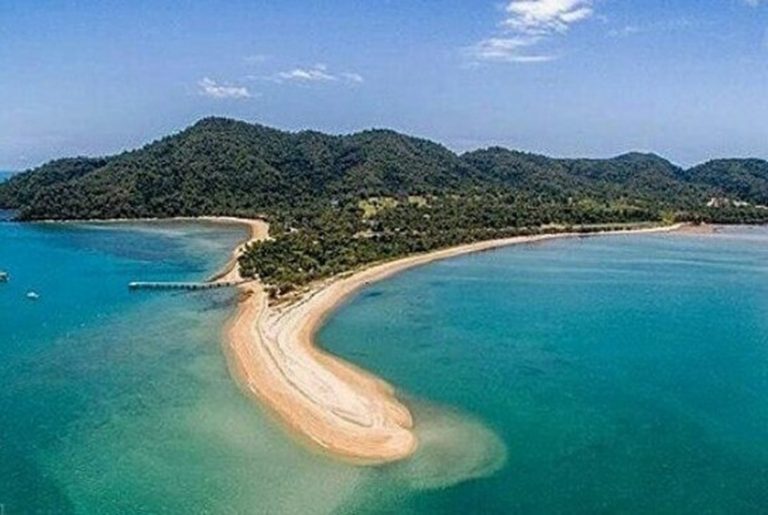

Is $1.5bn Dunk Island and Mission Beach tourism dream still alive?

Embattled fund manager Mayfair 101 is pitching a plan to turn around the fortunes of its redevelopment of the once iconic Dunk Island and Mission Beach into a $1.5.bn tourism hub.

The company said on Monday it would present a plan to the Federal Court at a hearing later this month in which it would outline a way in which investors could recoup some of their investments.

However, pressure is mounting on the group which has been under scrutiny from the Australian Securities and Investments Commission and provisional liquidator Grant Thornton, which has taken charge of its M101 Nominees Pty Ltd entity.

The liquidators warned in the report to the court that even secured investors could suffer substantial losses and Mayfair is yet to reveal the details of its turnaround proposal.

Mayfair said in a statement that its proposal to secured noteholders would be presented in the Federal Court on October 22.

“The objective of the proposal is to give noteholders a clear pathway to the return of their capital,” Mayfair said. “A favourable outcome in court will empower noteholders to make a decision on the future of their investment via a noteholder meeting.”

The company said a “high calibre” team of restructuring and financing professionals had been assembled over recent months to ensure its noteholders and the Mission Beach and Dunk Island project were “protected from the impact of proceedings brought by the Australian Securities and Investments Commission”.

Investors in the roup’s secured debenture product, issued by M101 Nominees, are currently subject to provisional liquidation, and have their investment underpinned by the equity interest in the group’s investment in Mission Beach and Dunk Island.

But the Bond family has repossessed the island resort after Mayfair could not meet its obligations and senior lender Napla has taken control of about 107 Mission Beach properties.

Mayfair said legal proceedings brought by ASIC had alleged there was no value in the security provided but said it “categorically rejects” this claim.

Mayfair claimed it had taken a “strategic approach” to acquire a “significant portfolio of complimentary real estate assets” in a region that has been dormant for nearly a decade, although the coronavirus crisis has prompted fears of an extended slowdown.

Mayfair said the way the properties had been assembled “paves the way for significant value to be created and released, and the long-awaited rejuvenation of the region”.

Mayfair said it had appointed Ashurst Lawyers to assist with co-ordinating a compliant, viable restructuring proposal which “it looks forward to presenting to noteholders with the court’s consent”.

Mayfair managing director, James Mawhinney said he was “bitterly disappointed” by the significant impact the events of recent months have had on noteholders and the Mission Beach community.

The company founder last month vowed that investors in his stricken funds will recoup their losses by Christmas despite a preliminary liquidators’ report claiming the investment vehicle was in trouble from the outset.

At the time he labelled a Grant Thornton’s provisional liquidators’ report into the affairs of M101 nominees as largely unsubstantiated and said more funding was in train from a syndicate of wealthy families, which he declined to name.

Grant Thornton warned there is a low likelihood of the recovery of $44.4m which was advanced to another Mayfair company, known as Eleuthera, which served as Mayfair 101’s treasury unit.

Some $21.7m of this was used to pay a “large amount of operating expenses” of the group.

This article originally appeared on www.theaustralian.com.au/property.