In brief: Second time lucky for Balmain’s Exchange Hotel

Balmain’s heritage-listed Exchange Hotel will be reinvigorated as a local destination after Sydney investor Jon Adgemis bought it for around $5 million.

The iconic hotel, built in 1885, was to be auctioned in July last year but went unsold, before being re-listed a year later and sold in an expressions of interest campaign.

Adgemis is reportedly hoping to entice locals back to the famous 640sqm corner site, which houses the hotel’s Beattie Bar, bistro, balcony bar and new cafe and bar ‘Oliver’s Corner’.

Colliers International’s Miron Solomons, who negotiated the sale with colleague Vince Kernahan, says the hotel’s unique offering contributed to strong investor interest.

The Exchange Hotel in Balmain has found a new owner.

“The Exchange Hotel is certainly unlike most hotels in the area. Its size alone over the multiple levels offers potential for diverse incomes streams and we received strong interest from national owner occupiers, investors and value-add specialists throughout the sales campaign,” Solomons says.

“With the buzz around White Bay, Balmain is starting to attract new interest from creative users, especially with Surry Hills and Pyrmont close to full occupancy, it appears that Balmain could be the next creative hub”.

Gold Coast: McDonald’s, 7-Eleven a happy meal

Investors can snare a McDonald’s restaurant and 7-Eleven service station in one fell swoop on the Gold Coast, with a Palm Beach property underpinned by leases to both global giants on the market.

The drive-thru McDonald’s and 7-Eleven outlet are positioned on a 3011sqm corner site on 19th Ave – Palm Beach’s major east-west intersection, 14km south of Surfers Paradise.

Both tenants are on long-term leases with fixed annual rent increases, selling agents Jon Tyson and Michael Harcourt, of Savills, say.

The Palm Beach property features long-term leases to McDonald and 7-Eleven.

Quality service station investments such as this are highly sought after by investors and this property also features a McDonald’s drive-thru restaurant, which are very rarely offered to the market,” Tyson says.

“As well as the strong fundamentals of a large corner site, main road exposure and 100% lease profile to major national tenants, this property also provides for future redevelopment potential,” Harcourt adds.

“The site is zoned Medium Density Residential under the Gold Coast City Council Plan, which allows for future development up to 29m in height.”

Adelaide: Strong medical market underpins Trinity Gardens sale

A recently completed medical centre just east of the Adelaide CBD has sold to a local private investor for $5.85 million.

The new centre at 206-208 Portrush Rd sold on a 5.7% yield and is subject to a seven-year lease to Australia’s largest operator of medical centres, IPN.

CBRE’s Will Brown and Ben Heritage negotiated the sale of the property, which was developed by Trilogy Property Partners.

The medical centre at Trinity Gardens is just 3km east of Adelaide’s CBD.

“With a secure lease in place to Australia’s largest operator of medical centres, this property represented an outstanding opportunity to acquire a presence in one of the fastest growing sectors,” Brown says.

“The medical industry is positioned to be a major economic driver in not just South Australia but nationally – a factor that underpinned interest from a strong pool of investors including local and domestic groups.”

The property will return an estimated annual rental income of $335,000.

Melbourne: Countdown on for Kew East Beaurepaires

The future of a Beaurepaires site at one of the busiest intersections in Melbourne’s east will become clear next week when the property is put up for auction.

The property, on the junction of busy High St and Burke Rd in Kew East, is leased to the tyre retailer on a new five-year lease but is being touted for its development potential

CBRE’s Josh Rutman and Rory James, who are marketing the 780sqm land parcel at 1417 Burke Rd, say it offers a prime tenancy, with Beaurepaires’ tenancy stretching over more than 30 years, but will also be attractive to developers.

The Beaurepaires site in Kew East will be auctioned in late August.

“With a longstanding tenure of over 30 years from a major national retailer, this property represents an exceptional retail investment opportunity in a high profile location,” Rutman says.

“The site’s central location at one of Melbourne’s busiest junctions has already attracted interest from land bankers and long-term developers, given its potential to be developed within the next five to 10 years,” James adds.

Beaurepaires is expected to significantly refurbish its building over the next 12 months. The property will be auctioned on-site on Friday, August 26.

