Sunshine State a beacon for industrial investors

Brisbane’s industrial property market is on the up, with investors looking to the Sunshine State in increasing numbers.

The latest snapshot on investment volumes and trends released by Cushman & Wakefield reveals Brisbane’s rolling annual investments reached $1.1 billion in the first quarter – its highest level since Q3 2015.

It is the fourth consecutive period of growth, with the Trade Coast precinct dominating, pulling in $200 million in investments in Q1 – 66% of the state’s total.

Commercial Insights: Subscribe to receive the latest news and updates

The upward trend contrasts with the south of the country where transactions declined for all Sydney markets and remained flat in Melbourne.

Cushman & Wakefield head of research Dominic Brown says investors are showing a “strong level of interest” in Brisbane.

“We are seeing more and more investors look up to Brisbane now, given a lot of the focus has been on Sydney and Melbourne in general,’’ he says.

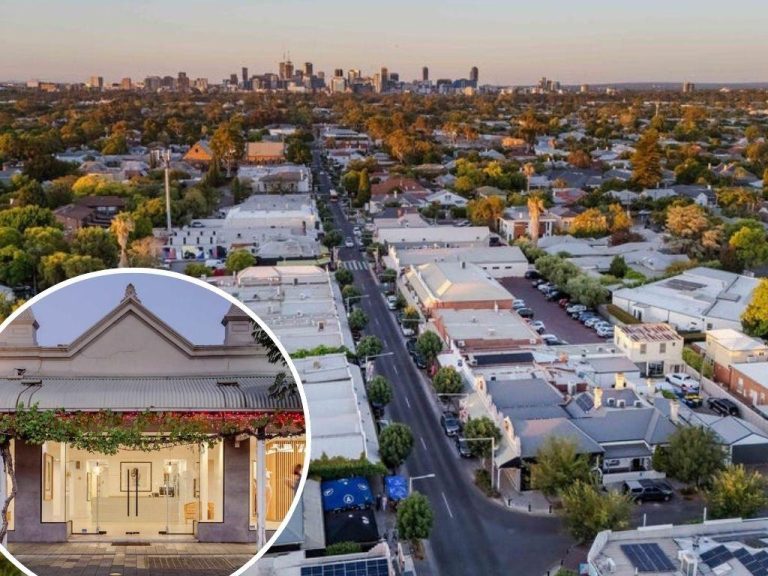

In Melbourne, a lack of stock has resulted in a stagnant first quarter, with the rolling annual investment totalling $1.2 billion.

Brisbane’s industrial market is seeing significant investment.

However, investor activity is tipped to pick up in the city’s west, with the new $5.5 billion West Gate Tunnel project now underway, improving access to the port.

Meanwhile appetite in the vacant land market remains strong with capital values increasing by as much as 36% year-on-year.

Melbourne landlords also saw modest growth with prime net face rents averaging $85-$95 per sqm across the South East and East.

In Sydney “demand from the logistics sector has been pretty strong over the past six months,” says Mr Brown.

The interest has led to several large lease agreements in the outer west, including DB Schenker’s deal to take 50,000sqm at Hoxton Park and AM Solutions taking 31,515sqm at Huntingwood.

However, overall transactions continued to trend lower – as they have for most of the past three years – with investments tallying just $245 million in 2018.

The decline coincides with tightening cap rates and waning average yields at or below 6.5%.