Greg Goodman calls for reality check on AI boom

Goodman Group’s Tsukuba Tech Central in Japan

Billionaire developer Greg Goodman has warned that the hype in the data centre boom is masking the risks of a surge in highly-leveraged development deals worldwide.

Some of the world’s largest technology companies have issued billions of dollars worth of bonds to help fund the roll out of huge data centres and players including Blackstone, KKR and Partners Group are active in this region.

Private equity players have piled into the sector, drawn by the potential for multi-billion dollar pay-offs on the back of the AI revolution despite concerns about the funding gaps for the massive complexes.

“The amount of leverage going into the sector all around the world is extreme. I don’t think it’s sustainable. I don’t think it will be sustainable,” Mr Goodman said told the company’s annual general meeting on Tuesday. The Goodman boss said there was exaggeration about the impact of AI and pointed to the reality of building huge data centres and predicted the hype would fade as excitement levelled out.

He emphasised that developers had to have the capacity to actually deliver sites. “We’re very focused on metro areas, which we think are the best, most sustainable investments for our long term investors,” he said.

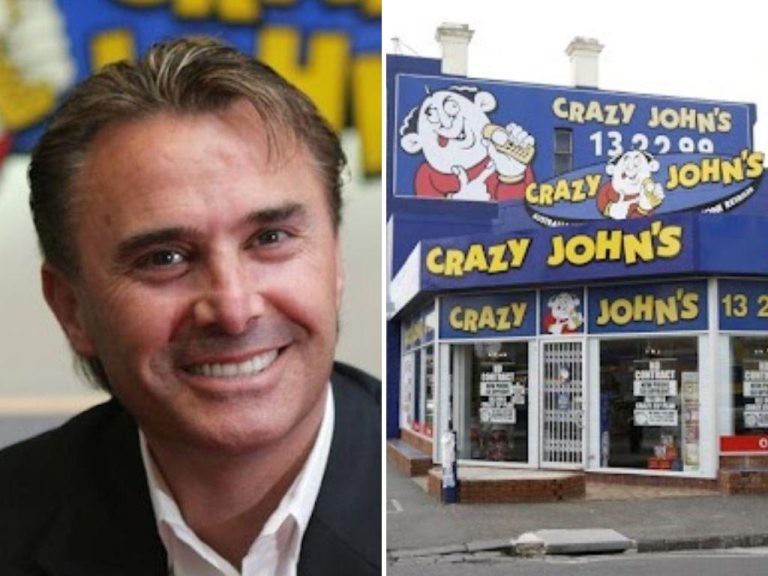

Billionaire developer Greg Goodman. Picture: John Feder/The Australian.

Mr Goodman said AI would change the world over the next ten years but it was harder to get done than to talk about. “It’s about having the capital and the infrastructure. And a lot of that infrastructure is actually people that know what they’re doing,” he said.

Goodman Group sees itself as having an advantage due to keeping its debt levels low and drawing on the backing of major pension funds from around the world to back its new buildings.

The company flagged that it was lifting up to a workbook of about $17.5bn of work-in-progress across data centres and logistics projects. It sees its advantage in being able to pick up sites, particularly in the US, which can be used for both purposes.

It is also defraying the costs of the massive centres by taking on partners, including in Europe, where it is seeking to launch a fund with four complexes, and in Australia where it is seeking backing for a complex in Sydney. The company is focused on major cities where land is tight and it already holds positions and where it can deal with hyper-scale developers.

The listed company is renowned for its lucrative pay and incentives schemes and has attracted multiple strikes against its practices. It saw off the latest threat of a second strike as the billionaire chief executive trimmed his wages.

The move was enough to satisfy proxy houses ISS and Glass, Lewis & Co. But Ownership Matters and ACSI objected, driving a protest vote of about 16 per cent. The company has been under scrutiny for payments not only to the billionaire founder, but also to other well-paid executives who have outstripped their rivals.

Goodman independent chairman Stephen Johns said the company was focused on dealing with hyperscale developers like AWS, Microsoft and Google, and their involvement would help underwrite its projects.

“We intend to maintain a very low leverage,” he said. “We’re confident, and management is confident, that the equity is there from major pension funds and institutional investors around the world and in Australia.”

Goodman shares rallied 1.5 per cent to $30.95.