Temu, Shein rip-offs: China’s Aus threat amid store shutdowns

Cheap online marketplaces are having a huge toll on traditional shop fronts.

Commercial property values across Australia could be at risk as discount online marketplaces like Temu and Shein facilitate the production and sale of cheap rip-off products that are putting popular Aussie brands under increased pressure.

Popular brands, many in the fashion sector, have been struggling to combat online sellers like Temu since it burst onto the scene in Australia in 2023.

The fight the traditional brands face is multifaceted because not only are sellers on Temu and Shein creating knock-off products and trading on the success of established market leaders, they are also selling the items cheaper on a platform more and more Aussies are embracing.

Similarweb’s 2025 Digital 100 Australia report listed Temu as the fastest growing digital brand in the country, beating out the likes of AI giant ChatGPT.

Temu’s own data claims the e-commerce giant produced a 72 per cent increase in unique website visits in 2024, a claim backed by Temu’s popularity in the Apple App Store where it was named the most downloaded app on iPhones in the same year.

Temu’s growth in Australia alone has been huge since its launch in 2023.

It is great news for Temu, but bad news for the bricks-and-mortar brands in Australia that are the faces of our shopping centres and main streets.

News of iconic brands closing stores or going into administration under the weight of poor sales and increasing costs has become the norm over the last two years.

In 2024, retail giant Mosaic Brands – owner of Millers, Rivers, Crossroads, Katies, Noni B and Autograph – spectacularly collapsed owing $318 million, with more than 4000 staff members impacted.

MORE:

Aus warehouse sales surge after joining Temu marketplace

Chicken farm with 51,000 bird capacity up for grabs

What the super tax backdown means for property investors

In March this year, Ally Fashion was placed into administration owing $58 million. A raft of store closures followed in a bid to save the business.

Just last month Australian retailers including Rip Curl and Kathmandu announced they would shutter 14 stores after parent company KMD suffered an annual loss of $105 million.

This list is not exhaustive but it represents a growing threat to Australia’s commercial property landscape.

Empty shops is a growing reality in the Aussie retail sector.

MORE Aus department stores lose their lustre

Failing businesses mean store closures. Store closures mean climbing vacancy rates. Empty shops mean falling values for commercial properties in the long term.

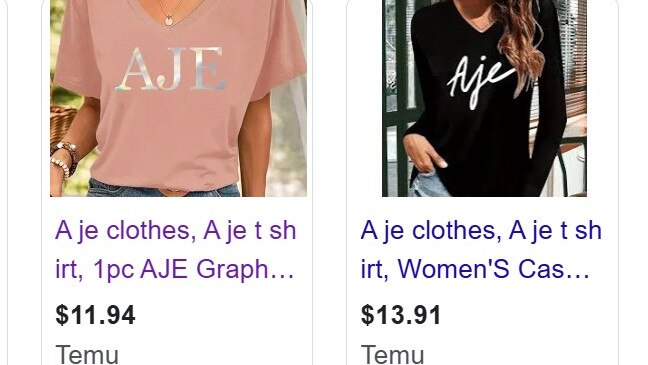

And the situation is ongoing. A simple Google search reveals the impact Temu and Shein continue to have on growing brands like Aje.

The cheapest authentic Aje T-shirt available on their official website retails for $90, a 40 per cent discount on its original price. The most expensive tee retails for $199.

Temu and Shein, however, both have hundreds of knock-offs bearing Aje’s logo for as little as $11.

Queensland University of Technology Business School retail expert Professor Gary Mortimer told news.com.au the pull of customers seeking a bargain was undeniable.

“You’ve got likes of Shein and, to lesser extent, even Temu, getting out copies all the time and getting the clothes to market without a physical presence,” he said.

“So a high end fashion retailer, which was delivering on that, have a value-conscious and value-seeking consumer that is willing to maybe forgo high end quality for just the look at a lower price.”

Aje is being hit hard by the Temu and Shein knock-off wave.

MORE: Aus jewellery brand shaking up the retail experience

But what does it mean for brands like Aje, which have spent the last couple of years expanding beyond Australia into global markets?

Not much, as it turns out. An investigation by The Australian into the replication and sale on Temu of Indigenous and Australian artworks revealed an exhausting amount of work for victims and little legal recourse to assist their fight.

The Australian’s investigation explained how Temu is owned by Whaleco Inc, a Delaware-based subsidiary of Chinese e-commerce company PDD Holdings, which means local copyright legislation protecting Australian businesses have no bearing on the site’s terms of use which fall under US law.

A Temu spokesman, however, told The Australian the company “takes intellectual property protection seriously”.

“Temu operates as an online marketplace where independent third-party sellers list their own products,” the spokesman said.

Cheap versions would be impacting Aje’s ability to expand.

“Sellers who violate these rules may face removal of their listings, account suspensions, or permanent bans in cases of repeated or serious infringements.”

A willingness to delist and ban knock-off traders would be welcome news for legitimate Aussie brands but they face an impossible situation.

Thousands of items are listed every day and reporting them all is an unrealistic task.

UK fashion designer Hanri van Wyk vented her own frustrations on social media after finding some of her designs advertised on Temu at a fraction of the cost of her legitimate products.

“If you’re tempted by ultra low cost websites such as Temu, you need to be aware of the ethics of these types of mega e-commerce companies,” she said.

“It’s blatant thievery of intellectual property and in breach of copyright.”

Her followers were quick to offer their support.

“That’s really shi**y – would never buy from a company like that anyway,” one person responded.

Meanwhile, brands struggle and collapse and the industries ingrained and reliant on their success – like the commercial property market – watch as the situation continues to evolve.

Vacancy rates in major shopping centres have begun to climb, with landlords scrambling to re-lease empty shops as fashion and homeware chains pull back on expansion plans.

Real estate analysts say the threat could reshape the nation’s retail property market, which underpins the value of super funds and suburban economies.