Retail crisis: How Temu, Shein are forcing Aussie store closures

Australia’s retail heartland is bleeding, and the wounds are deep. A silent, digital invasion by Chinese e-commerce behemoths like Temu and Shein is not just changing how we shop; it’s systematically dismantling our beloved brick-and-mortar stores and threatening to decimate the very fabric of our commercial property market. This isn’t just a trend; it’s a full-blown crisis and Australia’s business leaders are finally taking note.

According to Sky News Australia’s New South Wales Political Reporter Julia Bradley, the biggest concern is a lack of regulation and “just how cheap these goods are.”

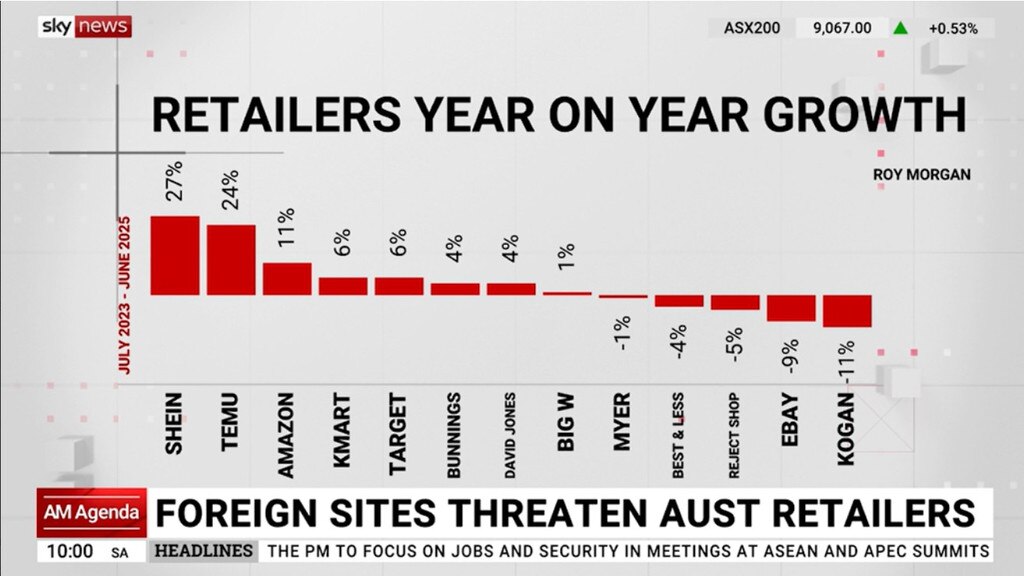

“We’re seeing massive growth from these two sites, in particular,” she told Sky News.

“So we’re seeing business leaders, anyone from the likes of Andrew Forrest and Dick Smith coming together to promote local manufacturing, local industries, and also pushing people to buy local.

“Our sector’s worth $430 billion in Australia, the largest private sector employer – 1.4 million Australian jobs, that represents.

“But over the past few years, so many Aussie labels have folded, whether that be Millers or shoe brand Wittner.”

RELATED

Aus retail under siege: Temu, Shein’s brutal impact

Temu, Shein rip-offs: China’s Aus threat amid store shutdowns

Major supermarket chain on cusp of closure

Source: Sky News

Since Temu burst onto the Australian scene in 2023, it’s been an unstoppable force, crowned the fastest-growing digital brand in the country by Similarweb’s 2025 Digital 100 Australia report – even outstripping AI powerhouse ChatGPT. Temu’s own data boasts a staggering 72 per cent increase in unique website visits in 2024, a claim echoed by its reign as the most downloaded app on iPhones that same year.

It is great news for Temu, but bad news for the bricks-and-mortar brands in Australia that are the faces of our shopping centres and main streets.

News of iconic brands closing stores or going into administration under the weight of poor sales and increasing costs has become the norm over the last two years.

In 2024, retail giant Mosaic Brands – owner of Millers, Rivers, Crossroads, Katies, Noni B and Autograph – spectacularly collapsed owing $318 million, with more than 4000 staff members impacted.

Source: Sky News

In March this year, Ally Fashion was placed into administration owing $58 million. A raft of store closures followed in a bid to save the business.

Just last month Australian retailers including Rip Curl and Kathmandu announced they would shutter 14 stores after parent company KMD suffered an annual loss of $105 million.

This list is not exhaustive but it represents a growing threat to Australia’s commercial property landscape.

“Amazon’s also being mentioned as a concern,” Ms Bradley said.

“They rip off local designs too and also add to landfill, and there’s not really a plan around how to combat that.

“Also, (Managing Director and Chief Executive Officer of Wesfarmers) Rob Scott, which owns Kmart, Target, Bunnings and Office Works, he says there’s an uneven playing field because Aussie retailers, they face high taxes and all the regulation that many foreign outlets don’t.”

Customers are drawn to Temu and Shein for their bargain prices but Aussie retailers are concerned the foreign e-commerce sector isn’t regulated enough.

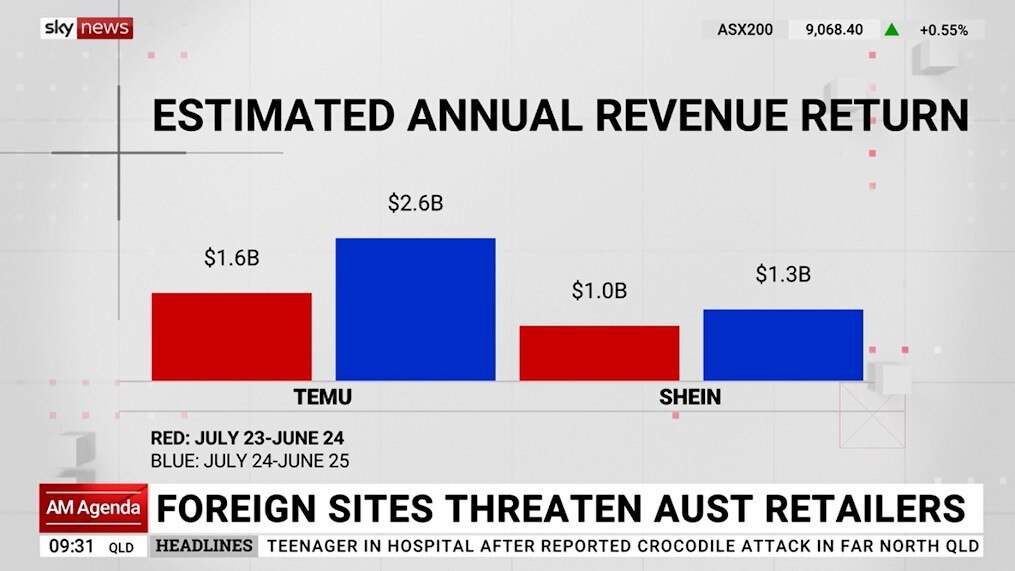

While Aussie businesses are crumbling, Temu’s annual Australian sales are estimated to be as high as $3 billion, capturing around 5 per cent of all e-commerce spending. Shein sits close to an estimated $1.3 billion in annual sales, with around 20 per cent annual growth over the past two years, accounting for as much as 2 per cent of all e-commerce spending.

Queensland University of Technology Business School retail expert Professor Gary Mortimer told news.com.au the pull of customers seeking a bargain was undeniable.

“You’ve got likes of Shein and, to a lesser extent, even Temu, getting out copies all the time and getting the clothes to market without a physical presence,” he said.

“So a high-end fashion retailer, which was delivering on that, has a value-conscious and value-seeking consumer that is willing to maybe forgo high-end quality for just the look at a lower price.”