Sydney CBD fringe attracts new wave of tenants as employers try to entice workers back to office

Popularity is surging for workspaces on the fringe of Sydney’s CBD as employers try to entice their staff back to exciting new offices in trendy areas.

Sydney CBD Fringe Leasing Manager Justin Rosenberg, of Colliers, says Surry Hills, Darlinghurst, Ultimo and Pyrmont are experiencing a leasing surge in the wake of the Covid lockdown.

“Business owners and companies have had to rethink what is going to draw staff back into the office and a lot of the CBD fringe suburbs provide an energy, atmosphere, amenity and point of difference to help companies retain high-quality talent,” Rosenberg said.

Tenants have put an increased focus on lifestyle locations close to cafes, restaurants and parks, looking to engage their workers on a deeper level who are searching for greater work- life balance.

MORE:

Home earns $18m in three years

Eastern suburbs apartment record smashed

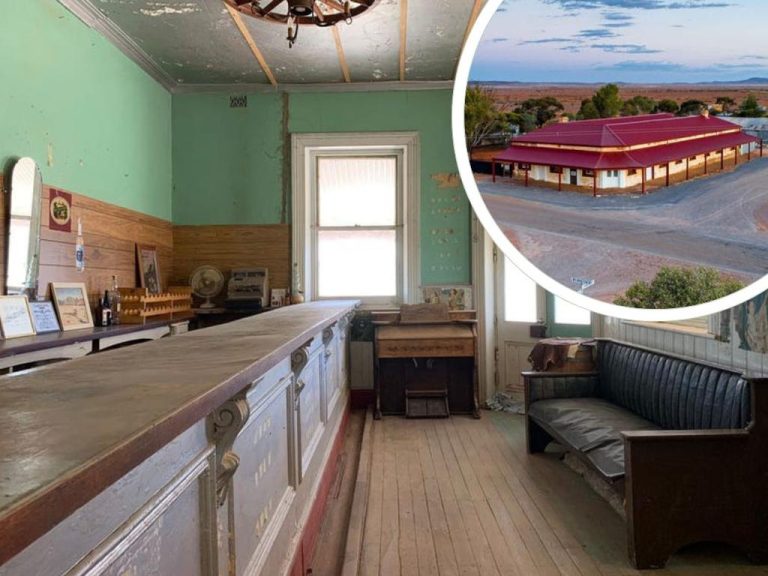

Withyouwithme recently acquired a 880 sqm whole building at 109 Regent St, Chippendale.

Leading tech company Withyouwithme recently acquired a 880 sqm whole building on Regent St in Chippendale, having moved their headquarters from North Sydney to be near the new Tech Central precinct.

“Our new Chippendale office will serve as our global headquarters, providing the space to house our team in Sydney, as well as a great creative space for our team to complete their best work,” said Withyouwithme Chief Operating Officer Jason Laufer.

“We could not be more excited about moving into our new home.”

The Commons, a co-working operator, has also taken out a lease on a 1,750 sqm space on Crown Street in Surry Hills, a deal negotiated by Colliers’ Tenant Advisors, Justin Lam and Rowan Humphreys.

Jason Laufer, Withyouwithme Chief Operating Officer

Surry Hills was named one of the coolest suburbs in the world by TimeOut Magazine in October, and although the recent lockdown dampened activity, Rosenberg has already seen levels bounce back.

“Covid was a speed bump on a fantastic beginning to the year,” he said.

“While things did slow down, they certainly didn’t stop and there was always confidence that people would, and still do, need an office.

“New developments like 52 Reservoir Street and 249-255 Crown Street have shown owners they can gain $1,000sqm + rents outside the CBD if owners deliver a high-end creative office environment with CBD-like building amenities.”

Social distancing at 109 Regent St, Chippendale.

Data collected by Rosenberg’s team over the past six months shows more than half of the inspections were for possible expansion, with most businesses inspecting from the media and communication space, followed closely by those in information and technology.

Inspection activity was highest in June before a drop off in July coinciding with lockdown. It has been climbing since, stabilising in October.

Spaces in the 0-200sqm and 201-500sqm range accounted for over 60 per cent of inquiries, while one-fifth were in search of a space larger than 1,001sqm.

Colliers have recently been appointed to lease more than 20,000sqm on behalf of Scentre Group, Goodman, Australia Post, Centennial Property Group, Abazio and Time & Place across their CBD Fringe assets, all spaces that offer CBD-like amenity and quality.

The kitchen at 109 Regent St, Chippendale.

“We’ve seen increased inquiry from a wide range of users. It’s not just creatives, media and technology, but there is also interest from professional services and traditional CBD operators,” Rosenberg said.

Large tech companies have already shown their commitment to the new precinct named ‘Tech Central’ at Haymarket, with approval recently granted for Atlassian’s new 40-storey headquarters, which is expected to be completed by 2026.

Data from Colliers Research reveals the impact Covid-19 has had on rental prices. Average net face A-Grade rents in the city fringe remained steady throughout the pandemic, and even slightly increased by 3.4 per cent between Q1 and Q2 this year.

Average net face B-Grade rents declined slightly in 2020 (-1.7 per cent), but have now levelled out heading into the latter part of 2021.