Priced out of renting: Housing crisis fuels co-living boom

More people are turning to co-living arrangements because they can’t afford rent in a traditional apartment.

Petty neighbour wars across Australia are set to explode as the country’s housing affordability crisis pushes more people into co-living units with shared kitchens and bathrooms.

More than 10,000 co-living units are in the national pipeline and developers are gearing up for rapid expansion in 2026 as soaring rents and record-low vacancy rates continue to shut many out of the traditional rental market.

Property heavyweight Knight Frank has released a report, including insights from UKO tenancy data, that found Sydney is leading the charge — accounting for more than 90 per cent of completed co-living developments, with 1,639 units already operating across the city.

Co-living developments are on the rise due to rising rents and housing affordability pressures.

But the next wave is now spreading beyond NSW, with projects in Queensland, Victoria and Western Australia beginning to take shape.

MORE: Luxe Aus celebrity retreat loved by the Irwins hits the market

‘Great Australian Scam’: Two thirds of homes for sale without a price

Knight Frank partner Living Sectors, Valuation & Advisory, John-Paul Stichbury said developers were increasingly turning to co-living as a faster, more viable option than traditional apartments, build-to-rent or build-to-sell projects.

“Co-living has established itself in Australia as a genuine alternative to traditional housing types, and its momentum is expected to continue next year with development spreading across the nation,” Mr Stichbury said.

The Potts Point Apartment Hotel sold for $31m earlier this year to UKO to be used as a co-living development.

“We anticipate a further acceleration in the overall pipeline in 2026 as developers respond to growing demand for this product type.”

Projects are also getting bigger, with proposed developments now averaging 130 units, signalling growing confidence from developers and investors alike.

For renters, the appeal is simple: cheaper, flexible living in prime inner-city locations. Weekly rents in inner Sydney start at $675 all-inclusive, compared to $730 for privately-leased apartments.

This building at 59 Liverpool Rd, Ashfield, recently sold for about $10m to be used for co-living.

MORE: ‘PTSD from bin day’: Why one family swapped the house in the suburbs for unit life

Why you could be waiting 21 years to buy in this suburb

But the reality can be far from what developers showcase in glossy brochures and display units.

Sharing kitchens, bathrooms and laundries with strangers you didn’t choose to live with can become a powder keg situation waiting to explode.

Stories of people experiencing neighbour difficulties in shared living situations get shared on social media platofrms all the time.

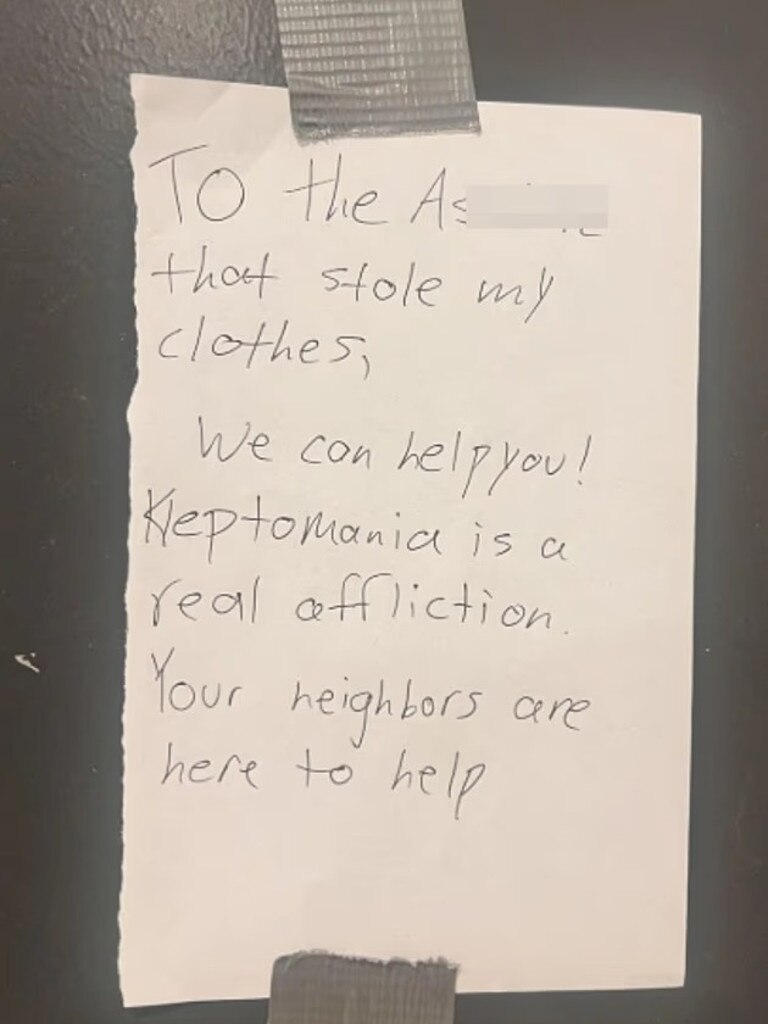

A recent example shared to Reddit involved someone lashing out publicly after someone allegedly stole their clothes.

”To the a**hole that stole my clothes, we can help you! Kleptomania is a real affliction. Your neighbours are here to help,” a note, stuck to a wall with duct tape, read.

The blow-up divided people who saw the post, with Australians split on who was really to blame.

”Clothes were probably thrown out because someone left them in the dryer for a long period of time,” one person commented.

Notes like this could become commonplace in AUstralia as co-living options take off. Picture: Reddit

”Funny this is posted just as I am taking out somebody’s laundry that has been sitting in the dryer for two hours,’ one person ranted,” another said.

“Lived in an apartment growing up – they would pull your stuff out of the washer mid-cycle. It was nuts. We would just go to the coin laundry down the street and save the hassle,” another lamented.

Despite the obvious pitfalls of sharing amenities in co-living developments, Australian investors are paying close attention. With bond yields higher and feasibility tougher across the board, co-living’s higher cashflow per square metre is helping it buck the trend.

Industry insiders say the next five years will deliver Australia’s first wave of large-scale co-living assets — transforming a once-misunderstood housing model into a mainstream solution for the country’s rental crisis.

Rhys Williams of UKO, which has more than 30 co-living assets under operation or construction, said all major capitals of Australia had strong demand for co-living.

UKO founders Rhys Williams and Alex Thorpe. Picture: John Appleyard.

“The bottom line is that co-living is a great way to live and rent, it solves housing for singles and provides flexibility and community, which is very valuable to a significant portion of the rental market,” he said.

“I see co-living transitioning out of a misunderstood ‘nascent’ asset class to be understood better for exactly what it is — a highly desirable, very defensive living sector product which solves housing for singles and young couples.

“It will be integrated into more BTR designs and will become part of mixed-use developments with hotels and serviced apartments.”