Gold Coast gets a polish as apartment market heats up

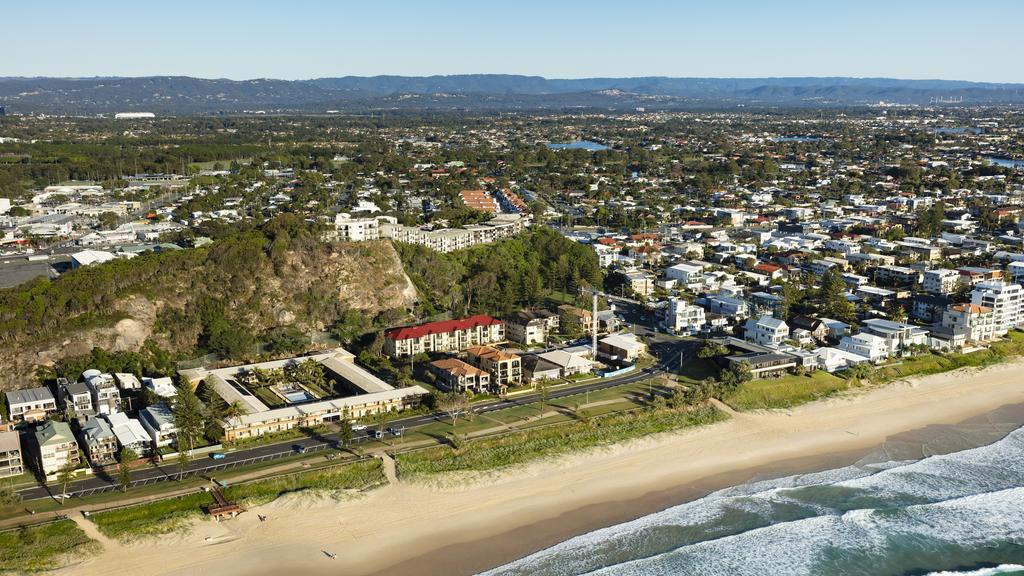

Nalu Resort, formerly Nobby’s Outlook, at 122 Marine Parade on the Gold Coast’s Miami.

Gold Coast apartment projects are making a comeback as a series of developers bet that rising property prices will outweigh soaring building costs, with a series of new towers getting under way.

In one of the latest plays, Monaco Property is snapping up a 1970s holiday resort on the Gold Coast for $70m in one of this year’s largest deals in the beachfront town.

The off-market deal arrives as demand for the tightly held apartment market in Queensland’s second-largest city continues to rise.

Nalu Apartments – formerly Nobby’s Outlook – comprises 46 long-term rental two and three-bedroom apartments and has two large swimming pools which overlook Nobbys Beach, about 15km from the centre of the Gold Coast.

The 7284sq m property at 122-130 Marine Parade property last sold for $23.75m in September 2018 to Moose Toys’ Paul Solomon, who renovated the resort and renamed it Nalu.

Monaco has outlined plans to turn the site into an “ultra-luxy” residential development, taking some inspiration from the developer’s Isle of Capri villas in the Gold Coast. That project, which includes 48 villas, is due for completion in the third quarter of this year.

Monaco partner Jonathan Grasso said Nalu was “one of the best beachfront development sites on the eastern seaboard of Australia”.

“Its position overlooking the beachfront and proximity to the heart of Nobby Beach provides a truly unique opportunity for our team to create an incredible residential development that will be a legacy for years to come,” he said.

The deal arrives as Azzura Investments has applied to halve its upcoming Southport development Monarch Place, reducing it from 40 storeys to 21. The updated plans are for 208 apartments across 14 levels and include a medical suite and three levels of short-term accommodation.

Robert Badalotti, the developer’s founder, said the move was a bid to get the project off the ground faster “which meets the needs of our buyers who are keen to move in as soon as possible”.

Monarch Place in Gold Coast’s Southport.

Monarch Place has more than $130m in preliminary sales, most of which are downsizers and owner-occupiers, the firm said.

Southern Gold Coast’s apartment market is now the region’s most tightly held, according to Urbis’s latest Apartment Essentials Report. The report found apartment sales in the Gold Coast in December rose to 290 – 73 of which were in the city’s south – up from 180 in the previous quarter.

There were 1041 sales over the full year, down from 1205 in 2023.

Urbis consultant Lynda Campbell said blue-chip apartments were on the rise in Gold Coast’s Southern Beaches.

“Most of the projects coming to the market are smaller-scale boutique developments either directly on the beachfront or close to the beach, which heightens demand for this type of product,” she said. “The problem is there are not enough of these projects coming on to the market to satisfy demand, which is putting upwards pressure on prices.”

Sophia by Mosaic, a nine-storey, $140m project at the northern end of Palm Beach, has also had strong early demand, reaching $105m in prerelease sales with 75 per cent of the complex now sold.

A render of Mosaic Property Group’s upcoming Sophia in Palm Beach, Gold Coast.

Malaysian conglomerate MRCB International’s $200m 192-apartment project Maris in Gold Coast’s Southport.

Hirsch & Faigen has also recently announced plans for a $240m residential apartment complex at Broadbeach, comprising 100 apartments over 31 storeys.

Meanwhile, Malaysia’s MRCB International is preparing to begin development on Maris, a $200m project comprising 192 apartments at 20 Queen Street in Broadwater, the home of the former Sundale Motel.