Opportunities abound for commercial property investors, if you know where to look

Sales and enquiry levels for commercial property are down, nudging yields up and creating price uncertainty. But opportunistic investors aren’t going anywhere.

The commercial property market is in a bind this year. Sales volumes and enquiry levels overall have plummeted, mainly due to higher interest rates and lending criteria constraining buyers’ capital. And this slump in turn has wobbled price valuations, discouraging owners to list.

But despite this vicious cycle shaping the market, there are some bright spots and opportunities, experts say.

The latest realcommercial.com.au Commercial Property Update for August 2023 depicts a market dogged, but not swamped, by challenges.

“Commercial sales over the first half of 2023 fell to the lowest levels seen in over a decade,” PropTrack economist Anne Flaherty said. “This has been seen across almost all asset types.”

“Commercial valuations have taken a hit off the back of higher debt costs, leading many owners to avoid selling.”

Commercial property sales over first half of 2023 were the lowest in over a decade. Picture: Getty

Vanessa Rader, head of research for Ray White Corporate, says the sense of urgency and fear-of-missing-out (FOMO) fuelling the market in recent years has departed.

“It’s a tough time. The large increases in cost of finance has pressured yields upwards for all asset types,” Ms Rader said.

With limited transactions, Ms Flaherty says it’s been hard to understand where values are actually sitting.

“This pricing uncertainty has contributed to a growing mismatch in the expectations of buyers and sellers.”

Opportunistic investors remain

But while many first-time commercial property buyers and REITs may have left the market, private high net worth individuals and families remain motivated, though more considered.

Burgess Rawson CEO Ingrid Filmer says while the property agency has seen less registered buyers at its recent portfolio auctions, it has maintained clearance rates, with 70% clearance at its August auction.

“I think we’re seeing a more serious buyer who is there to transact.”

In 2022, Australia’s population grew at the fastest pace since 2008. Picture: Getty

Experts agree that population growth is one tailwind breathing life and opportunity into Australia’s commercial property sector.

Australia’s population grew by 1.9 per cent in 2022, according to the Australian Bureau of Statistics, the highest growth rate since 2008, with the increase largely driven by international students and working holiday makers plus fewer people departing.

“More people require more goods and services, and this will support the real estate in which these are provided,” Ms Flaherty said.

Essential services remain the bright spot

Assets set to benefit are recession-proof essential services such as healthcare, childcare and fast food that have remained popular among investors throughout Covid.

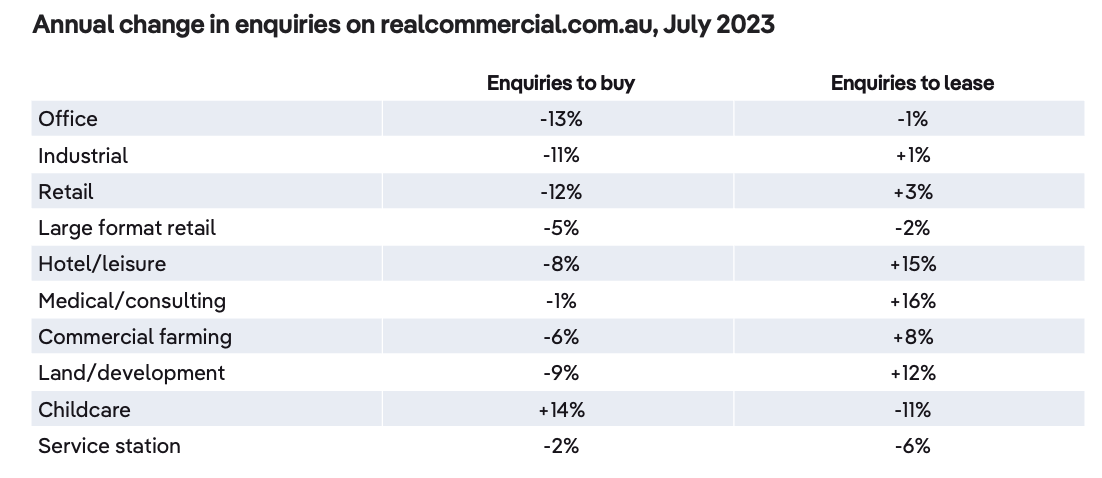

Childcare was the only asset class that saw enquiries to buy on realcommercial.com.au increase over the 12 months ending July, up 14%.

“Demand for childcare assets has been underpinned by growing enrolments, higher participation rates, a growing population and government subsidies,” Ms Flaherty said.

Source: realcommercial.com.au; July 2023 12-month moving average.

Healthcare, meanwhile, will also benefit from an ageing population. Currently around 17% of Australians are aged 65 or over, according to the ABS, with this number predicted to hit 20% over the next 10 years.

Ms Filmer says while listings and enquiry numbers are down, essential services “have continued to come to market and outperform”.

