Mayfair order casts shadow over Dunk Island resort plans

Investment manager Mayfair 101 has been hit by a ruling in the Victorian Supreme Court that ordered its IPO Wealth Holdings unit into provisional liquidation and could crimp its dreams of reviving Queensland tourism icon Dunk Island.

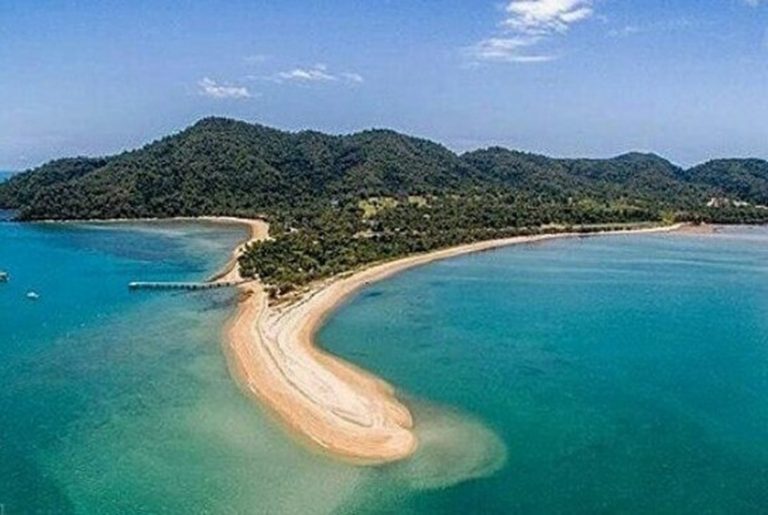

The failed subsidiary controls stakes in companies that were destined to float and is separate from Mayfair’s high-profile $1.6 billion plans to redevelop Dunk Island and Mission Beach into a tourism mecca, but will cast a shadow over these plans.

The ruling by Justice Ross Robson will see receivers Dye & Co, who took control of a series of IPO Wealth-related units in May, step up to become provisional liquidators, with powers to examine group founder James Mawhinney.

Justice Robson said it was “highly likely” that provisional liquidators would have to exercise their power to examine Mawhinney.

The move came after two days of hearings in which the state of assets held by the $80 million IPO Wealth Fund was laid bare, with concerns raised about the transfer of a stake in Indian software venture Accloud to a British Virgin Islands entity controlled by Mayfair.

Mawhinney offered a number of explanations for the shift, including that it was for the repayment of an internal loan, but the court heard that the fund’s finances were a “shambles” and a provisional liquidator should be appointed.

Justice Robson said Mr Mawhinney had not provided an adequate explanation for the share transfer and the court ruling also ended the prospects of a deed of company arrangement the founder proposed after calling in voluntary administrators Cor Cordis last month.

Mawhinney had argued against the appointment of provisional liquidator, saying Dye & Co had adequate powers as receivers to conduct their investigation and could apply to the corporate regulator if required.

However, the Australian Securities & Investments Commission intervened in the case in support of a provisional liquidation and Justice Robson found that the IPO Wealth scheme had failed.

A second report submitted by Dye & Co during the case said that records disclosed payments by IPO Wealth entities to facilitate the acquisition of properties by director-related parties.

Searches identified the recent acquisition of Mission Beach properties opposite Dunk Island registered in the name of Mr Mawhinney’s sister and her husband and in the names of the Panetta family, relations of Mr Mawhinney’s partner Brigette Panetta.

The receiver said further inquiries may be warranted in order to ascertain if the IPO Wealth entities had an interest and equitable interest in any of those properties.

Mawhinney tendered an affidavit saying Mayfair 101 had entered into about 250 contracts of sale and had settled on over 130 properties near Dunk Island.

“My family members have bought property in the region of their own accord, because they believe the Group’s redevelopment plan will be a success. Their properties do not form part of the Mayfair 101 Group,” the affidavit said.

“IPOW Group does not have any equitable interest or entitlement to these properties, and the Second Report provides no basis for suggesting that it might.”

But the receivers turned provisional liquidators have flagged their interest in the Queensland property transactions. Their initial report also identified properties held by Jarrah Lodge Holdings Pty Ltd, another Mawhinney-linked company.

“Further inquiries may be warranted in order to ascertain if the Borrower has an equitable interest in any of these properties,” the receivers said.

This article originally appeared on www.theaustralian.com.au/property.