Mum-and-dad property investors turn to Thirsty Camel, Domino’s

Victorian mum and dad investors are shifting from residential property into fast-food assets as demand for long-term, low-maintenance leases grows across Melbourne.

Pizza joints and bottle shops are on the menu as Victorian mum-and-dad property investors serve up $1m offers for fast food and convenience offerings instead of housing.

A Domino’s, Barber Kingdom and Thirsty Camel were among the latest purchases made by private buyers through Burgess Rawson’s in-room auctions at Crown Casino this week, with agents reporting more families and first time investors entering the commercial market.

Burgess Rawson from CBRE senior director Matthew Wright said many small investors who previously relied on residential property were now reconsidering their portfolios due to higher holding costs and increased compliance requirements.

RELATED: Global fast-food giants taking over Australia

Inside Australia’s wild pancake chain war

Wendy’s first Melbourne location accidentally revealed

“People who have held residential investments for years are now considering commercial options,” Mr Wright said.

“They want predictable income and clarity around the lease.”

He said enquiry for the Clyde properties reflected demand for established tenants in high-growth suburbs, where population increases support consistent daily trade and lower vacancy rates.

All three properties were in the sub-$2m range, regarded as accessible entry points for private buyers shifting away from traditional rental homes.

A Clyde Domino’s was among the commercial fast-food assets purchased by Victorian investors moving away from traditional residential property.

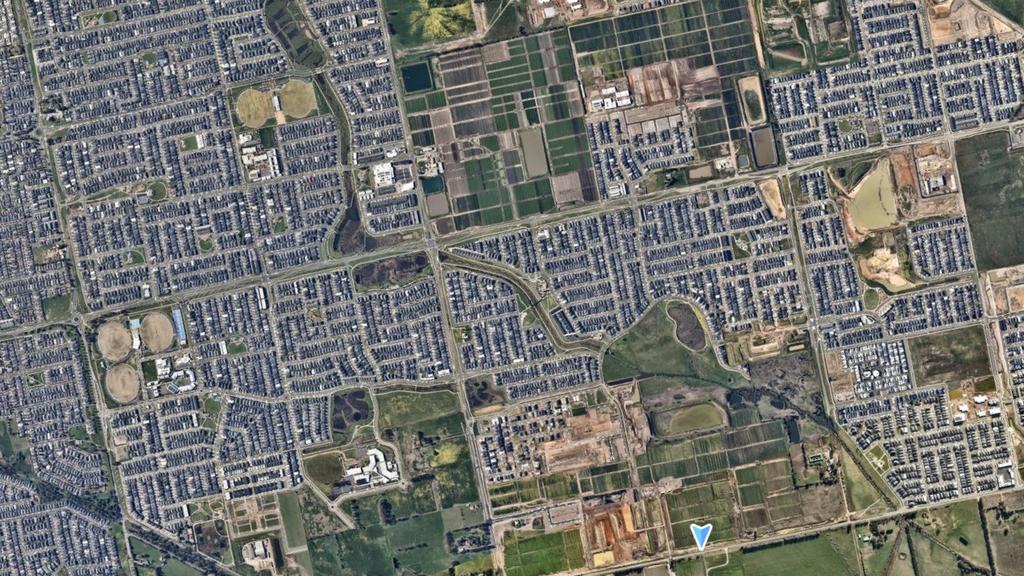

Nearmap view of Clyde’s neighbourhood commercial strip where investors targeted long-term fast-food and convenience leases.

Mr Wright said confidence among Victorian commercial buyers had remained steady throughout 2025, when long leases and essential-service tenants were in place.

“There is confidence among investors when secure, long-term leases are available,” he said.

The Burgess Rawson senior director said investors were reviewing their residential holdings due to higher land tax, rising insurance premiums and the cost of maintaining older rental properties.

“Commercial leases, provided clearer allocations of outgoings and steadier income streams,” Mr Wright said.

Fast-food and childcare assets also drew interest from Melbourne participants, continuing a pattern seen all year in which investors prioritised tenants with consistent trading irrespective of broader economic conditions.

Burgess Rawson senior director Matthew Wright says more mum and dad investors are turning to commercial property for predictable income and clearer lease structures.

Mr Wright said the behaviour among mum-and-dad investors indicates a wider shift in Victoria toward income-driven strategies, rather than the capital-growth focus that has historically shaped investment decisions.

Sign up to the Herald Sun Weekly Real Estate Update. Click here to get the latest Victorian property market news delivered direct to your inbox.

MORE: ‘Catastrophic’ risk: Vic landlords behind on reforms

Asbestos bombshell halts Channel 7’s reno gamble

Inside Australia’s wild pancake chain war

david.bonaddio@news.com.au