The future of investment house Mayfair 101’s plans to transform Dunk Island and nearby Mission Beach into a $1.6bn tourism mecca hangs in the balance after assets controlled by a separate fund it manages fell into the hands of receivers.

The trustee of one of the group’s best-known vehicles, the IPO Wealth Fund, last Friday had receivers Dye & Co called in to manage the Mayfair entity to which it had lent money, with about $85m at risk.

Although IPO vehicle is separate to Mayfair 101’s Dunk Island scheme, the move has put a spotlight on its ambitions to revamp the island it bought for $31.5m last September.

Tourism players said interests associated with former owner, Linc Energy founder Peter Bond, had been weighing up options for the island.

The businessman declined to comment when contacted by The Australian, but private Bond family interests hold a mortgage over the island resort as part of Mayfair 101 purchase.

Industry executives claimed that Mayfair entities had not made scheduled payments, which might see the Bond interests resume control of the resort and offer it for sale again, probably for a lower price in the wake of the coronavirus crisis.

Bond declined to comment on and Mayfair 101 was uncontactable. But it issued a statement lashing the trustee of the IPO fund and blaming the Australian Securities & Investments Commission for clamping down on its debenture products.

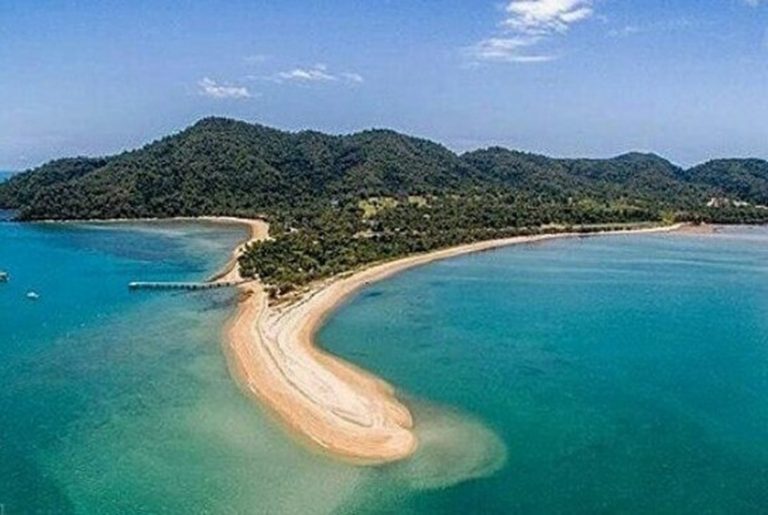

After raising about $200m from investors via debentures, Mayfair 101 bought a variety of residential properties in Mission Beach, about two hours south of Cairns, adding to its purchase of Dunk Island resort.

Mayfair 101 last month suspended the purchase of at least 20 Mission Beach homes after it flagged plans to spend about $200m.

It had blamed COVID-19 for the suspension but claimed to have settled 130 properties.

Mayfair 101 said at the time it had a funding commitment for Dunk Island but industry sources said the tougher post-virus environment meant the company’s scheme no longer stacked up.

Mayfair 101 confirmed the IPO fund’s trustee, Melbourne-based Vasco Trustees, had called in Hamish MacKinnon and Nicholas Giasoumi of Dye & Co as receivers to the borrowing entity, which held stakes in unlisted companies.

The fund is separate to vehicles used by Mayfair to back its ambitions for Dunk Island but the receivership could put a strain on the overall business.

The IPO fund had been frozen and then failed to make payments of $684,000 and $2.3m due investors in mid-May.

Vasco says it has received “no communication” from Mayfair 101 about why payments were not made despite attempts to contact the fund manager.

This article originally appeared on www.theaustralian.com.au/property.