Foreign investors snap up Australian farmland larger than 148 countries combined

Forget your tiny island nations and European principalities – in 2025, Australia’s top farm sales alone carved up a landmass so colossal it eclipsed the size of 148 countries and dependencies combined.

While the year commenced with a record low in overall farm sales nationwide, the top transactions alone spanned an astonishing 2,240,718ha – an area equivalent to 22,407.18 square kilometres, dwarfing places like Israel, Fiji, East Timor, The Bahamas, Lebanon, Palestine, and Singapore.

This year has seen a significant influx of foreign capital, with Canadian and UK investors making substantial plays, alongside prominent local families securing prime agricultural assets.

Here are some of the most notable farm sales of 2025.

Canadian pension giant snags Riverina farm empire

Size: 30,000ha

Location: Griffith, NSW

Sale price: About $500m

A major Canadian pension fund significantly expanded its footprint in Australian agriculture this year, acquiring full ownership of a sprawling Riverina farming aggregation in a deal valued at an impressive $500m.

PSP Investments, through its Australian Food & Fibre (AFF) joint venture, swept in to acquire the entire 30,000ha Kooba aggregation near Griffith, New South Wales, by buying out co-investors Chris Corrigan and David Fitzsimons.

The colossal transaction marks the veteran businessman Mr Corrigan’s emphatic exit from his largest agricultural holding, fuelled by his outspoken frustration over federal Labor’s water buyback policy.

MORE: Named: Aus’ shock new $3m suburbs exposed

Kooba station near Griffith in New South Wales.

“Enough is enough. Labor and the Greens are hellbent on destroying Australian agriculture,” he declared to The Australian Financial Review in April.

“I decided there are better things to do with your money. You’re fighting constantly against the people who want to destroy Australia’s agricultural capacity. Maybe bigger fish can do it, but for me it’s tiring to fight uphill against those forces.”

Seller Chris Corrigan said he felt frustrated over federal Labor’s water buyback policy.

Kooba, a powerhouse previously under ASX-listed Webster Limited, boasts extensive cotton, cropping, and livestock operations, alongside a significant 1400 hectares of almond orchards.

With Foreign Investment Review Board approval secured, PSP Investments, managing funds for Canadian public service workers and police officers, now commands an $8 billion portfolio of Australian farmland and water assets, a testament to the global appetite for our agricultural might.

Rawlinna Station: Australia’s largest sheep farm sells to UK investor

Size: 1,046,323ha

Location: Rawlinna, WA

Sale price: $20m+

Imagine a property so vast it boasts its own postcode – that’s Rawlinna Station, Australia’s largest sheep farm, which has been snapped up by a UK-based buyer in a deal estimated at more than $20 million.

After nearly seven months of intense negotiations, the Western Australian government finally gave its nod to the sale this year, transferring this iconic station to UK-based Consolidated Pastoral Company, already a major player with Queensland’s Isis Downs Station.

Located approximately 400km east of Kalgoorlie-Boulder, this pastoral lease sprawls across an extraordinary 1,046,323ha (10,463 square kilometres).

MORE: Where you should’ve bought in Aus 10yrs ago

Rawlinna Station is considered Australia’s largest sheep station.

To truly grasp its scale, consider this: it’s larger than Lebanon, Palestine, Puerto Rico, Brunei, Hong Kong, and roughly the size of Sydney itself.

The acquisition, initially reported by ABC News, includes a staggering 30,000 sheep, with ambitious plans to restock cattle on the property’s southern reaches.

Adding to its legendary status is a renowned boundary exclusion fence, stretching an incredible 400 kilometres.

Rawlinna Station larger than Lebanon, Palestine, Hong Kong, and roughly the size of Sydney itself. Source: Facebook

The landmark sale was contingent on both Foreign Investment Review Board approval and the Western Australian government’s endorsement of the pastoral lease transfer, highlighting the strategic importance of such a monumental holding.

Read more here.

Kimberley Meat Co changes hands, hopes to be operational by 2027

Size: 1 million ha

Location: Roebuck WA

Sale price: $55m

After years shrouded in uncertainty and a dramatic plunge into voluntary administration, the Kimberley Meat Company (KMC) – the sole commercial-scale abattoir in northern Western Australia – and its parent company, Yeeda Pastoral Company, have finally found a new owner in a multimillion-dollar deal.

