Nine years after Outrigger left our shores it wants back in a big way

Outrigger missed out on securing the Sheraton Grand Mirage resort on Gold Coast.

The Hawaii-based private-equity controlled Outrigger Hospitality Group has stepped up its plans to acquire a foothold in Australia’s tourism industry, nine years after it exited.

Outrigger president and chief executive officer, Jeff Wagoner recently came close to buying the Sheraton Grand Mirage on the Gold Coast but lost out to pub baron Arthur Laundy and the Karedis family in the final round of bidding.

“We made a valiant effort, (but) they outbid us by a couple of million dollars,” Mr Wagoner told The Australian in his first interview since the sale.

“It would have been an amazing Outrigger, there’s so much opportunity, there’s so much energy with that property,” he said.

“We put our heart and soul into buying the Sheraton Grand Mirage. We understood the market, (but) we are not down. We will find something in Australia eventually,” he said.

“I am always looking at properties in Australia. I am meeting with people this week.”

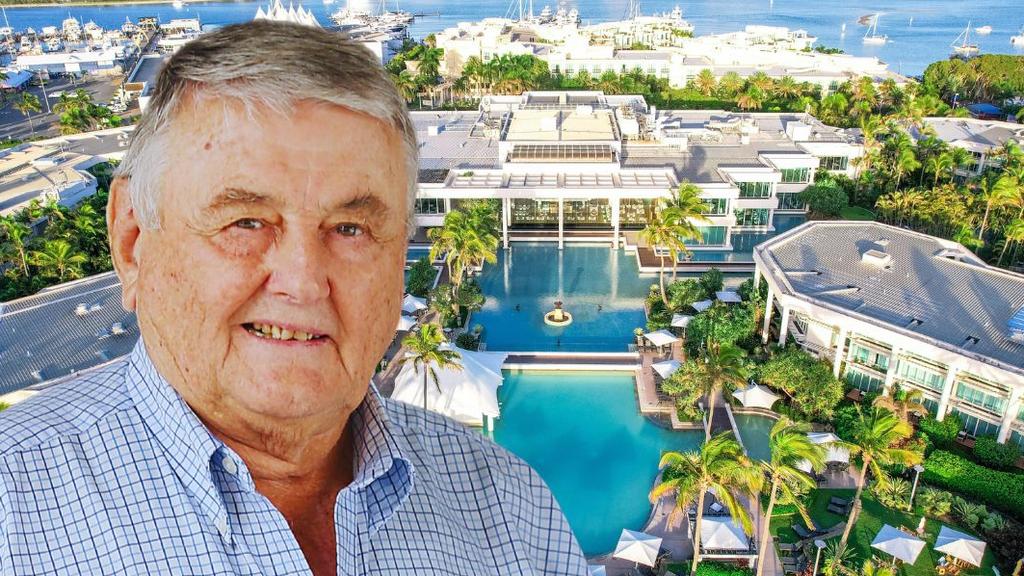

Arthur Laundy with the Sheraton Grand Mirage at the Gold Coast that sold for about $190m.

The Laundy and Karedis families – long time co-investors who also own the Sofitel Noosa – ended up paying more than $190m for the Sheraton Grand Mirage which fronts the Gold Coast Seaway, with plans to return it to its former glory as one of the drawcards of the Australian tourism industry.

Despite being out of the market for almost ten years – having once boasted 14 properties in Australia – Outrigger has maintained a strong presence with regular trade shows and its ownership of a multitude of properties in Fiji and Hawaii are drawcards for Australian tourists.

Mr Wagoner said Outrigger properties in Fiji, particularly Castaway Island, were virtually full of Australian tourists and he was continuing to scour Australia for a property.

“With Australia, (Outrigger) is looking for existing properties,” he said.

“If a developer was building a hotel and looking for a brand and management partner we would do that, we would provide sliver (a small piece) equity. That’s something we would entertain.

“But we would not do a wholly-owned, ground up hotel.”

Jeff Wagoner.

In Australia he is looking for a hotel of up to 200 to 350 rooms, possibly larger.

“We want to buy something with scale, we would buy something even larger, but it comes down to pricing, the location and the cost of the renovation,” he said.

“In today’s prices the renovation would be significantly more than it was four years ago. All those elements come into play.

Mr Wagoner said Outrigger, which is owned by the Denver-based KSL and only invests in travel and leisure assets, would also look at Vietnamese and Japanese beaches to purchase a resort.

Worldwide, Outrigger has 33 properties and about US$300m worth of resort renovations either on foot or recently completed, Mr Wagoner said.

Outrigger has bought eight properties in the past three years including resorts in Thailand and the Maldives.