Hot dates and house music: Why Yo-Chi is winning the fro-yo race

Aussie fro-yo chain Yo-Chi kicked off the year launching a new flagship Barangaroo store – a luxe waterfront building that previously housed two celebrated fine diners.

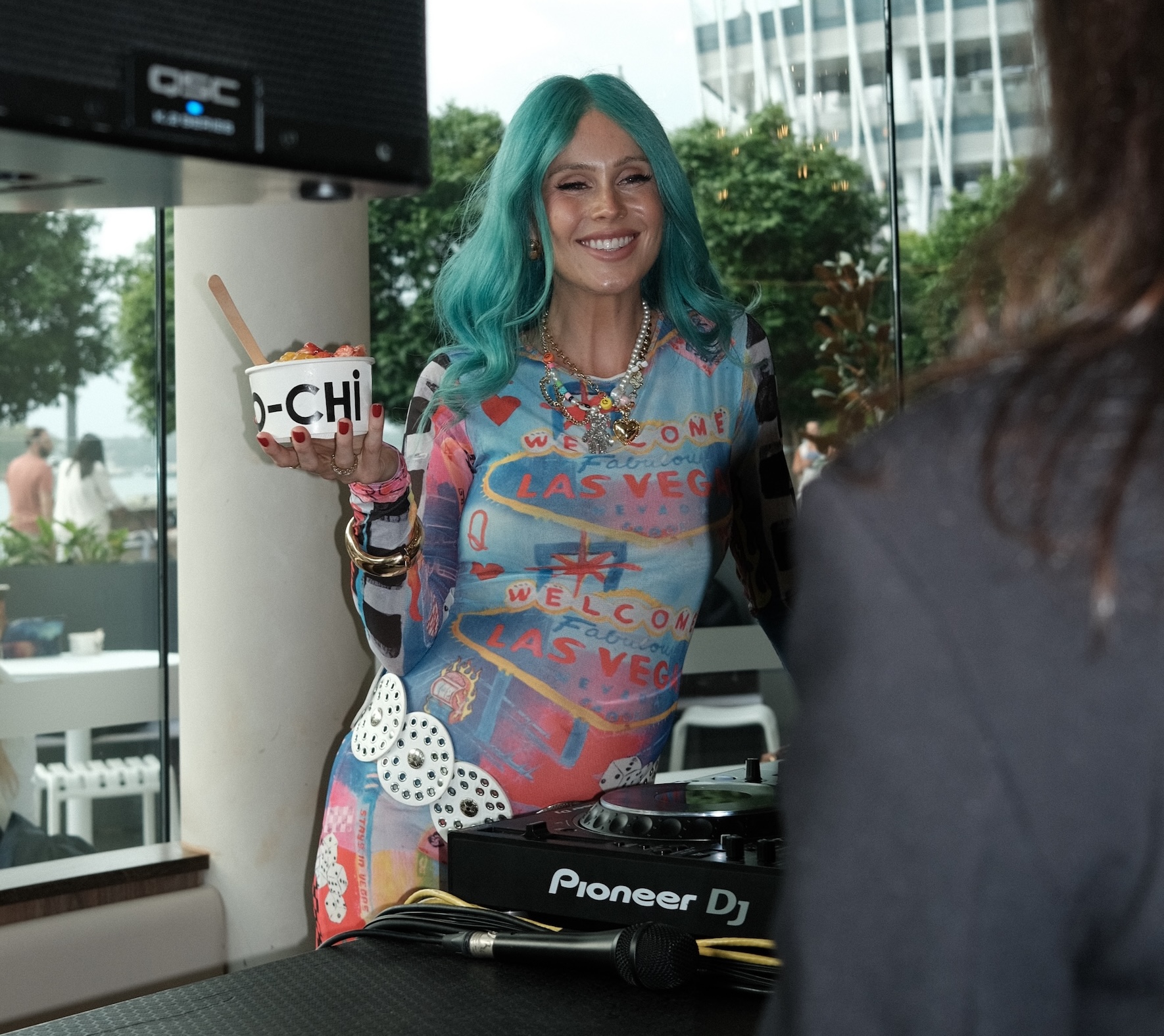

Akin to the opening of a new bar or club than a yoghurt joint, as the fro-yo taps flowed freely and day transitioned into night, eager punters partied to a live set from DJ Tigerlily.

