Revealed: beloved Aussie retail brands that went bust after Covid

Jeanswest announced in March it would close its doors. Photo: Gaye Gerard

Many Aussie retailers have been struggling in the post-Covid world and have closed shop in recent years owing millions in debt.

These business were often under immense pressure from the unprecedented economic conditions, coupled with increased competition, high rental costs and changing consumer preferences.

Ray White Head of Research Vanessa Rader said there has been a shift to fast fashion and online trends, leaving some stores in difficulty.

MORE: Global brands that went bust in Australia: truth behind biggest flops

“There has been a greater acceptance for fast fashion – where people buy an outfit replica or a copy of something somewhere else – at a much, much lower cost,” she said.

“In addition to that, you have the Temu and Shein effect, the very very low prices that are on offer for buying a lot of clothing and soft goods but also just generally anything.”

Here are some of the businesses that have gone bankrupt or into administration since Covid:

JEANSWEST

Jeanswest entered voluntary administration in January 2020. The retailer was later acquired by Hong Kong business Harbour Guidance Pty Ltd, but in March it was announced the brand would be closing up to 90 stores in Australia.

Australian model and television presenter Chloe Maxwell modelling the brand. Picture: Jeanswest

Appointed administrators Pitcher Partners Lindsey Bainbridge cited cost of living and challenging business conditions as the reason it was shutting physical stores. There are plans to clear store stock online.

“The owners have done everything they can to keep Jeanswest going, but market conditions mean sustaining bricks-and-mortar stores is not viable and unlikely to improve,” Pitcher Partners Lindsey Bainbridge said.

According to ASIC filings obtained by RagTrader reported in May 2025, Jeanswest’s parent company Harbour Guidance owed more than $48m to creditors.

MOSAIC BRANDS: Katies, Rivers, Rockmans and more

The major retail group comprising iconic Aussie household names such as Katies, Rivers, Rockmans, Crossroads, Millers, W.Lane, Noni B and Autograph went into voluntary administration in October 2024.

Mosaic Brands included iconic names such as Katies and Noni B

Mosaic Brands ceased all trading in April this year, closing more than 650 stores across the country.

In a notice to creditors in February, Mosaic’s total debt reportedly tallied more than $318m.

Ms Rader said, commenting in general terms, that it was a challenging environment for many types of clothing retailers that rented stores within big shopping centres in the years directly following the Covid pandemic.

“People weren’t going into stores as much,” she said. “During that time there was quite a few closures, it would’ve just been hard to get people back into stores and confident to go back into big malls.”

DION LEE

The Australian label modelled or worn by the likes of celebrities Gigi Hadid, Taylor Swift and Dua Lipa, faced a post-pandemic collapse period which led to the label entering administration and eventually liquidation after reportedly getting no “acceptable offer” from investors.

Dion Lee was a runway regular worn by the likes of A-listers such as Gigi Hadid

Founded in 2009, Dion Lee sold through 160 outlets worldwide.

The high-profile retail chain’s stores closed in mid-2024, with the group owing creditors a reported figure of $35m.

In May 2025, the Australian Financial Review revealed the label sold to US-based Revolve Group, including the brand’s remaining assets and archives for under $1m.

ALICE MCCALL

Founded in 2004 by fashion designer Alice McCall, the beloved high-end label faced a Covid collapse where in a statement in 2020, Ms McCall announced it was with a “heavy heart” that the company called in administrators.

Fashion Designer Alice McCall for the Afterpay Australian Fashion Week Launch. Picture: Tim Hunter.

The impact was seemingly unresolvable when in February 17, 2023 Alice McCall shared to a post on Instagram the physical stores would be shutting their doors for good, thanking all that have supported the brand in its 20 years.

RagTrader claimed the brand owed more than $1m in debts as it entered liquidation in February, reporting this included $677, 922.93 to the Australian Taxation Office.

SEAFOLLY

The beloved swimwear brand went into administration in 2020, with a downsizing of stores.

In June 2020, Scott Langdon and Rahul Goyal from KordaMentha Restructuring were appointed as the voluntary administrators of the swimwear and women’s beachwear fashion brand.