KMC and its parent company faced a challenging period, entering administration in February 2024 with a staggering $100 million in debt.

Prior to this, the company had been under intense scrutiny from the WA Government following investigations into more than 400 cattle deaths in 2022 and the illegal dumping of abattoir waste.

MORE: Aussies in these 77 suburbs earn +$200k

The Kimberley Meat Company (KMC), the only commercial-scale abattoir in northern Western Australia, and its parent company, Yeeda Pastoral Company, have been acquired by TLP4 Australian Holdings.

However, a lifeline emerged in August 2024 when Canadian super fund manager Alberta Investment Management Corp (AIMCo) stepped in, purchasing the combined Yeeda Group of companies.

This acquisition includes KMC and two substantial nearby pastoral leases, Yeeda and Mt Jowlaenga stations, covering 475,000 hectares of mostly leasehold country and almost 14,000 head of cattle, for a reported $55 million.

KMC operates across 1 million ha of farming land.

In total, KMC operates with over 1 million hectares of pastoral land.

Despite delays due to legal proceedings, partly concerning the company’s land valuation, the sale finally settled this year, offering a fresh start and the promise of operational revival by 2027.

Major farming enterprise sells in multimillion-dollar deal

Size: 5,313ha

Location: Dalyup, WA

Sale price: $50m+

In a significant win for local agricultural interests, a prominent farming family has shelled out in excess of $50 million to secure The Oaks, a strategically positioned mixed farm on Western Australia’s south coast.

The substantial 5,313ha holding, located 40 kilometres northwest of Esperance in the Dalyup region, came to market after more than 50 years of ownership by the Malaysia-based Russell family.

A local farming family has paid in excess of $50 million to secure The Oaks. Photo: Colliers

The registration-of-interest process, expertly handled by Colliers Agribusiness agents Rawdon Briggs, Duncan McCulloch, and Gabi Mewburn, alongside AWN Rural’s Rowan Spittle, generated considerable buzz.

While Mr Spittle remained tight-lipped on the exact sale price, he confirmed to Grain Central that it comfortably exceeded the guide offered during the marketing campaign.

Historically, the aggregation had operated as sheep and farming enterprise, with more than half the land under pasture. Photo: Colliers

He did, however, reveal that the Hopetoun family, the new custodians, are eager to build upon the Russell family’s legacy, continuing the transition from a predominantly grazing property to a fully dedicated 100 per cent cropping operation.

The Oaks attracted robust interest from both institutional investors and local buyers, with settlement anticipated after the harvest.

Quality breeding enterprise attracts bidders from near and far

Size: 32,250ha

Location: Hughenden, Qld

Sale price: $39.6 million

One of North Queensland’s most historic grazing properties, “Glendower,” changed hands in a dramatic November auction this year, fetching a remarkable $39.6 million after almost four decades under the same ownership.

The 32,250ha property, offered by Clive and Larine Poole at the Stockplace Marketing auction in Townsville, came complete with 3000 guaranteed branded composite and Angus-cross cattle.

Highly regarded breeding and fattening property Glendower has sold for an impressive $39.6 million. Source: Realestate.com.au

The atmosphere was reportedly electric, with approximately 80 people attending and eight parties registering to bid.

According to Farm Weekly, the coveted property ultimately sold to Patrick and Edwina Hick of Argyle Pastoral Company, Julia Creek, who successfully navigated the competitive bidding war.

The Flinders River system and its creeks provide abundant water during the wet season. Source: Realestate.com.au

Interest in the prime asset flowed from across Queensland, the Northern Territory, and New South Wales, underscoring its reputation.

Located 22 kilometres northwest of Prairie and 40 kilometres northeast of Hughenden, Glendower boasts an estimated carrying capacity of 4000 adult cattle equivalents, making it a truly significant acquisition.

Large-Scale Kimberley cattle-country sells for first time in 30 years

Size: 122,519ja

Location: Derby, WA

Sale price: $27.5 million

The highly regarded Western Australian Kimberley Region witnessed another significant transaction this year with the sale of Kalyeeda Station, a premier cattle breeding, backgrounding, and finishing operation, following a keenly watched expressions of interest campaign.

