Brisbane’s Uptown sale to spark redevelopment play

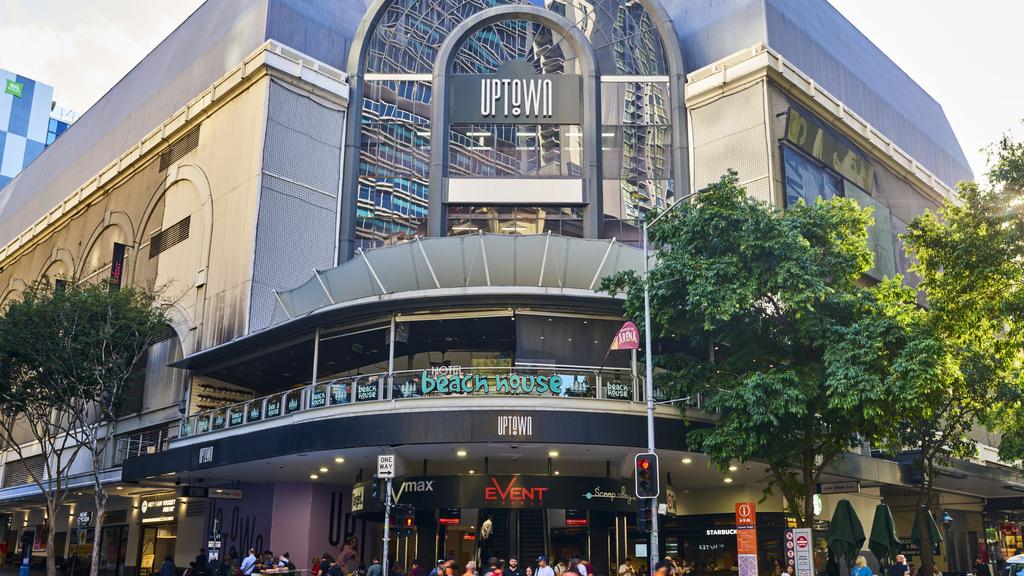

Upper floors in Uptown, formerly the Myer Centre, Brisbane. Picture: Lyndon Mechielsen

Property funds manager ISPT is moving to sell its 75 per cent stake in the Uptown complex that formerly housed Myer in Brisbane’s Queen Street Mall, with the property billed as the country’s top city retail redevelopment opportunity.

A sale could spark a resurgence of the well-known retail centre as Brisbane sees a pick up in conditions that could spur a renewal of the city icon in a way that mirrors southern capitals. In Melbourne, fund manager IP Generation made a $223.5m acquisition of the flagship David Jones building in Bourke St and Charter Hall and Abacus Group are invested in the Myer Melbourne building, while Steadfast Capital is redeveloping The Walk Arcade.

Sydney has been abuzz with renewals including Scentre Group and Cbus Property’s revamp of the former David Jones Market St building in Sydney’s CBD and other high-profile projects, including the 25 Martin Place retail redevelopment and the overhaul of retail at 388 George St.

Brisbane has been quieter on the development front but conditions are lifting with the retail vacancy rate falling to the city’s lowest level since the end of 2019.

The city is starting to see more projects, with ISPT also kicking off a revamp of its nearby Elizabeth St commercial and retail precinct by opening the Intercontinental Brisbane.

Myer’s decision in 2023 to move out of the complex came as city retail landlords faced tough times and both the listed company and the private equity-controlled David Jones were cutting back their networks. But the balance has shifted back to city retailing, particularly in Brisbane that has been less affected by working from home, and the recovering retailer could even make a move back into a renewed centre.

The Uptown complex.

Simon Rooney of CBRE is handling the asset sale via a confidential off-market EOI sales process. Vicinity Centres, which also owns a 25 per cent stake, is keen for a partner to come into the complex by picking up ISPT’s 75 per cent interest, and helping drive a redevelopment of the asset. Vicinity has been driving the redevelopment of malls as it focuses on the luxury end of the market though the Brisbane project could be more mid-market.

In 2023, it took full control of Sydney mall Chatswood Chase, buying a half stake for $307m from Singaporean sovereign wealth giant GIC, and kicked off a redevelopment.

Vicinity has also revamped its shopping, offices and hospitality at Melbourne’s Chadstone Shopping Centre, which it co-owns with billionaire John Gandel.

The Uptown complex continued trading after Myer vacated and an incoming buyer could develop plans with Vicinity to capitalises on the mall’s significant foot traffic and its status as a major integrated transport hub.

Major projects are underway in Brisbane including the $17bn Cross River Rail with a new Albert Street train station under construction a 150m walk from Uptown. The Brisbane Metro Subway System will also have a new underground portal near Adelaide St slated for this year.

Vicinity has been quietly developing plans for a proposed $400m redevelopment that would capitalise on the Uptown complex being on the largest site on Brisbane’s Queen Street Mall, spanning 13,877sq m with over 120m of prime frontage. The six-level centre is anchored by Target, Coles and Event Cinemas and has more than 95 specialty stores.

A range of homegrown players including Marquette are likely to chase the property along with the property funds managers that have made the running in the retail market, including IP Generation, HMC Capital and AsheMorgan. They have mainly bought passive assets but as opportunities tighten, they may chase higher-returning developments.