Interest rate cuts drive commercial property market with retail a standout winner

The two interest rate cuts handed down by the Reserve Bank this year have stimulated new buyer activity in the commercial sector, with investors circling certain pockets of the market.

REA Group senior economist Anne Flaherty says commercial property sales are surging as investors look to specific pockets of the market in search of higher returns on investment and stable returns.

“Expectations that interest rates are going to be cut further will stimulate demand and make certain investments more feasible to buyers,” Ms Flaherty said.

Read more:

Commercial Property Loans

Business Loans

Warehouse Loans

Business Lending & Equipment Financing

A retail renaissance in the commercial property sector has seen retail assets outperform in 2024/25. Picture: Getty

This ‘selective recovery’ is set to favour assets with strong fundamentals, according to Ray White’s head of research Vanessa Rader.

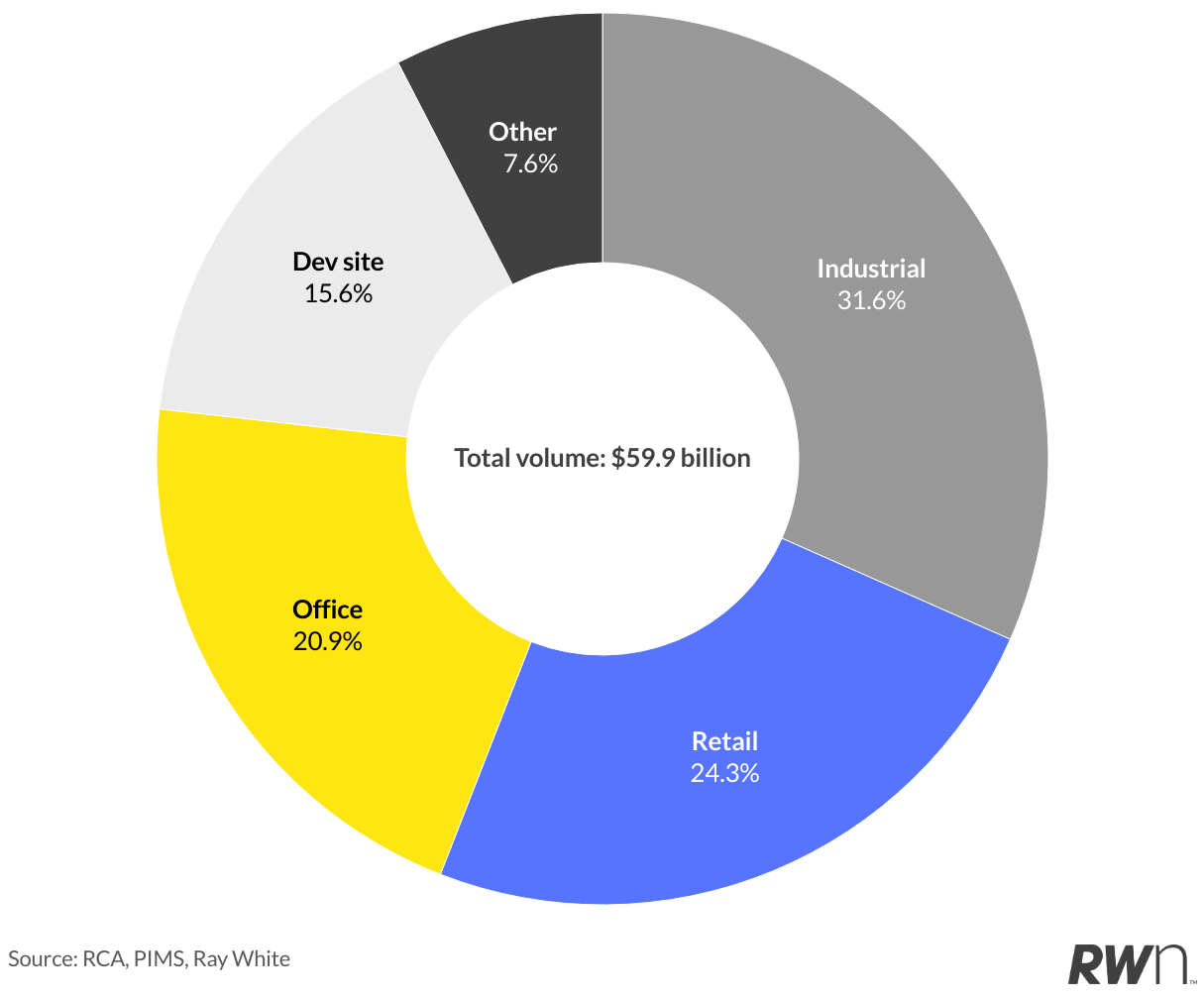

Over the 2024/25 financial year, Ray White data shows $59.9 billion worth of commercial property was sold across 7,754 transactions.

While the number of deals was 18.5% lower than a year earlier, the value of sales remained stable as institutional and offshore investors pursued fewer but significantly larger transactions.

Retail has emerged as a standout winner, posting a 19.2% surge over the year, while recession-proof assets such as medical and childcare faced a substantial decline as investors became more choosy in the buoyant sector.

“This reduction reflects increased selectivity from investors in these previously popular alternative asset classes, with buyers becoming more discerning about location, operator quality, and long-term demographic trends,” Ms Rader said.

“Smaller industrial will remain attractive to private and owner-occupiers, with a more affordable entry point. With the reduction of interest rates, renewed interest in leased investments such as childcare, medical, service stations, fast food, however, location will need to be considered,” she said.

Investors had a strong appetite for fast food restaurants in the 2024/25 financial year. Picture: realcommercial.com.au

Commercial real estate agency Burgess Rawson from CBRE says investor appetite for essential services, particularly fast food, convenience and retail and childcare has been strong heading into the new financial year.

