Companies weigh up potential listings of property trusts on ASX

The property sector is proving a profitable ground for potential listings of new companies on the ASX, with Newmark Capital the latest to weigh up a move as it readies a potential listing of its $300 million hardware trust.

The company, which is best known for high-profile assets such as Melbourne’s Jam Factory and Como Centre, flagged a possible listing to investors in the hardware vehicle and has held talks with potential advisers.

The move by the institutional real estate owner — which has assembled a portfolio valued at about $1.5 billion — could see it list the trust that owns large-format retail centres and expand it as investors chase steady returns while interest rates are at record lows.

Newmark declined to comment but the company’s moves are in keeping with investors’ desire for property assets that have delivered throughout the coronavirus crisis.

The Melbourne-based company, which has a strong record in adding value to properties, is one of a number of groups that are looking at listing their products.

Last month, unit holders of the Newmark Hardware Trust voted overwhelmingly for changes to the fund required for it to be restructured and listed on the ASX.

The portfolio includes large format retail complexes in Maroochydore, Queensland, Launceston, Tasmania, Lake Haven, NSW, and Warragul, Victoria. Anchor tenants include Bunnings, Kmart, Officeworks, and JB Hi-Fi ,and there is a lease term of more than seven years.

Since the vote, Newmark Capital has also been considering merging the trust with a separate fund that owns an $80 million property in the Melbourne suburb of Chadstone and listing the combined vehicle.

The other trust owns the HomePlus+ Chadstone Homemaker Centre, with tenants including Bunnings, The Good Guys, Freedom, Snooze and Barbeques Galore.

Meanwhile, private funds manager Real Asset Management is looking to float a neighbourhood shopping centre and medical property trust with about $500 million worth of assets, with the pitch being it can be expanded while delivering on daily needs.

In late December, RAM picked up a parcel of three regional hospitals for $100 million as it considers listing essential services REIT. It bought the hospitals in Tasmania and NSW from Canada’s Northwest Healthcare Properties and lifted its property portfolio to about $500 million.

RAM’s essential services property portfolio now has 13 neighbourhood retail centres and six medical properties, four of which are private hospitals.

RAM managing director Scott Kelly said that over the past five years the company had been assembling a portfolio of smaller, neighbourhood-based retail and medical assets.

“Record low rates and essential services-based tenure, among other factors, is supercharging investment demand for these types of assets, and so we plan to provide for that with some exciting capital markets initiatives in mid-2021,” Mr Kelly said.

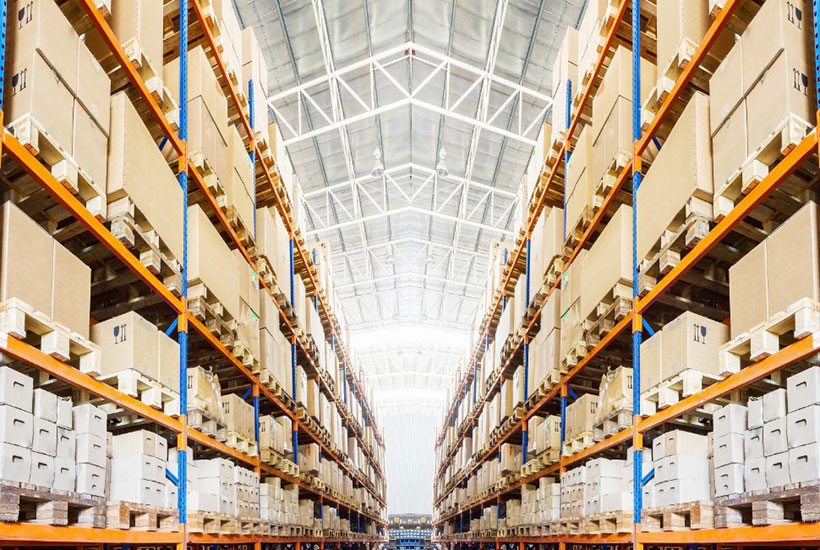

The largest potential float is private equity firm Blackstone’s option of listing a $3.5 billion logistics portfolio, which is partly predicated on its ability to grow and even set up new funds.

Blackstone is pitching the company, known as Milestone Logistics, as having the potential to become Australia’s only internally managed and largest domestic pure-play logistics real estate platform.

It will own 45 warehouses that span about 1.4 million square metres and has told investors via JPMorgan and Morgan Stanley that there are significant growth opportunities. The portfolio is almost three-quarters weighted towards Melbourne, Brisbane and Sydney and is 98% occupied with almost 90% to government, national and multinational tenants.

Blackstone may keep a stake of up to 45% — but the fund, which is led by veteran executive Chris Judd, could generate strong growth via bolt-on acquisitions and expand into funds management.

The trust’s outlook is also underpinned by a structural shift to e-commerce and a punt that the prices of warehouses will rise even more in future.

Each of the new companies would be listing in parts of the A-REIT sector that are performing strongly.

Newmark Capital would follow the recent path of HomeCo and the daily needs trust it successfully listed last year, as well as strongly performing large-format specialist Aventus.

This article originally appeared on www.theaustralian.com.au/property.