WA and Qld estates shaken, not stirred by mining peak

The extraordinary surge in resource investment is slowing yet there are few gloomy faces in WA and Queensland’s industrial property sectors, Paul Thornhill finds.

In Australia’s resource rich states, the slowing of project investment is having an impact, but the supply and demand fundamentals are weighing more heavily on the market – and they point to continued growth.

In the sunshine state, Jones Lang LaSalle’s Queensland Head of Research, Leigh Warner, doesn’t see the transition away from resource investment having a major impact.

“Brisbane is a market that matured only ten years ago and we’re finding that many investors who were traditionally underweight here are now looking to up their stake.”

In WA, the property sector remains upbeat with the recent Property Council of Australia-ANZ Property Industry Confidence Survey finding the state still scores highly in the confidence stakes.

WA Property Council Executive Director, Joe Lenzo told RealCommercial that, “Existing industrial estates around Perth are essentially full. While there are some vacant smaller lots, the real demand is for large sites closely linked with transport and infrastructure.”

“Sure we’ve seen some winding back of resource-based activity in areas like steel fabrication but that’s being offset by demand for large warehousing properties – and there’s not much of that around.”

Coles and Woolworths both recently established new centres close to Perth Airport while Aldi is searching for a base in WA.

In Queensland, retailers are behind an efficiency drive which is spreading across commercial property. Warner told RealCommercial that, “Management wants cost savings where ever they can find them and property use is the first place they start looking.”

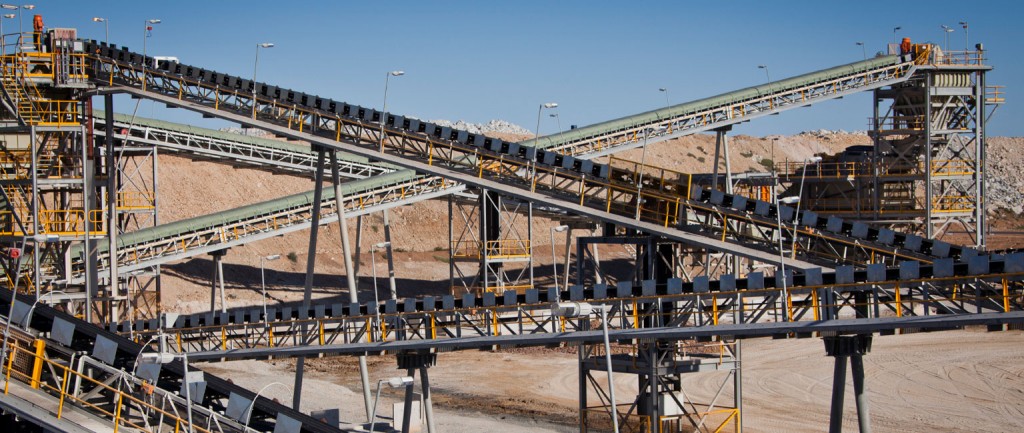

The biggest impact of the resource boom fell on smaller regional markets, but even here there is confidence. Warner points out that that, “Much of the demand for industrial property associated with the boom was for storage space of construction materials. While that may taper off, particularly in regional markets, there’s an overlap to some extent with a surge in coal seam gas activity.”

In regional WA, LandCorp brought new estates in Port Hedland and Karratha onto the market, but this has been offset by the deferral of the $2.3 billion Okagee port development in Geraldton.

Perth industrial properties remain resilient though according to Lenzo. “Rents in areas like Welshpool and Malaga are holding up, but in the medium term, we’ll be watching whether supply from new estates like Latitude 31 has an effect on the market.”

In Brisbane, Warner sees yield compression over the next year or so with values rising. “Industrial rents are higher than Melbourne and at the same level as Sydney, so I expect them to remain stable in the short term.”

“Construction is picking up but many institutions are holding developments in trusts of related entities, not releasing them onto the market. That’s leading to some frustration with investors contemplating a move up the risk curve into secondary properties.”

“The other factor to consider is that properties developed in our construction boom 9-7 years ago have their leases coming up in the next couple of years. With businesses looking to prune their costs, it’s likely we will see some movement.”