Queensland islands back in the sun as resort schemes take off

Lindeman Island on the Great Barrier Reef has been listed for sale.

Owning a tropical island resort in Queensland has traditionally been one of the fastest ways in real estate to lose money. But a new breed of buyers is emerging with serious schemes to make the volatile sector more viable and even thrive if the local domestic tourism boom keeps apace.

Traditionally labelled “ego purchases” island buys are not for the faint-hearted and will always face challenges ranging from natural disasters, disruptions from the coronavirus pandemic, rising construction costs and critical labour shortages.

And offshore players are getting out, with China-based firm White Horse putting Lindeman Island – once a famed Club Med destination – on the block after a decade long odyssey of trying to gets plans up.

But these factors have not deterred some of the most savvy business minds in the country from snapping up islands in order to create legacy properties which will be unrecognisable from their current dilapidated and cyclone ravaged state.

Just last week, Annie Cannon-Brookes, the wife of Atlassian chief executive Mike Cannon-Brookes, bought Dunk Island off Queensland’s Mission Beach for about $23.6m, with plans to preserve its natural beauty.

That move came after a bid by Upsense Media Capital to buy the island in the wake of a failed scheme by property funds house Mayfair to transform it into a $1.5bn tourism mecca.

And it still won’t be easy.

One island player says that Dunk Island is a beautiful place but some sort of cyclone would hit within the next 10 years and insurers will not take the hit this time.

“It wipes them out,” the island veteran said.

But the billionaire Cannon-Brookes couple are not alone in showing interest in islands.

Andrew “Twiggy” Forrest last November splashed out $42m for the up-market Great Barrier Reef retreat of Lizard Island, in an early sign the market was picking up.

Other billionaires were already well established in the island game.

Annie Cannon-Brookes, the wife of Atlassian chief executive Mike Cannon-Brookes, bought Dunk Island off Queensland’s Mission Beach for about $23.6m, with plans to preserve its natural beauty.

Owners include Sir Richard Branson, who has a co-share in the Makepeace Island retreat near Noosa, Singaporean investor Koh Wee Meng paid $3.45m for Turtle Island off Gladstone and Clive Palmer, who bought the Club Med resort at Bora Bora for $10m.

Mining tycoon Gina Rinehart had toyed with buying a landmark island but last month pulled out of buying a resort on idyllic Great Keppel Island for a rumoured $50m.

The magnate had plans to make it a world class property sporting a year- round beach club, sandy bars, shopping and a marina like Puerto Banus on Spain’s Costa del Sol.

GKI owner and veteran developer Terry Agnew is believed to be revising his plans for Great Keppel Island and he will make an announcement shortly.

Sources added that the Queensland government had, as a sweetener, offered Ms Rinehart the ability to turn some of the leases on Great Keppel into freehold – which would have helped get a major development off the ground – but it is understood she knocked that back.

JLL Hotels head of investment sales Peter Harper said given the booming regional leisure destinations around Australia there was a renewed focus on island assets.

“However, I think it is safe to say that the market is approaching opportunities with a level of caution given the various challenges owners have faced in the asset sub class over recent years,” Mr Harper said.

“The reality is while there will continue to be success stories there are some that have not or won’t have the same fortune.

“You have issues with cyclones, staffing, comparative destinations in South-East Asia, and regulatory approvals as well as the cost of construction and ongoing operations,” he says.

Some developers are getting out.