Matthew Wright, partner at Burgess Rawson said a shift towards long-term resilience will see buyers continue to favour essential service investments that offer reliability, tenant strength and long-term relevance.

“Buyers are increasingly focused on properties that will perform across all cycles. There’s strong competition for assets backed by household names, with long leases and secure income streams, particularly in growth corridors and established suburban markets,” Mr Wright says.

The agency reported record sales in the childcare sector in its latest portfolio auction, with total sales volumes exceeding $124 million in 2025 so far.

Rate cuts to drive activity in year ahead

With more rate cuts on the way, Ms Flaherty noted a broad range of assets from childcare centres, service stations, swimming pools, laundromats and retail assets are changing hands as buyers take advantage of population growth, the low unemployment rate and favourable tax settings offered in some states.

Buyers consider the unemployment rate when analysing parts of the commercial market to seek out key targets.

“Any industry experiencing a growth in the number of employees being hired in that sector and location could represent an opportunity in the commercial sector,” Flaherty says.

An expectation for further interest rate cuts in 2025 is driving market optimism and activity for the commercial market. Picture: Getty

Ms Rader predicts that the expected continuation of rate reductions into 2025/26 will provide further stimulus to transaction activity, particularly benefitting sectors with strong fundamentals such as industrial and retail.

“While sellers remain in a cautious holding pattern due to global economic uncertainties, the combination of improving interest rate conditions and Australia’s relatively stable economic environment suggests increased investment activity ahead,” she said.

The outlook remains somewhat complex within the outperforming industrial sector, as soaring demand for specialised assets such as data centres and cold storage skews headline performance – masking some cooling in traditional warehousing.

Investors are looking at assets that shield them from high construction costs and longer build timeframes, Ms Rader said.

“Demand and limited supply, particularly in high population growth areas has seen high net worth buyers, family offices and private syndicates move up the price range, securing larger assets.

“With reduced interest rates, we may see some buyers move up the risk curve, however, most buyers are more cautious after yield corrections seen over the last 18 months on most asset classes,” Rader says.

