insiders say reflects a broader shift in how global food brands are entering the Australian market.

RELATED: ‘Fix it’: Portelli faces fuel furyRevealed: Metro Tunnel retail frenzy

Surprise Melb property predictions for 2026

Ainsworth Property associate director Tan Thach said Melbourne was a natural launch city, given Ben & Jerry’s existing CBD performance and the enduring appeal of the city’s laneway dining culture.

“They’re very selective about where they open,” Mr Thach said.

“Ben & Jerry’s really wanted to embed themselves in that iconic Melbourne laneway experience, and Hardware Lane made sense because it’s active across lunch, dinner and into the evening.

Ben & Jerry’s new in-line Sundae Shack has opened in Hardware Lane, one of Melbourne’s most competitive food precincts, amid strong demand for high-foot-traffic sites.

“It allows them to tap into both locals and tourists in a high-energy, food-led precinct.”

Mr Thach said while the store was being positioned as a careful first step, it was clearly part of a broader rollout strategy.

“From our conversations with the Ben & Jerry’s team, this is definitely intended as a first step, but the priority was to get the first store absolutely right,” he said.

The in-line Sundae Shack model differs from traditional Ben & Jerry’s scoop shops by focusing on a smaller footprint and faster service, a shift that comes as hospitality operators rethink costs and expansion strategies.

Industry sources say establishment costs for the in-line Sundae Shack format typically range between $300,000 and $500,000, significantly lower than many traditional hospitality fit-outs.

“What we’re seeing now is operators pivoting to smaller, more efficient stores,” Mr Thach said.

“Staffing and fit-out costs are lower, and the income-to-cost ratio is much stronger.

“That makes these smaller, high-turnover concepts far more attractive in today’s environment.”

The move comes amid a rebound in Melbourne’s retail and hospitality market, driven by improving consumer confidence and the gradual return of office workers to the CBD.

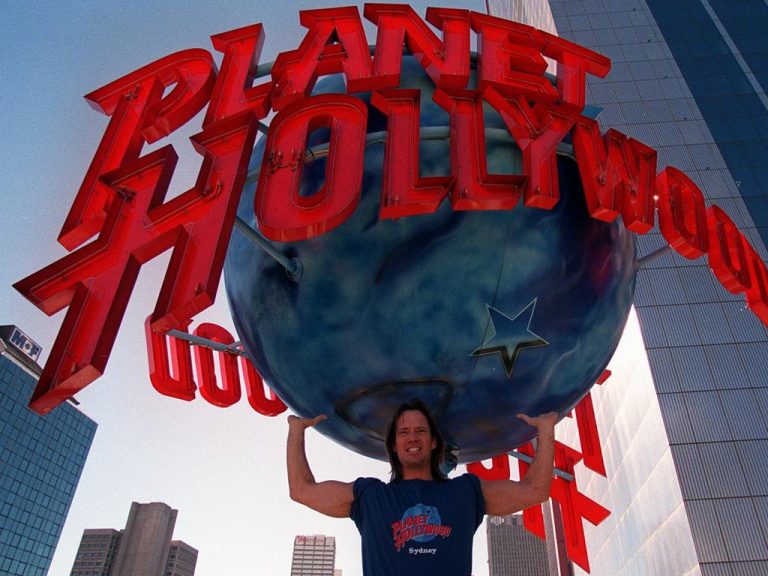

Global food brands are increasingly favouring smaller, high-turnover stores as rising costs reshape Australia’s retail landscape.

Picture: Glenn Campbell

“Retail performance is closely tied to the office market,” Mr Thach said.

“The more workers returning to the CBD, the stronger the customer base becomes for retailers.

“While some discretionary retail has softened, people still need to eat and drink.

“Restaurants are busy, dessert venues are seeing queues, and that momentum has really built over the past 12 to 18 months.”

Confidence in the location was underscored by strong competition for the Hardware Lane site, with Mr Thach confirming eight separate offers were received before the landlord selected Ben & Jerry’s.

“Ultimately, the landlord chose Ben & Jerry’s because of the strength of the brand, their track record and their experience operating successfully in the Melbourne CBD,” he said.

Ben & Jerry’s has operated in Australia since 2009 and now has more than 30 scoop shops nationwide. The brand has also established franchise territories across multiple states, paving the way for further expansion using the lower-cost Sundae Shack format.

Melbourne’s CBD and laneways are emerging as test beds for global brands trialling leaner retail models ahead of wider national expansion. Picture: Jason Edwards

Mr Thach said the economics of smaller stores made national scaling far easier.

“Rather than opening one large store that costs significantly more and doesn’t necessarily generate proportionally higher revenue, brands can open multiple smaller sites across different locations and markets,” he said.

Interest is already coming from outside Victoria, particularly from overseas operators looking to enter Australia via Melbourne.

“We’re seeing strong interest from interstate and international groups,” Mr Thach said. “Japanese food concepts in particular are looking at Melbourne, Sydney and Brisbane as part of an east-coast strategy.

“The city’s inner-city food precincts are unique. They carry a lot of appeal for brands wanting to establish credibility and visibility quickly.”

While some global brands still favour large flagship openings, Mr Thach said the rise of smaller, flexible formats was reshaping Australia’s retail landscape.

“It really depends on the brand and their appetite for scale,” he said.

“But what’s clear is that getting the location right has become critical, and that’s driving more careful, deliberate launches like this one.”

Sign up to the Herald Sun Weekly Real Estate Update. Click here to get the latest Victorian property market news delivered direct to your inbox.

MORE: Bourke St buyers bet big on revival

Final Melb riverfront lots spark west rush

Melb KFC ignites insane $8m battle

david.bonaddio@news.com.au