Donald Trump ‘could lose’ $400m worth of property

Donald Trump could give up a huge chunk of his real estate portfolio if he loses his civil fraud case. Pictures: Getty

Long-time real estate investor Donald Trump could lose around $US250m ($A392m) worth of property if he loses his civil fraud case in New York.

For decades before his presidency, Donald Trump had long been synonymous with the real estate industry — as well as his namesake New York properties, which have been the subject of great discussion recently.

That’s when a New York judge, Arthur F. Engoron of the state Supreme Court, concluded in a 35-page judgment that Trump had exaggerated the value of his holdings to secure favourable loan and insurance terms with financial institutions.

New York Post reports, Judge Engoron’s decision was issued as part of New York State Attorney General Letitia James’ $250 million civil fraud case against the former president, his company and executives. And if that ruling ultimately stands, Trump could lose control over some well-known New York City properties that bear his name.

Trump Tower on Fifth Ave in Manhattan is one of the former President’s best known properties. Picture: Getty

MORE: James Packer’s $132m mansion for sale

Why NRL losers are winning more fans than Panthers

Scary interest rates warning issued

The highly publicised trial began on Monday, and in opening remarks, The Post reported Trump lawyer Christopher Kise argued the defendants didn’t intend to defraud anyone with differing property values. He said it’s the essence of the real estate market: “Buyers have a view, sellers have a view, none of them are wrong.”

Indeed, the “Art of the Deal” author’s lawyers and a real estate industry expert also argued that James’ suit doesn’t properly factor the value of the Trump brand or subjective valuations, in which lenders and borrowers offer varying estimates.

One industry insider even told The Post, “Nothing is out of the realm in New York City. Have you seen property prices lately? You have a simple penthouse going for [$195] million. So I cannot give you an exact estimate of what all Trump’s Manhattan properties are worth … Estimates in New York have always been subjective.”

And now, about a dozen properties owned or partially controlled by Trump and his business are on the line. Here’s a look at some of them.

Protesters outside Trump tower after the Republican’s 2016 General Election win. Picture: Getty

Trump Tower: 721 Fifth Ave

Standing tall at 721 Fifth Ave. in Midtown, Trump Tower is a 58-story skyscraper that has been a fixture in Manhattan since its completion in 1983.

MORE: Fashion power couple’s $100m real estate plunge

Aussie house prices ‘set to soar 15 per cent’

10,000 sqm for $41K: Sydney’s mind-blowing property buy

It serves as the central headquarters of the Trump Organization and boasts a mix of apartments, offices and stores. But perhaps the most famous feature of Trump Tower is former President Trump’s own penthouse, perched high above the city.

The Attorney General’s suit claims that the Trump Organization used deceptive practices to get the highest possible value for the tower. For instance, the organisation based value on the transaction for a building located nearby, which headlines supposedly detailed had set a world record.

That said, the former president and current candidate, along with his associates, claimed the tower’s value had risen by $170 million from the previous year.

The judge denied this argument and ruled that the building was overvalued between $114 to $207 million.

Real estate tycoon Donald Trump poised in Trump Tower atrium. (Photo by Ted Thai/The LIFE Picture Collection/Getty Images)

MORE:

Israel Folau pockets $400,000 profit as Wallabies defeat sinks in

John Singleton’s old ‘Great Gatsby’ home for sale for $85m

Also vulnerable is that triplex penthouse. The suit alleges the longtime home was worth less than claimed. James and Engoron allege that Trump and his associates exaggerated the size of the unit — bringing it from roughly 11,000 square feet to 30,000. In Trump Organization financial statements, the home’s value jumped by 400 per cent, from $80 million in 2011 to $327 million in 2015.

Trump’s defence defended this by arguing that “the calculation of square footage is a subjective process that could lead to differing results or opinion based on the method employed to conduct calculation.”

Outside Manhattan Supreme Court on Monday, Trump himself took the opportunity to lash out at James and Engoron, calling the latter “unfair, unhinged, and vicious in his pursuit of me.”

Trump Park Avenue: 502 Park Ave

At 502 Fifth Ave., Trump Park Avenue was transformed into a residential building from a hotel in 2004 after Trump’s purchase in the early 2000s.

Trump bought the property for $115 million. Costas Kondylis & Partners, architects for many of Trump’s condo developments and numerous others throughout Manhattan, created 120 luxury homes, ranging in size from one to seven bedrooms. Reportedly, the renovator’s total cost was $100 million.