The expansive 122,519ha property, located 100 kilometres from Fitzroy Crossing, 220 kilometres from Derby, and 260 kilometres from Broome, had been meticulously operated by the Camp family since 1995.

Kalyeeda Station has sold following an expressions of interest campaign. Source: Realestate.com.au

While the exact price remained undisclosed, industry insiders understand the figure paid by Emanuel Brothers’ Nerrima Pastoral Company to be in line with market guidance of more than $27.5 million.

Located 100km from Fitzroy Crossing, 220km from Derby, and 260km from Broome, the 122,519 hectare (302,751 acre) property has been operated by the Camp family since 1995. Source: Realestate.com.au

The sale was not just for the land; Kalyeeda was sold with a high-grade, predominantly Droughtmaster cattle herd, 12 well-bred stock horses, and an extensive list of plant and equipment, ensuring a seamless transition for its new owners into this productive Kimberley enterprise.

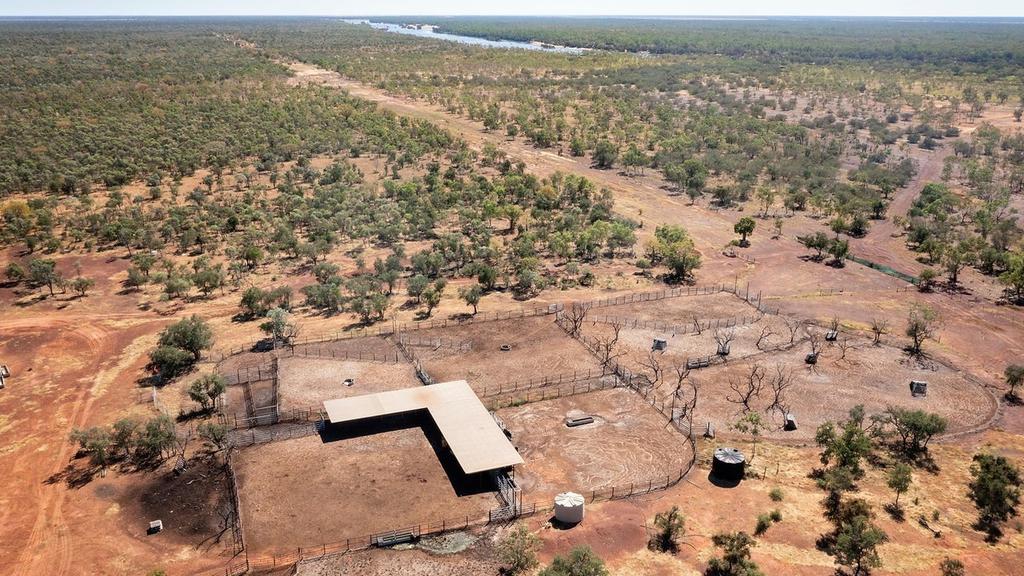

Central Queensland cattle farm sells via online auction

Size: 4,313.10ha

Location: Comet, QLD

Sale price: $22.3m

A “quintessential” Central Queensland cattle farm, Carnangarra, has officially welcomed new owners after a gripping four-day online auction in November.

The property was sold under the virtual hammer for an impressive $22.3 million to a private local farming family, showcasing the growing sophistication of agricultural property sales. Owned by Scott and Julia-Ann Brown since 2012, Carnangarra has been a testament to productive grazing, successfully carrying 1700 adult equivalent cattle to feeder weights on a rich and diverse mix of buffel, Rhodes, blue grass, Flinders, panic, and native pastures.

Scott and Julia-Ann Brown have sold the 4313ha Carnangarra property for $22.3m via a multi-day online auction.

The online format proved highly effective, attracting 13 registered bidders, with six actively participating throughout the multi-day auction.

RBV Rural agents Matt Beard, Terry Ray, and Bryton Virgo expertly managed the sale of Carnangarra, which ultimately achieved a robust sale price equivalent to $5170 per hectare, underscoring the strong demand for quality cattle country in the region.