Dunk Island could be up for grabs again

The Bond family, which has seized control of Dunk Island from troubled investment house Mayfair 101, could put it back up for sale as ambitious plans to convert it into a $1.5bn tourism mecca have all but collapsed.

Mayfair bought the island resort in a blaze of publicity last September for $30m but private Bond family interests held a mortgage over the property as part of the purchase.

As the finance house stumbled, with provisional liquidators called in to key companies that were backing its plans for Dunk Island and Mission Beach, the family of the former owner, Linc Energy founder Peter Bond, has taken back the famed Queensland resort.

Industry executives claimed that Mayfair had not made scheduled payments, which gave the Bond family the right to take back control and offer the resort for sale again, albeit at a lower price in the wake of the coronavirus crisis.

Bond’s son Adam told The Australian that the family was “assessing our options but it is most likely that we will commence a formal sales process in the near term”.

He expressed hope that there would an “an outcome that benefits Mission Beach and the wider Cassowary Coast region into the long term”.

In a statement, Bond said “unfortunately, under the circumstances we have been left with no alternative but to foreclose”.

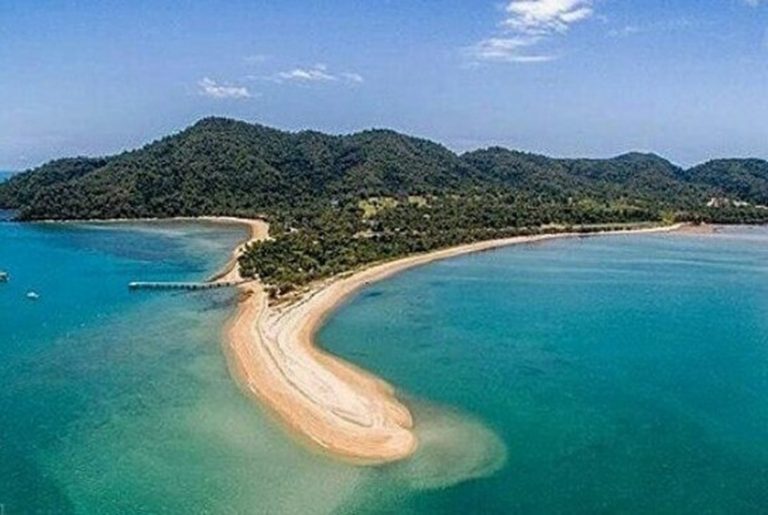

The Dunk Island jetty near the sand spit at the southern end of the island. Picture: Peter Carruthers

“We have spent several months working with Mayfair in an attempt to engineer a solution. However, despite several extensions to payment terms Mayfair have remained unable to meet their obligations,” the statement said.

The company said it recognised “the impact the decision may have on Mayfair investors”. “We can assure all concerned that this decision was not taken lightly or without other alternatives being thoroughly explored first,” he said.

Bond said in the capacity as “controller of the asset” it was the family company‘s intention to move quickly to ensure that Dunk Island ”can attract the right ownership to continue toward reopening and re-establishing its position as one of Queensland’s iconic destinations”.

Mayfair‘s residential acquisitions in Mission Beach have also stalled for now. “Everything is still in suspension, they are not retracting from sales they are predicting their funding will be in place soon,” local agent Steve Wiltshire of Mission Beach Real Estate told the Australian.

A beach front bungalow on Dunk Island in a state of disrepair after being damaged by Cyclone Yasi. Picture: Peter Carruthers

Wiltshire said Mayfair 101 had purchased 15 residential properties in Mission Beach worth about $20m in total and paid a 5% non refundable deposit.

“I have spoken to James Mawhinney and senior management … there is still hope from the management of Mayfair that things are proceeding,” Wiltshire said.

But Mayfair 10’s ambitions for transforming Dunk Island into a $1.5bn tourism mecca were dealt a blow last week when the Federal Court appointed Grant Thornton as provisional liquidators of key parts of its empire.

A judgment showed the precarious state of the debenture-backed property empire, with the Australian Securities and Investments Commission saying the firm may have been running a Ponzi scheme and group founder James Mawhinney restrained from leaving Australia, as he may face criminal charges.

Despite a showcase of the island last October, plans to revamp the island have now stalled. Picture: Supplied

The controversial project to transform the Queensland tourism icon was backed by high-interest debenture and property bonds but the regulator told the court that investors could face substantial losses with the projects on the brink for months.

The regulator won orders to freeze certain Mayfair assets and to prevent the group founder leaving Australia.

Mayfair claimed ASIC’s actions put at risk more than $150m of investor funds and its Mission Beach and Dunk Island projects.

Mayfair insisted it was still committed to the Mission Beach region and its plans to turn it in to Australia’s next tourism mecca. It claimed via a statements that it was “well progressed with significant local and overseas institutional financiers who are currently undertaking due diligence on the project”.

Muggy Muggy Beach on Dunk Island. Picture: Anna Rogers

“The Group expects to complete the final stages of its refinance next month, enabling it to pay out the finance on Dunk Island provided by the Bond family in the required time frame and refinance its mainland property financier, Napla,” the statement said.

The regulator is worried Mayfair investors may stand behind Napla at a time when Mission Beach properties could fall in value if the tourism scheme collapses.

Mawhinney said in a statement that the company was working with the “right, credible financiers to deliver this project in full”. “Due diligence processes are well under way, including on-site visits that commenced last week,” he said.

Work has also been temporarily suspended on the Dunk Island Spit Bar but Mayfair said it would start again once finance though.

Muggy Muggy Beach on Dunk Island. Picture: Anna Rogers

Mawhinney noted the appointment of Grant Thornton as provisional liquidators to M101 Nominees Pty Ltd and said his company “will be putting forward a formal proposal for the return of the company to the Group in line with the finalisation of our refinancing activities”.

Mayfair said that prior to ASIC’s actions, it was working with a team of advisers, including PwC and KPMG, on a plan to refinance the tourism projects, so that distributions could be unfrozen and an “exit path” for existing investors established.

But the risky property scheme has been in jeopardy for months, ASIC told the court in an urgent hearing before Justice Stewart Anderson.

The entrepreneur’s companies have also been restrained from raising funds, including its M Core Fixed Income Notes, M+ Fixed Income Notes as well as the bonds.

Grant Thornton are now joint and several provisional liquidators of the M101 Nominees Pty Ltd, which received about $67m. The firm will investigate the solvency of the Mayfair entity and the value of its assets, and the likely return to creditors in a wind-up.