Warning as Melbourne’s CBD car parks face financial pressure | Ray White

Melbourne’s CBD car parks are under siege and the cost of a bay for a day is dropping.

Melbourne’s CBD car parks are under siege as government levies, work from home and close to 1 million square metres of empty office space put them under growing financial pressure.

There are now warnings growing numbers of carparking complexes will be sold off, or even converted into data centres to support the city’s growing computing needs as operators search for ways to keep them profitable.

New research from Ray White’s commercial arm shows the average $64.43 daily rate for a car park in the CBD is now cheaper than it was more than a decade ago, with the figure at $65 in 2013.

RELATED: Ex-Tiger star chases $1.85m payday

Future Victoria: From paved parking lot to play paradise

Holes of Melbourne: Mayor prepares to fight ‘zombie’ sites around the city

It is the only major capital to have recorded a reduction in parking costs in the 12 years covered by the research, which also shows operators are also now offering nation-leading early bird discounts of 62.9 per cent in a bid to lure commuters back into the city.

It comes as Property Council data shows office vacancy rates sit at a national high of 18 per cent, while hospitality magnate Justin Hemmes has revealed plans to turn a recently sold city council carpark into an entertainment hotspot.

The carpark complex at 34 Little Collins St, Melbourne, has sold to the Merivale Group.

The complex is expected to become a multi-storey entertainment precinct. Picture: Timothy Burgess.

Ray White head of research Vanessa Rader said carparking was a key indicator for the health of a city’s office market and “Melbourne is looking pretty bad”.

“I wouldn’t be surprised if the city’s vacancy rate was more than 18 per cent,” Ms Rader said.

“And for a market that is a bit over 5 million square metres of space, that’s about 1 million square metres of empty space.”

The analyst said while more car park operators would probably consider selling, they might struggle.

“I don’t think they will necessarily transact,” she said. “The levies are high, the occupancy is low and so are the parking rates, and you have to pay land tax. Who will buy that?”

However, alternative uses, such as transforming them into data centres to boost digital security and computing power in the CBD, could become more feasible.

Ray White Group head of research Vanessa Rader says car parks could be a hard sell.

JLL head of capital markets in Victoria Josh Rutman handled the recent sale of the City of Melbourne’s 34-60 Little Collins St complex to Justin Hemmes Merivale Group and said carpark ownership had become far more challenging as a result of congestion levies.

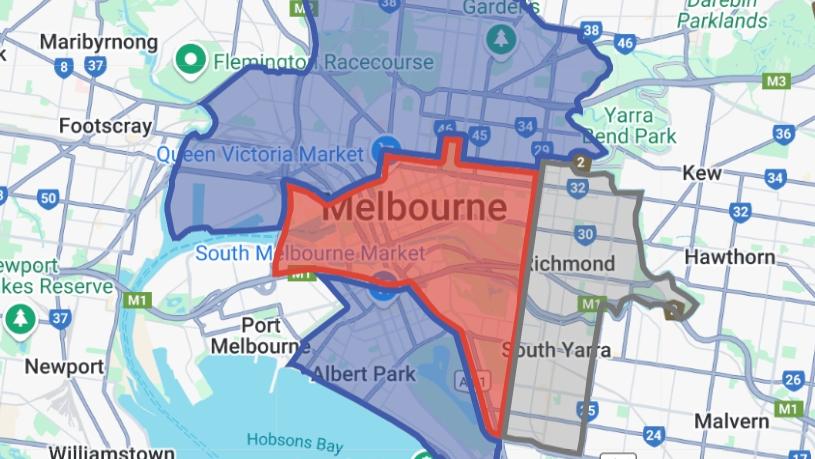

This year the state government has applied a levy on all individual carparking spaces of $1750 across Melbourne’s CBD and its immediate surrounds.

A secondary catchment faces fees of $1240, with this region to be expanded next year.

“The appeal of them has been that it’s low-maintenance and easy to do investment, but costs have changed dramatically and the demand has shifted,” Mr Rutman said.

“So the demand for carpark investments has changed, as it’s not viewed in the same light it used to be, particularly with the levies on inner city and CBD carparks.”

However, the commercial property agent added that they were also typically in strategic locations that could suit other developments.

“That’s what we saw with Little Collins St, a great range of interest from hospitality groups and developers who saw value in that location,” Mr Rutman said.

“But not so much in it as a carpark.”

While he didn’t believe carparks would immediately disappear, he did note operators looking at buying them today would be pricing their budget for them based on the new, lower, demand levels — and heightened costs.

A State Revenue Office map shows Melbourne’s car park levy areas including a $1750 red zone and a $1240 a car parking blue zone. The grey zone will join the blue zone in 2026.

With city planners prioritising bike lanes, a nearly completed metro tunnel about to boost rail access to parts of the city and its fringes, Mr Rutman said it was possible Melbourne could head down more of a New York path — where most residents did not use a car day to day.

Colliers director Matt Stagg has specialised in CBD and city fringe car park sales for more than two decades and said the market had been polarised since the Covid pandemic.

“Collins Street, Flinders Street and Spring Street have performed well,” Mr Stagg said.

“But car parks in secondary locations have not.”

The agent added that weekday demand now peaked on Tuesdays, Wednesdays and Thursdays — but Monday and Friday volumes remained soft.

He said institutional landlords and councils were increasingly viewing city car parks as non-core assets, and many were likely to be sold off in the months ahead.

“Yes, I think you’ll see more councils and landlords divest car parks over the next 12 to 24 months,” Mr Stagg said.

“Increased land tax and increased car park levies are eroding the net income.”

He said many of Melbourne’s car parks sat on highly valuable land parcels and were being eyed for development.

Carparks across Melbourne’s CBD have cheaper weekday rates than they did in 2013.

However, the agent added that tradespeople, essential workers, and commuters from outer suburbs who couldn’t rely on public transport continued to drive demand in key locations, but the days of car parks as cash cows were fading.

“I think if new car parks are going to be built, it’ll be in the outer suburbs near train stations,” he said.

“Closer to the city, we’re going to see many of them redeveloped.”

Mr Stagg said individual car spaces in the CBD, especially in premium apartment buildings or strata offices, were still changing hands for anywhere between $50,000 and $100,000, with off-market sales in top-tier locations occasionally pushing as high as $150,000 per bay.

— Additional reporting, Nathan Mawby

Sign up to the Herald Sun Weekly Real Estate Update. Click here to get the latest Victorian property market news delivered direct to your inbox.

MORE: Couple ordered to demolish dream home

Melbourne businessman Ali Ali’s Shrublands mansion in Canterbury gets $6m price cut