Three asset classes benefiting from a stronger Aussie Dollar and economy

The Aussie Dollar is at its highest level against the greenback in nearly three years and is steady against others, so what does this mean for the commercial property sector?

CBRE’s head of research Sameer Chopra believes the recent uptick to 70 US cents – 11% stronger than a year ago – is a “rounding error” but what it implies is more important.

He said it’s easy to point the finger at US politics and US President Donald Trump’s decision to act on Venezuela, and talk of colonising Greenland, but this is noise.

“Investment markets don’t care as much about geopolitics – what is more important is two things becoming more evident,” Mr Chopra told realcommercial.com.au.

“One is our interest rates are not expected to fall as far as US interest rates. Currency is fundamentally about interest rates – the rest is noise.

“The second is our economy is that it’s doing a bit better than where we were looking at last year. What’s driving this is population growth – and population growth is good for real estate.”

CBRE’s head of research Sameer Chopra. Picture: Supplied

The next RBA interest rate decision will be delivered on 3 February, with speculation building that a hike is on the table following a stronger-than-expected jobs report released by the ABS earlier in the month, which showed the unemployment rate fell to 4.1% in December.

Confidence of a rate hike grew again on Wednesday as headline inflation hit 3.8% in the 12 months to December, higher than expectations; the trimmed mean rate hit 3.3% – well outside of the RBA’s target band of 2-3%.

“Interest rate holds are bearish for real estate, but population growth is a net positive for property markets,” Mr Chopra said.

This was echoed by PropTrack senior economist Anne Flaherty.

“From the impact of offshore investors, the impact of where the Aussie dollar is sitting is typically secondary to factors such as yield, as well as factors such as economic and population growth that could impact the performance of the asset,” Ms Flaherty told realcommercial.com.au.

Mr Chopra also believes rent growth or yield is what’s more important in 2026, rather than price growth.

REA Group senior economist Anne Flaherty

Flashpoint in the market

While a weaker US Dollar is good for those buying goods or travelling overseas, Mr Chopra said a continued uptick in the Aussie Dollar wouldn’t necessarily be a good thing for commercial property investment.

“(If Australia suddenly bought USD $0.80) markets would freeze, and volatility is never good – you actually want as low a volatility as possible,” Mr Chopra said. “If there’s a big movement in the interest rate or currency rate, people just sit.

“We saw this in November and December – bond yields moved up by 40 basis points and that caused for a pause in the market over what is the right cap rate, and if we need to change our exit cap rate.”

The cap rate is used in commercial property to help assess a property’s expected yield or value, and is also a useful measure of an asset’s risk profile. A higher cap rate can signal higher risk, with investors seeking higher returns as compensation.

It is calculated as the net operating income divided by the property’s market value; the percentage return an investor would get if they purchased the property for cash.

Which sectors are benefiting from a stable economy?

During periods of a higher dollar, Ms Flaherty said foreign demand doesn’t typically disappear, but tends to be more selective and focused on prime, long-term assets.

“Large institutional assets such as CBD offices and prime industrial stock are the most sensitive, given their reliance on offshore capital,” Ms Flaherty said.

“By contrast, sectors like retail are more driven by domestic buyers, meaning currency movements tend to play a smaller role.”

If yield is key, and population growth is propping up the economy, the experts agreed investors should look for the key sectors benefiting from this: retail, hotels, and childcare.

“All of this for now is screaming a positive for retail – shopping centres and the like – because anything that’s immigration driven is very positive for shopping centres,” Mr Chopra said.

“The other sector where population growth plays a bigger role is childcare because of the increased demand and people moving to Australia with their kids.”

“The third is hotels because everyone that comes to Australia is initially ‘on holiday’. Hotels are undersupplied at the moment – especially in Queensland in the lead up to the 2032 Olympic Games.”