More investors are looking to increase exposure to healthcare as the population ages. Expressions of interest for this entry level physiotherapy in Victoria close Wednesday, 27 September. Picture: realcommercial.com.au/buy

She says Burgess Rawson’s yields have softened but only very slightly. For fast food assets, yields have increased from 4% a year ago to 4.18% at its August auction; for childcare centres, average yield over the year to August was 5.3%, up slightly from 5.14% in 2022 and 5.06% in 2021.

“At the start of the rate cycle investors sat back to watch. However as time went on and we saw essential services retain price and demand, we’ve seen vendors feel quite comfortable bringing stock to market and investors taking confidence that they’re not overpaying,” Ms Filmer said.

Demand for industrial is holding – for now

Growth in e-commerce continues to drive demand for more warehouse and logistics space, which has driven vacancy rates to record low levels.

“Low vacancy risk and high rent growth has helped to shield industrial values from the full impact of higher interest rates, limiting the level to which yields have risen,” Ms Rader said.

Industrial rents grew at the fastest rate on record over 2022 and are still rising in 2023. Picture: realcommercial.com.au/buy

But while demand for industrial assets is high, sales volumes remain low due to supply, Ms Flaherty said.

“This could be due to the high interest rate environment impacting values and discouraging owners from listing, but could also be due to the profitability of these assets making them extremely tightly held.”

With signs the manufacturing and economic growth is slowing, the industrial sector may follow suit.

Very different picture for office and retail

The outlook is gloomier in office and retail.

Driven by high numbers of people working from home, office vacancy has been rising for three years and is now at 12.8% for Australian CBDs, and 17.3% for non-CBDs, according to the Property Council of Australia’s July data.

While office vacancy continues to increase in most markets, the performance of office assets varies significantly by grade, Ms Flaherty said.

“Premium-grade buildings, especially those with high environmental credentials, are more likely to attract tenants.”

Increased supply and weakened tenant demand for office space has driven vacancy rates higher. Picture: Getty

Ms Rader says the vacant office space is “a massive issue”, exacerbated by new projects in the pipeline that are adding to vacant stock levels.

“There aren’t many buyers in the marketplace. Sellers will look to position their assets with new leases before making the decision to sell to maximise value.”

Meanwhile restricted consumer budgets were hurting the retail sector, Ms Flaherty said.

“Retailers offering in the discretionary space are likely to be hardest hit. Over the past 12 months, household goods, department stores, and clothing footwear and accessory retailing have seen the largest drops in consumer spending.”

Challenges going forward

Ms Flaherty said economic uncertainty remains a key challenge over the short term, and commercial property yields are expected to further expand.

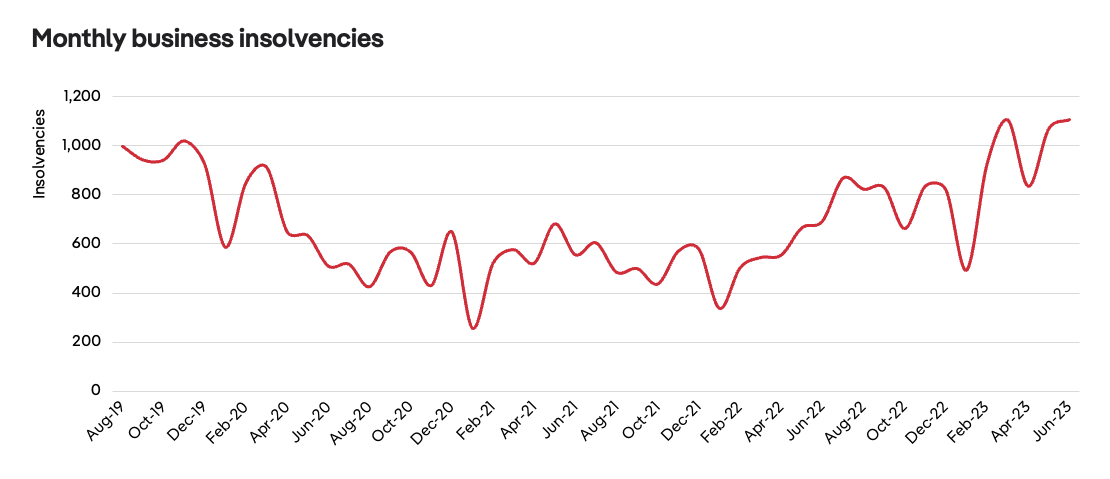

“Business insolvencies have been trending upwards since early 2022, which is likely to correspond with an increase in vacancy in the hardest hit sectors.

“Another challenge is the difficulties faced by the development sector. Construction costs and timelines have increased substantially, which is slowing the delivery of new commercial real estate.”

Source: Australian Securities and Investments Commission

Ms Rader expects more distressed assets to come to market, which she says will create opportunities for buyers.

“There will be a place for opportunistic investors willing to upgrade or develop, however it will be hard for many vendors to meet the market.”