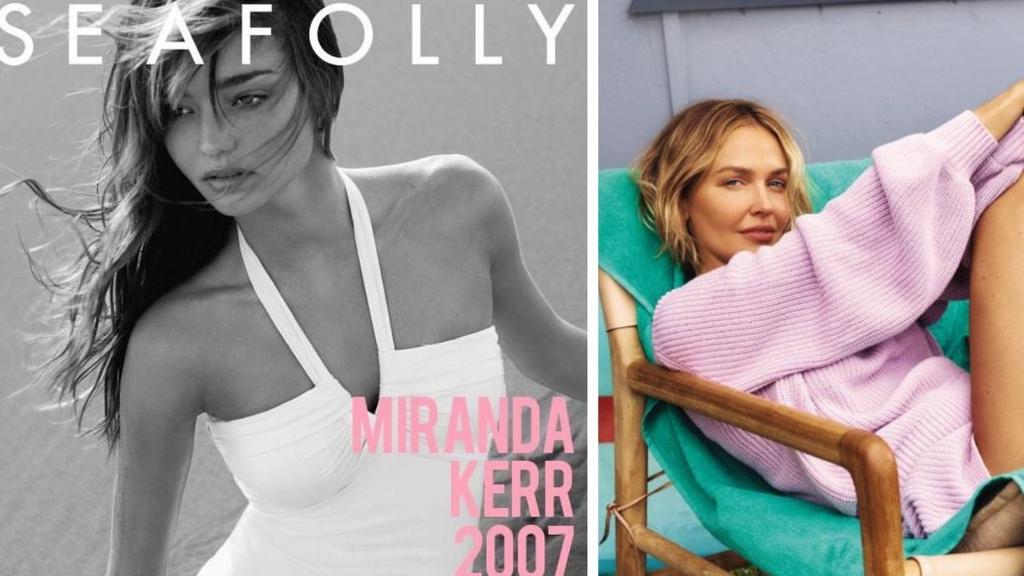

A number of celebrity A-listers have modelled for Seafolly campaigns including Miranda Kerr and Lara Worthington

MORE: The Pickled Possum goes into receivership

A month after Seafolly went into administration, it was bought by investment group L Catterton.

US retail specialist L Catterton resold the brand in 2023 in a deal estimated to be approximately $70 million to an Asian strategic buyer, according to Australian Financial Review.

TIGERLILY

In March 2020, Tigerlily collapsed into voluntary administration, reportedly due to some of the challenges of the Covid pandemic.

The brand briefly restructured post-Covid, including joining forces with brand Crumpler to offer operational and resource support, but it went into administration again in early 2024.

The brand had operated 10 stores and had 40 wholesale partners in Australia and the US as well as an online presence.

Tigerlily is reportedly set to make a comeback in time for its 25th anniversary

In August 2025, it was reported the brand is set to make its return to Australian shops in time to celebrate its 25th anniversary.

Tigerlily general manager Prue Slocombe told NewsWire the brand is looking to bring back its “personality” as it returns.

“What we are looking to do with Tigerlily is take it back to that really vibrant, fun personality that it had 10-15 years ago when it was in its prime,” she said.

BARDOT

The Aussie fashion chain Bardot experienced a turbulent period beginning in late 2019, when in November, the store announced it had entered voluntary administration.

Bardot’s at Westfield Chermside shopping centre. Bardot’s is closing its Qld stores in January 2020. (AAP image, John Gass)

In early 2020 the retailer announced its 58 store closure across Australia and the retailer shifted to focus on e-commerce.

The Business currently comprises Bardot and Bardot Junior with in-person retailing, found in certain Myer and David Jones stores, it also launched collaboration with The Iconic.

HARROLDS

The luxury fashion retailer entered liquidation in October 2024 after 39 years, reportedly owing $16m. According to Ragtrader, the total creditors owed were 70.

The brand Victoria Beckham was among the groups owed after the Harrolds closures. Photo by Handout/Victoria Beckham Beauty via Getty Images

Some of the groups reportedly owed money after the liquidation were the brand Victoria Beckham, Tom Ford and Thom Browne.

In July 2025, Ragtrader reported a return to operations. This followed Harrolds’ intellectual property getting acquired by a new ownership team. It is reportedly set to re-target the business as a luxury menswear offering.

ALLY FASHION

In March 2025, the retailer was ordered into liquidation accumulating a reported debt of $58m.

In March, Ally was ordered into liquidation, accumulating a debt of $58m

News.com.au reported the retailer was ordered to be wound up by the Federal Court of Australia at the end of February due to insolvency, with liquidators moving quickly to shut down 51 stores as well as axe hundreds of jobs.

MORE: All you can eat: Where are Australia’s last remaining Pizza Hut dine-in restaurants?

Ray White Commercial head of research Vanessa Rader

According to Ms Rader, there have been other trends emerging post-pandemic such as increased luxury store offerings and a reduction of existing retail stores.

“We’re seeing a lot of (retailers) that are brands that we’ve known for a long time that are shrinking their footprint,” she said, adding that there was a growing preference among some customers to shopping in their suburb rather than going into CBD areas.

Cost of living and customers’ increasing priorities to save were also pushing physical retail stores in new directions, Ms Rader said.

“We’re going to get these smaller and smaller stores but there’s more competition coming from these other players, such as the overseas options and cheaper options.”