Ray White head of research Vanessa Rader. Picture: Supplied

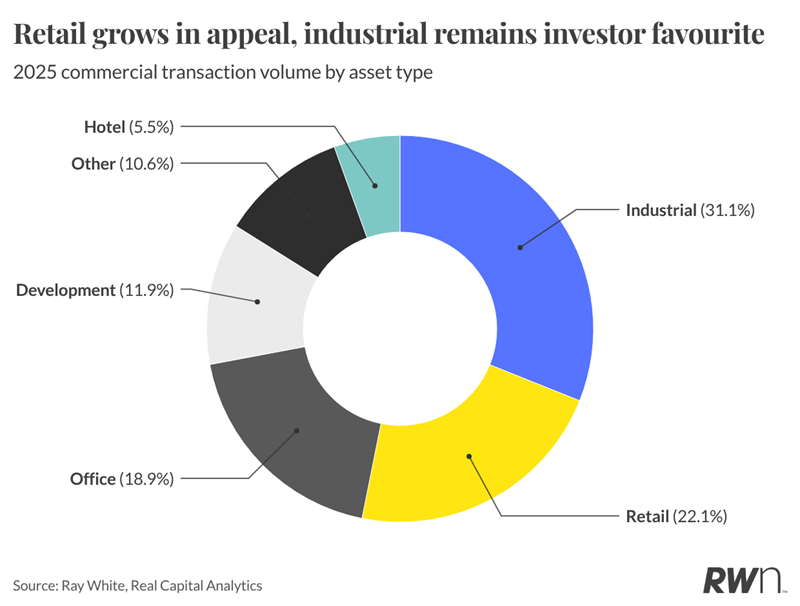

This is supported by Ray White research, in which retail was 2025’s “most notable shift” – volumes climbed 43.8% to $18.90 billion, amounting to more than a fifth of all commercial transaction volume.

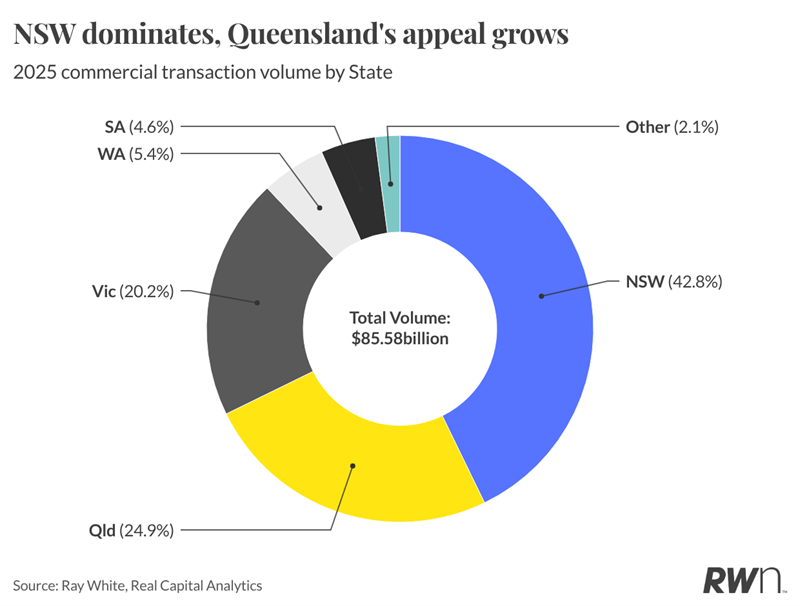

Queensland accounted for a quarter of all transaction volume, up 61.1% on 2024 to $21.35 billion.

The average deal size nationwide jumped 50.5% to $11.72 million, and the research identified supermarket-anchored assets in growth corridors as being particularly strong.

For hotels, transaction volume amounted to $4.72 billion, up 42.5% on the year.

“Strong occupancy data and robust tourism activity, both domestic and international, are driving buyer interest across city and regional locations at varied quality levels,” said Vanessa Rader, Ray White’s head of research.

Queensland saw strong commercial property sales volume in 2025. Source: Ray White Research

Sales volume in the ‘other’ category, which encompasses childcare centres, climbed 80.5% to $9.04 billion.

The childcare sector is set to be further supported by the federal government’s three-days-a-week childcare guarantee in 2026, according to Ms Rader.

This was also reflected in a recent CBRE sale of a childcare centre in Sydney’s southwest at 120 Lodges Road, Elderslie, for $11.5 million with a yield of 5.26%.

“Childcare is regarded as a defensive asset class known for its resilience, and Australia continues to offer stable investment opportunities supported by strong demographic fundamentals driving long‑term demand,” co-agent Yosh Mendis said.

“Combined with its land‑tax‑free status in NSW and ongoing bipartisan government support, the childcare sector remains highly attractive to Asian investors.”

The strongest asset classes by sales volume in 2025. Source: Ray White Research

Experts’ warning: Don’t be complacent

On policy, CBRE’s Mr Chopra had a word of warning.

“Australia should not become complacent… land taxes and any foreign taxation [are counterproductive],” he said.

“We think stability is what’s needed – including green shoots in immigration and government infrastructure spending.”

This was echoed by Ray White’s research.

“Retail’s resurgence confirms operational resilience, and rising average prices indicate buyers see value despite higher entry costs,” Ms Rader said.

“The critical question for 2026 centres on interest rate policy. If rates fall as markets anticipate, development activity should accelerate meaningfully, while continued focus on existing stock will reflect replacement cost economics and genuine scarcity value in quality assets.”

A continued strength in the Aussie Dollar, as Mr Chopra suggested, could also weigh on the tourism sector, particularly against many Asian currencies in which a lot of visitors originate.

Where it’s a positive, as Ms Flaherty points out, is lowering construction costs because imported materials become cheaper.