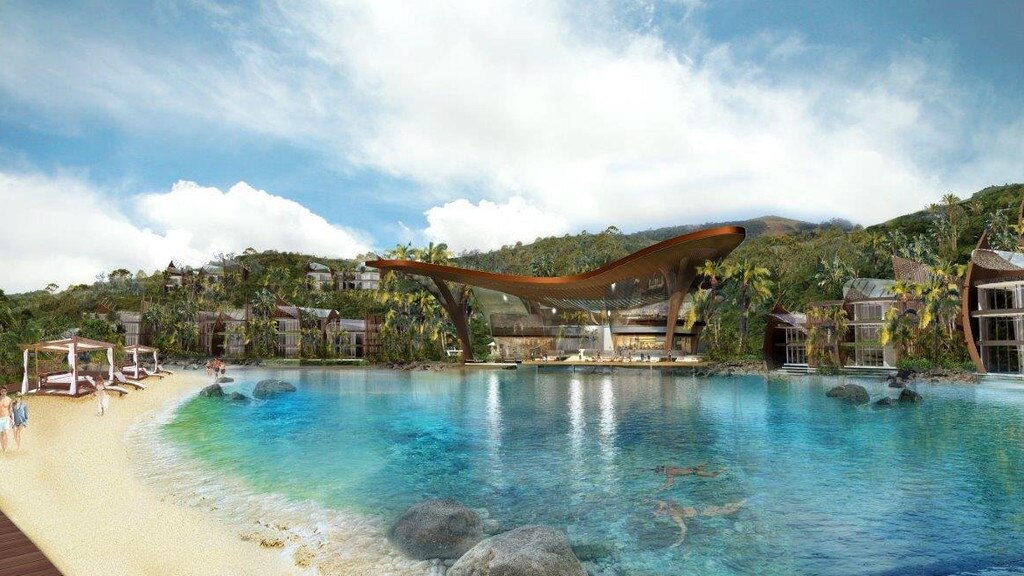

Lindeman Island, one-time home of a now shuttered Club Med, has just hit the block with hopes of about $20m, as China-based firm White Horse exits. It had planned a mega-resort to be run by Singapore-based luxury operator Banyan Tree and builder Watpac was lined up for a $600m redevelopment.

An artist’s impression of the lagoon pool in the masterplan concept for Lindeman Island.

The island, northwest of Brisbane, was picked up White Horse in 2012 for $12m after the exit of Club Med, but its plans for five and six-star hotels were pushed back by the pandemic.

The firm’s local representative, Michael Dawn, said it was “with regret” that after 10 years of ownership the company “has made the decision to divest Lindeman Island”. It hopes that the new owner “continues with its vision to redevelop this once great island resort and restore it to its former glory”.

Agents, CBRE Hotels’ Wayne Bunz and Hayley Manvell, are billing the property as a chance to create a new Great Barrier Reef property. The island is one of 24 Queensland islands with resort approvals and houses the closed beachfront resort, golf course and air strip over 136ha.

“Lindeman Island provides investors with the opportunity to redevelop the asset in line with other nearby successful luxury resorts, such as qualia Hamilton Island, to capitalise on strong domestic tourism demand and a resurgence in the international inbound market,” Mr Bunz said.

Ms Manvell said an incoming investor would have a blank canvas to follow White Horse’s plans or to undertake a smaller scale luxury redevelopment. The existing plan includes 325 suites villas, apartments, an eco-tourism centre, restaurants, bars, a beach club and a nightclub.

A scaled-back plan appears most likely to get off the ground as some local buyers are investing in islands to make money.

The Sydney-based Oscars Hotel Group is bullish about regional tourism after paying nearly $20m for Long Island and has a resort project planned on the island off Airlie Beach.

Hook Island in the Whitsundays sold in May to Sydney hospitality entrepreneur Glenn Piper of Meridian Australia, who is planning a luxury eco-resort.

The Sydney-based Oscars Hotel Group is bullish about regional tourism after paying nearly $20m for Long Island.

But does it all make sense? Hospitality consultant Dean Dransfield said Queensland islands were at last having their time in the sun after years of failed developments.

“We have done more island due diligence and development schemes in the last two years than we have done in 30 years,” Mr Dransfield said.

But there is a caveat. “With the right proponent and the right scheme, they make sense,” he said.

But owners need to be disciplined for islands to work well, he noted, pointing to the success of the billionaire Oatley family.

“Hamilton Island showed the path to significantly higher rates and significantly higher occupancy,” Mr Dransfield said.

“That path was reasonably well established before Covid and Covid has put some additional lighting around the path.”

Developers are thinking larger scale and are benefiting more low cost carriers serving islands, which makes projects stack up. He is optimistic the new wave of wealthy local buyers would get it right.

“These are the right types of actors to have these things; they’re mostly business people,” he said. ”The thing that you can’t do is take your eye off these balls because they do drop.”

Smaller islands are also trading.

The Elysian Retreat Long Island, which sold to Shayne Smyth, founder of Perle Ventures and travel insurance group Cover-More, is already up and running after selling earlier this year, while the new owner of Victor Island is looking to upgrade its purchase.