Sydney: Darling St duo to test Balmain market

Agents are backing the emerging status of Balmain’s Darling St as one of Sydney’s most elite retail strips to deliver big returns on a pair of shops within the precinct.

The freehold titles at 359-361 Darling St are currently home to international fashion retailer Bassike and Japanese restaurant Mushiro, and their sale comes at a time when Balmain is “tremendous growth”, according to selling agent Miron Solomons, from Colliers International.

Two freehold titles at this popular Balmain corner are up for sale.

“Darling St, in the heart of Balmain, is on the edge of being Sydney’s best performing suburban retail strip,” Solomons says.

“There is strong renewed interest in the harbourside suburb, with support from a loyal population of 30-somethings young professionals who in recent years have helped the area become a Sydney hotspot for both residential and commercial property values.”

The two titles across the 335sqm block currently draw an annual income of $215,000, plus GST, and are currently in private ownership.

Melbourne: Owner-occupier pays $5.1 million for Cremorne warehouse

Inner-city Cremorne is continuing to prove popular as a Melbourne investment hotspot, with the sale of a warehouse rolling well beyond its reserve price.

Five bidders made a play for the property at 11-13 Cubitt St after a local investor put it on the market with vacant possession, with the fierce competition driving the price to $5.1 million.

The warehouse consists of a single-level building covering 624sqm, with a small office area and two roller doors.

The single-level warehouse in Cremorne sold for $5.1 million.

Teska Carson’s Matthew Feld sold the property in conjunction with Lemon Baxter’s Paul O’Sullivan and Ned Kufic, and says Cremorne’s position, just 2km from the CBD, remains a significant drawcard.

“Properties in this area – right on Melbourne’s CBD fringe – are always going to attract some interest and this was no exception,” Feld says

“We had numerous enquiries from owner-occupiers, developers and investors, including self-managed super funds, and so it was no surprise that the auction drew such a great crowd and very competitive bidding process.”

Victoria: Timing right for Wimmera silo sale

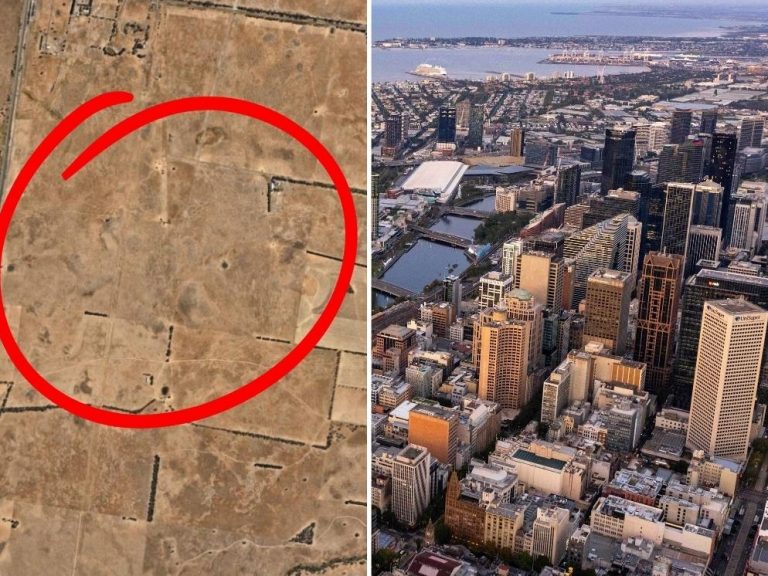

A significant grain-handling facility in Victoria’s West Wimmera region is being put to market as the industry braces for a bumper cropping year.

Located at Charam the 28.31ha facility, owned by the Holland family and Emerald Grain, is the go-to property for around 80 growers in the areas between Naracoorte, Casterton, Hamilton and Horsham.

The facility features a total storage capacity of 90,000 tonnes, courtesy of its 16 silos, two substantial grain sheds, a smaller grain shed and two grain bunkers with expansion capabilities.

The grain facility at Charam in regional Victoria.

CBRE’s Phil Schell is managing the expressions of interest campaign, which is expected to see action from both local and offshore groups.

“A syndicate of farmers could look to acquire the property or it might be purchased by an investor with a view to striking a leasehold arrangement with growers or commodity traders,” Schell says.

“We also expect to field interest from corporate players within the grains industry.”