Pokies, food and redevelopment potential now driving surge in Australian pub values

Watsons Bay Hotel recently reopened following a $3m renovation.

Pubs with plenty of pokies, tasty food offerings and redevelopment potential are the big winners, according to a new report.

If the pub hosts lucrative corporate events that also helps increase its value as does the fact that per capita alcohol consumption jumped from 10.0L to 10.5L between 2020 and 2025, according to a new CBRE research report.

Also helping pub operators along is a stabilisation of interest rates and cap rates compression, according to CBRE’s pub grub indices, which reveals pub drinking and dining trends in Australia’s eastern states based on data from 105 pubs on the eastern seaboard.

If you fancy a chicken parmigiana at your local paired with a schooner or perhaps an Aperol Spritz you will fork out the most for your meal in Victoria according to CBRE’s newly released Raising the Bar, Investment and Innovation in Australian pubs report, which reveals pub drinking and dining trends in Australia’s eastern states.

Victoria stands out as the most expensive state overall, highlighting its strong dining culture and willingness to pay for elevated pub classics, and is closely followed by NSW.

Queensland remains the most affordable, given greater price sensitivity in that state.

Despite higher operating costs, hotels are demonstrating strong income stability and liquidity, particularly those pubs which have diversified into gaming, food and beverage, accommodation for locals and international tourists, as well as functions.

“The highest priced venues were typically those that had undergone recent significant refurbishments, suggesting a correlation between capital investment and premium menu pricing,” according to the report.

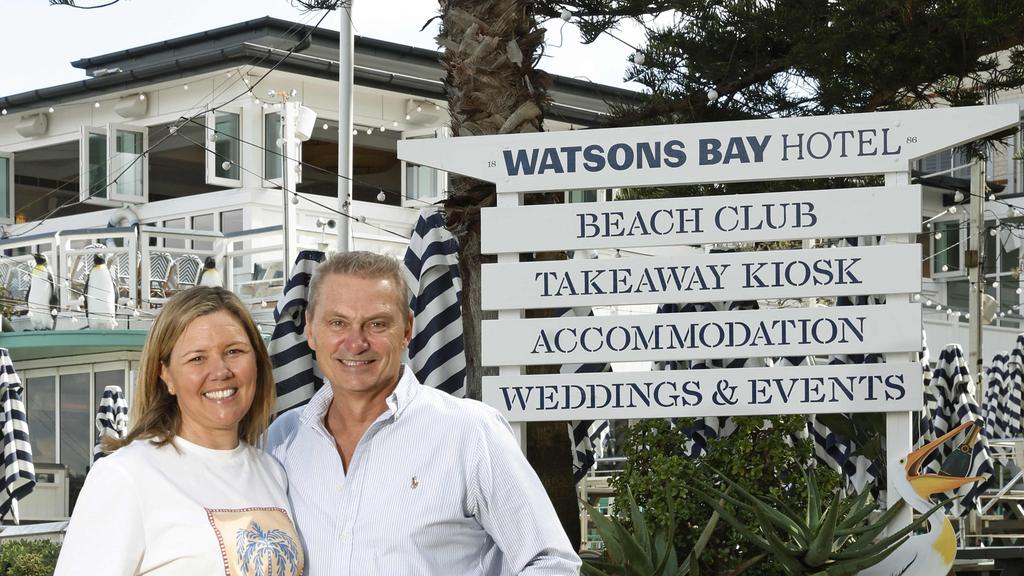

Sydney’s Laundy pub family have recently spent $3m upgrading one of their 90 plus pubs, the Watsons Bay Hotel on Sydney Harbour in an effort to attract more events business including weddings and corporate functions.

Danielle and Shane Richardson at the newly revamped Watson’s Bay Hotel. Picture: John Appleyard

According to the CBRE report, major events are a critical demand driver in Australia’s hospitality industry, delivering measurable uplift for hotels and pubs.

“Short high impact events typically generate sharp spikes in patronage and spend, while longer tournaments and cultural festivals sustain elevated conditions across multiple nights, building consistency into trading performance.”

Indeed, hospitality spending surged by 72 per cent over the past four years, according to the ABS. “Although early 2025 saw a modest dip, overall spending remains significantly above pre-pandemic levels, especially in urban centres like Melbourne and Brisbane, where pubs and dining are deeply embedded in the local lifestyle,” according to the report.

“Increased appetite from traditional bank lenders – particularly for assets with strong gaming entitlements and consistent cash flows – was adding further momentum to the sector,” said Kire Georgievski, CBRE senior director, hotel valuations.

“This resurgence in credit availability is enabling more competitive bidding, especially among private investors and syndicates, and is helping to underpin valuations,” Mr Georgievski said.

But there are high entry barriers in areas such as Southeast Queensland, where the cost of acquiring the venue, gaming licences and entitlements can reach up to $30m. “These barriers stem from strict regulatory controls, limited availability of gaming machine entitlements and the premium placed on well located, large format hotels with strong trading histories.”

In NSW, high barriers to entry are expected to drive further consolidation within the sector, while Queensland is undergoing a maturing investment landscape following targeted policy reforms and enhanced capital liquidity. However, Victoria remains a ‘quieter and more complex market compared to Queensland and NSW.”