“I’d never seen a Yo-Chi venue turn into a full-blown nightclub with a dance floor before,” Co-CEO Brooke Rodger told realcommercial.com.au. “It was epic.”

DJ Tigerlily at the opening of Yo-chi’s Barangaroo store in January 2025. Picture: Supplied

Since being purchased by the Allis family (of Boost Juice fame) in 2020, Yo-Chi has achieved cult-like status and remarkable growth in just five short years, expanding its store footprint from four to 57, and elevating Australia’s dessert culture to a whole new level of cool in the process.

Now an exemplar of Gen Z cool, its modish stores are buzzing hubs of students, date-nighters and digital savvy 20-somethings all opting for instagrammable desserts in lieu of after-dinner cocktails.

Yo-chi has exploded in the past five years with dozens of new stores opening across the country. Picture: Supplied

It’s a far cry from the nostalgic, if somewhat daggy pre-millenium era of summer arvos spent chasing down the Mr Whippy van, balmy evenings at the local Cold Rock, or a late-night Maccas run to grab a McFlurry.

But how exactly did we go from strolling the beachfront with an ice cream cone in hand to hanging out in nightclub-inspired fro-yo bars?

Gelato disruption

Innovative gelato brands had a lot do with it.

Back when traditional ice cream parlours ruled supreme, for many Aussies, the word ‘gelato’ meant Mr. Pisa desserts served at local Italian restaurants, à la Passion Delight and Baci Kiss.

But when brands like Messina and Gelatissimo stormed onto the scene in the early 2000s, traditional ice-cream and tacky frozen gelato suddenly fell out of favour and artisanal gelato came into vogue.

Gelato chain Messina redefined the industry with sleek retro-inspired fit outs and house music. Picture: realcommercial.com.au

Both chains captured strong market share via their authenticity, freshness and abundant choice, however Messina in particular successfully redefined gelato’s image with its bold flavour profiles and punny names (who could forget Robert Brownie Jr?).

“When I started in 2002 my driving ambition was to get people to understand that gelato wasn’t this icy hard fake colouring and flavouring; gelato was never meant to be that way,” founder Nick Palumbo told The New Daily in 2014.

Messina also helped pioneer the modern dessert bar by replacing the fluorescent look of the traditional ice cream shop with moody lighting and sleek retro-inspired fit outs, and blasting specially curated DJ sets of underground house music.

The brand’s laidback and accessible social media presence also matched the unique vibe of its stores, gifting the company plenty of street cred.

“We let the product speak for itself in many ways. Images are everything. We also like to maintain a very specific tone of voice that’s friendly and inviting to all,” said Messina co-owner and former brand manager, Declan Lee.

“It’s not aimed solely at millennials; it’s really about appealing to everyone. Our tone of voice must match the product.”

The rise and fall of fro-yo

Despite being introduced to the Australian market in the 1970s and growing in popularity during the diet-conscious 1980s, the fro-yo category didn’t truly explode until the early 2010s.

Marketed as a healthy alternative to ice cream which played into millennial wellness culture, brands like Yogurberry, Mooberry, Noggi, and of course Yo-Chi – which launched in 2012 – offered interactive make-your-own experiences that promoted fun and collaboration.

Boost Juice co-founder Janine Allis and her family bought Yo-Chi in 2020. Photo: Getty

At the time, Australian fro-yo culture was heavily influenced by the ‘cool factor’ of Korean and American markets, where chains like Pinkberry and Red Mango had exploded.

K-pop and Korean pop culture also fuelled interest in Asian dessert trends like mochi toppings and green tea flavours.

Yo-chi’s self service model allows customers to get creative. Picture: realcommercial.com.au

Fro-yo shops were also relatively cheap and quick to open, often in small kiosks or tight retail spaces in shopping malls.