Commercial property performance in 2024/25

The commercial property market has transitioned from correction to cautious recovery in the latest financial year with broad-based investor interest in the retail sector driving a ‘retail renaissance’, according to sector-specific analysis by Ray White.

Turnover by asset class

Industrial

According to Ray White, the industrial property market maintained its position as the largest sector by volume, attracting $19 billion in transactions during the 2024/25 year, representing 31.6% of total market activity.

Warehousing, logistics facilities, and the increasingly significant data centre segment performed particularly well, offering low vacancy rates and continued demand from ecommerce and logistics operators. Data centres have attracted substantial institutional and offshore investment.

Retail

The retail sector emerged as the standout performer, with transaction volumes surging 19.2% to reach $14.6 billion in 2024/25, representing 24.3% of total market activity.

“The sector attracted broad-based investor interest across neighbourhood centres, sub-regional assets, and strip retail locations, with private investors particularly active in the sub-$20 million segment while institutional and offshore capital targeted larger portfolio opportunities,” Ms Rader said.

Ray White’s report suggests this is evidence of a retail renaissance underpinned by limited new supply and strong population growth. Despite the strong volume growth, transaction numbers did decline 21.3% to 1,472 deals, again reflecting the trend toward larger transactions.

Office

The office sector recorded $12.5 billion in investment activity, representing 20.9% of total market activity and achieving a modest 2.1% increase from 2023/24. This continues the structural adjustment within the sector, reflecting ongoing high vacancy rates and the permanent impact of hybrid working arrangements.

Prime assets have performed best, attracting both institutional and offshore investors seeking quality, while secondary grade stock faces mounting pressure, with potential for further value declines.

Meanwhile, development site transactions reached $9.4 billion, representing 15.6% of total market activity, marking a 15.8% decline year-on-year.

Hotel and pubs

The hotel and pub sector attracted $2.9 billion in investment, representing 4.8% of total market activity and experiencing a slight 1.3% decline year-on-year.

The sector continues to benefit from tourism recovery and strategic repositioning of assets, with both domestic and offshore capital showing interest in quality hospitality assets.

Medical and childcare

The medical and childcare sector generated $1.7 billion in activity, representing a 2.8 per cent of total market activity, representing a notable 28.9 per cent decline year-on-year.

A 2024/25 state-by-state breakdown

New South Wales continued its dominance, attracting $25.8 billion in transactions during 2024/25, representing 43.1% of total national activity. Despite a modest 1.5% increase in dollar volume, NSW experienced a 7.2% decline in transaction numbers, indicating a flight to larger, institutional-grade assets, Ray White’s latest commercial data shows.

Victoria recorded $13.4 billion in commercial property transactions, representing 22.3% of national activity, although this representing a concerning 12.2% decline in dollar volume and a substantial 27.7% reduction in transaction numbers as incoming buyers continue to turn away from the market due to concern about taxation issues – reducing urgency from buyers and dampening a commitment to purchase from domestic and international buyers.

Queensland’s commercial property market demonstrated solid momentum, with total transactions reaching $11.8 billion, presenting 19.7% of national activity and achieving a healthy 5.6% increase in dollar volume.

South Australia emerged as a standout performer by percentage growth, recording $3.5 billion in commercial property transactions and achieving a remarkable 16.9% increase in dollar volume, which still represented an 11.5% decline in transaction numbers.

Western Australia attracted $4.2 billion in commercial property investment, achieving a solid 5.0% increase in dollar volume despite a 22.4% reduction in transaction numbers. Perth accounted for the majority of this activity.

The smaller jurisdictions of ACT, Tasmania and Northern Territory all experienced declines in both dollar volume and transaction numbers, with Tasmania showing the most dramatic reduction in transaction count at 39.9%. These markets reflected reduced investor interest and limited stock availability. Ray White suggests that opportunities remain for investors seeking smaller-scale assets.