Pub market reopening puts Redcape back on track

The MA Redcape Hotel Fund has bought The Criterion Hotel.

A series of big ticket hotel trades worth about $70m just struck by a hotel investment fund run by investment bank MA Financial show the pub market is getting back on track.

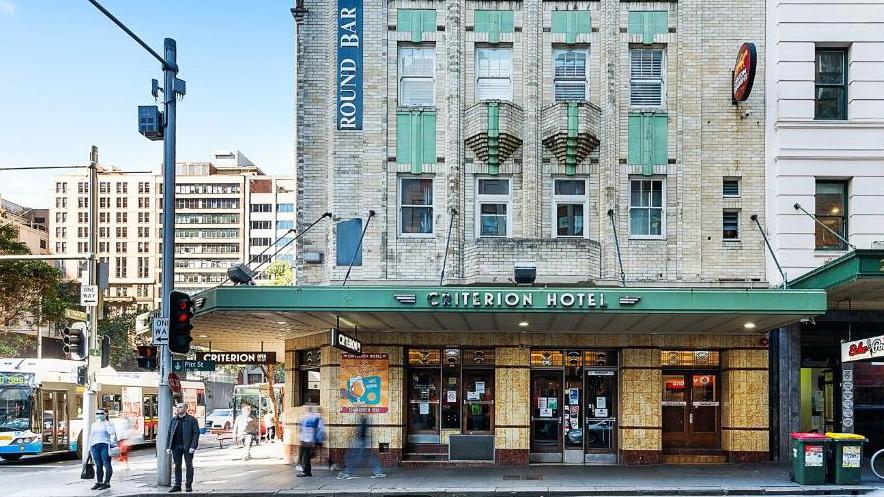

The MA Redcape Hotel Fund has snapped up well-known watering hole The Criterion Hotel in the Sydney CBD and also sold off a gaming hotel, the Crescent Hotel, in the western suburb of Fairfield.

The two transactions totalled about $70m and were struck with the veteran Sydney publicans Gallagher Hotels. The family group bought the Crescent Hotel at a price of just over $47m and then sold The Criterion Hotel to Redcape.

The deals were brokered by JLL Hotels agents John Musca and Ben McDonald.

Redcape wanted to add an iconic inner-city pub to its portfolio, which led it to target The Criterion Hotel, which is located on the corner of Park and Pitt streets in the CBD.

Redcape said that after its asset sales program realising about $200m and the extension of a $150m debt facility, it had recently announced its reopening to investors and that it will start to process redemptions held over from last year.

“We are buoyed by the resilience of the pub sector, both in liquidity and operational performance. Customers are continuing to visit their local pubs though they are understandably more mindful of value,” Redcape managing director Chris Unger said.

In a sign that consumers are continuing to pour into pubs, Redcape said it had experienced like-for-like venue earnings before interest, taxes, depreciation and amortisation growth since the September quarter, and boosted distributions again.

“The fund is in a position to capitalise on opportunities to recycle assets and further enhance its portfolio through refurbishments and capex,” Mr Unger said.

The run of deal-making shows that the sector has come through the worst of the drop in pub values. The reversal of boom times in pub trading last year saw Redcape pause redemptions in mid-2023 as it was battered by higher borrowing costs and concerns about operational performance.

But despite the cost of living squeeze, the fund has managed to negotiate a tougher environment, selling off smaller pubs, but still keeping its empire of gaming pubs focused on western Sydney humming.

Redcape now runs a portfolio of about 30 hotels across NSW and Queensland. It sold off a series of pubs with big-name pub families stepping up to buy them. In November, Oscars Hotel Group, helmed by Bill and Mario Gravanis, picked up the Unanderra Hotel near Wollongong in Sydney’s south for close to $15m.

Redcape’s Mount Annan Hotel in outer Sydney was purchased by a major pub-owning family for $50m-plus, and the Eastern Creek Tavern went for more than $20m to the Fal Group owned by the Falcone family.