Six Adelaide pubs on block with $70m price tag

The Blue Sky-backed GM Hotel Group in Adelaide has hit the block and is tipped to sell for more than $70 million as buyers circle the portfolio.

The six-strong portfolio is being sold off by the private equity arm of Blue Sky Alternative Investments that picked up 10 Adelaide pubs from Independent Pub Group for about $66 million in 2015.

Blue Sky teamed up with former IPG boss Greg Maitland to buy the portfolio and rebranded the business GM Hotels.

Commercial Insights: Subscribe to receive the latest news and updates

The large-format suburban pub network could appeal to buyers ranging from the listed Redcape Hotels Group to the KKR-backed Australian Venue Company.

The portfolio includes two freehold hotels, Christies Beach and The Lodge, Brahma, and four leasehold hotels, the Tower Inn, Crown Inn, Emu Hotel and Beach Hotel.

The portfolio’s 203 gaming machines and their high ranking on turnover measures is tipped to give a buyer a major slice of the state’s gaming turnover.

There are also seven retail liquor outlets and more than 20,000sqm of site area and a large on-premise business.

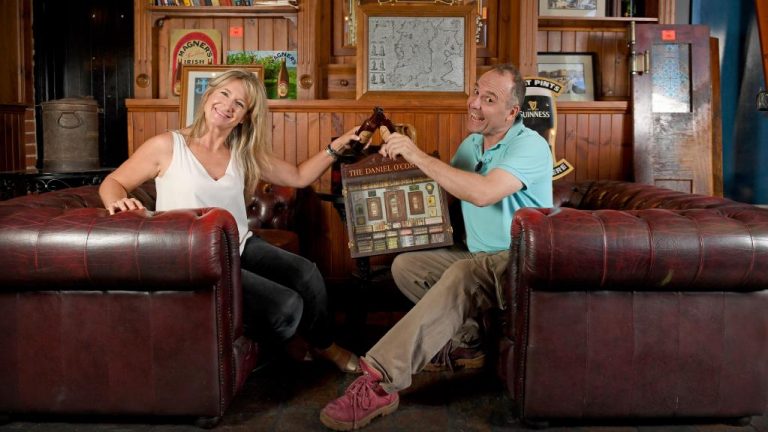

The Lodge at Brahma is a part of the GM Hotels portfolio.

Not since the privately held Saturno hotel portfolio was sold to the Woolworths-backed ALH Group in 2007 for about $110 million has such a large pub group been on the block in South Australia.

The two most recent large hotel sales were ALH Group’s acquisition of the Watermark Hotel for about $25 million and the sale of Lockleys Hotel for $16m.

JLL national director John Musca is handling the sale and says South Australia has among the lowest number of hotels and gaming machines per capita across the country, providing an opportunity for growth.

Few pub portfolios have been offered since the $240 million Zagame Hotel portfolio in Victoria was taken to market last year. It drew interest from investment bank Moelis but there was no deal.

Australian Venue Company, backed by a venture between Bruce Dixon and US private equity firm KKR, also struck a deal with Coles earlier this month.

Under their venture, AVC will run Coles’s 87 Spirit Hotels venues in Queensland.

This article originally appeared on www.theaustralian.com.au/property.