Market saturation ensued and by 2013, the ACCC listed 112 frozen yoghurt suppliers and 32 brands operating hundreds of outlets.

As Titanium Food director Suzee Brain notes, following a meteoric rise, the industry subsequently experienced significant decline.

“The fro-yo of the 2010s only had a small window to trade in. As a dessert offering it couldn’t really get any sales volume until after school and on weekends,” Ms Brain explained.

“It was originally pitched as a takeaway option at a low price point – say $5. Operators needed to pay top dollar rents for high traffic locations to get an ‘impulse’ purchase. Eventually, the numbers didn’t stack up.”

Fro-yo 2.0: The rise of Yo-Chi

If Messina set the template for the contemporary dessert bar, Yo-Chi took the concept of architecturally designed stores soundtracked by cool music and amplified it for the TikTok generation.

“Yo-Chi takes its cues from many TikTok tourism leaders, be it Messina, Lune Croissanterie, Black Star Pastry or restaurants like Chin Chin, who know that loud music has an impact on up-spending,” said Suzee Brain.

Stores are designed to encourage customers to remain in store. Picture: Supplied

Yo-Chi design director, Claudia Marro, notes how the stores are intuitively curated to attract young people to stay inside the venue, rather than buying their fro-yo to-go.

“From the team member who greets you at the machines and guides you through the process, to the toppings bar where you can build your creation alongside friends, every part of a Yo-Chi venue is designed to encourage socialising,” Ms Marro told realcommercial.com.au.

“The abundance of round tables and stools makes it easy to gather with friends in a casual space where you can stay as long as you like. Our venues become just as much about positive connection as it is about the product.”

As for the chain being heralded as nightclubs for Gen Z, Co-CEO Brooke Rodger says music is an essential part of the Yo-Chi experience.

“We’re very specific about playlists and making sure the vibe is right across the different parts of the day. All our music is centrally controlled by our in-house DJ.”

Yo-chi has rapidly expanded since 2020, opening 53 new stores Australia-wide including this one in Sydney’s Newtown. Picture: realcommercial.com.au

Rapid expansion has Yo-Chi on track to achieve 60 stores by the end of 2025. Sights are also firmly set on Asia after the company launched its first Singapore location earlier this month in the city’s upscale shopping district of Orchard Road.

Brooke Rodger said the response from Singapore customers has been “mind-blowing.”

“On the day of launch we had people queuing outside from 3am and the queues continued until we closed at 11pm that night. It was the same the next day, and the next. There were memes floating around on socials all week about the lengths Singaporeans were willing to go to queue for Yo-Chi.”

Customers queued outside Yo-Chi’s new Singapore store from 3am until 11pm when it first opened. Picture: Supplied

Customers have flocked to the new Yo-Chi store in Singapore. Picture: Supplied

When pressed further on Yo-Chi’s expansion into South-East Asia, Rodger revealed more is to come.

“We’re a small Aussie company that’s having a crack at a new market, so we’re stoked that our brand-new team over there has been able to pick up on the positive energy that’s so central to the brand in Australia. Watch this space.”

Ice cream still dominates…for now

With health-conscious Gen Z-ers now flocking to club-inspired dessert venues while actual nightclubs continue to struggle, are the glory days of the classic ice cream cone numbered?

IBISWorld research reveals that while gelato and frozen yoghurt brands have clearly become increasingly popular in recent years, and classic ice cream franchises like Wendy’s Milk Bar have floundered, traditional ice cream shops still account for most industry revenue.

Yo-chi’s Chadstone store. Picture: Supplied

2024 data shows traditional hard-serve and soft-serve ice cream in Australia has a market share of 44.5% and $187.4 million, while gelato and yoghurt products combined make up 31.1% and $131 million.

While Yo-Chi only has opened 53 new stores in five years, Ms Brain said that compares to 529 ice-cream stores.

“If we add ‘fringe’ uses like dessert bars that number probably doubles,” she said.

“There’s certainly room for everyone, but right now Yo-Chi is the gold standard of a dessert bar business.”