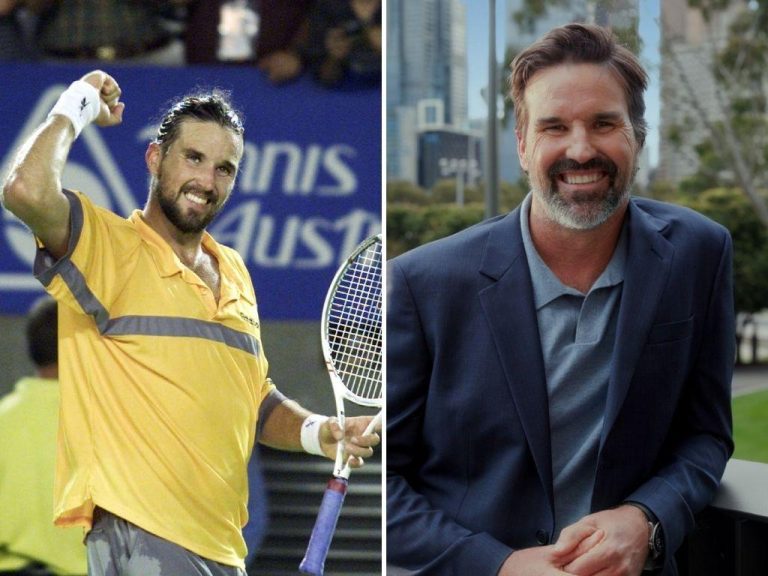

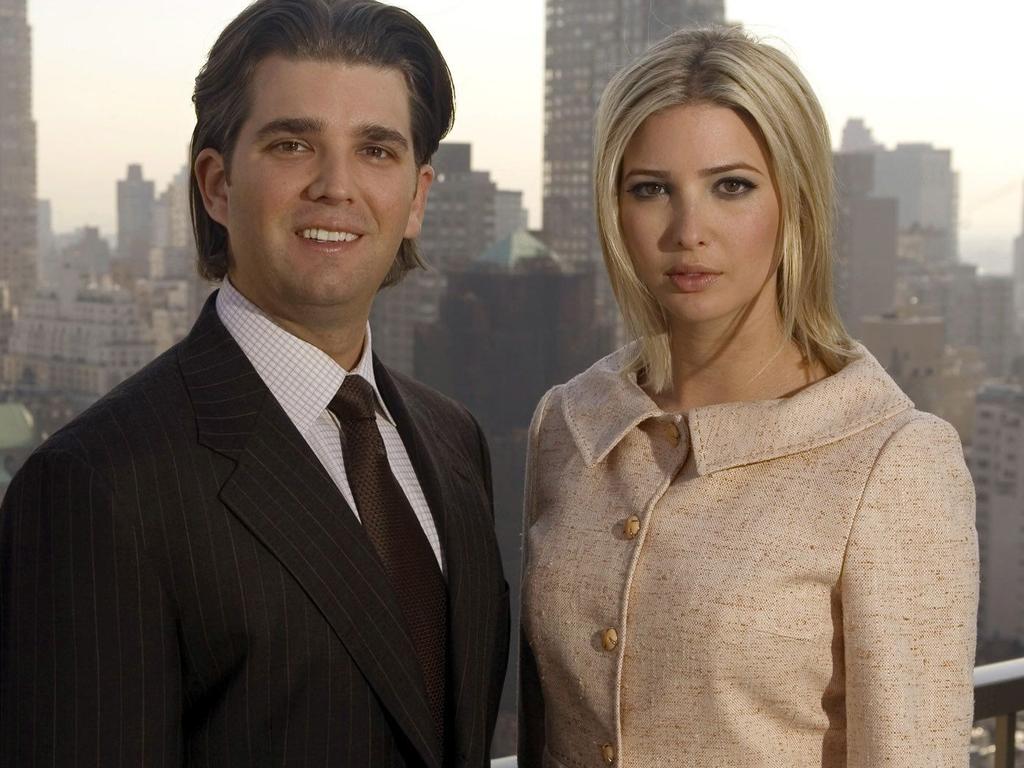

Donald Trump Jr. and his sister Ivanka Trump pose for a photo on the penthouse terrace of the Trump Park Avenue building in New York 11/04/06.

The building houses 12 rent-stabilised rental units, which the suit alleges were valued by the organisation as if they had rented for market prices. The Trump Organization offered a value for them of nearly $50 million, while the suit says the value cited by a third-party appraiser was much less — $750,000.

4-6 E. 57th St

Many may recognise this address as the former Niketown location.

In 2019, Trump and his companies that rent the buildings valued the property’s interest at $445 million, according to the New York Times. The lawsuit alleges that sum was inflated by mismatching income and expense periods. That inflation is at least $37 million. The lawsuit claims this is the result of the organisation of using higher forward-looking income figures combined with lower backward-facing expense figures.

40 Wall St

In the Financial District, this 71-story commercial skyscraper, completed in 1930, was designated as a city landmark in 1998.

Trump building – 40 Wall Street New York City.

MORE: Airbnb guest ‘from hell’ squatting at home for 500 days

Hugh Jackman’s luxury Sydney mansion for sale

The Trump Organisation’s 2015 appraisal of the property it leased was $735.4 million — though the lender-ordered appraisal was $540 million, according to the suit. The valuation included a $1.4 million lease with the upscale food market Dean & DeLuca for the building’s ground level, even though it hadn’t been signed. (Ultimately, and separately, that market location never came to fruition.)

Meanwhile, financial statements also understated building expenses. The Times noted that the Trump Organization reported management fees and expenses of $100,000 each year for 2012, 2013 and 2014 — though fees were closer to $1 million annually.

1290 Ave. of the Americas

Trump owns a 30 per cent share in this Midtown building, per the suit, located on a prime stretch of the avenue next to Radio City Music Hall and Rockefeller Center, but the rules of the partnership limit Trump’s own ability to sell his stake.

Still, in valuing that stake, the organisation is accused of calculating 30 per cent of the tower’s value minus its debt. Trump is also accused of using a “cap rate,” a valuation measure in real estate to compare investments, to inflate the building’s worth.

Trump National Golf Club Hudson Valley, Hopewell Junction

In the lawsuit, details regarding this upstate golf course, near Poughkeepsie, have to do with inflating the cost of memberships to boost property value. In 2011 and 2012, there was a listed initiation fee of $10,000. In 2011, the organisation pegged a value at 93 per cent of 161 unsold memberships at a $15,000 minimum. The next year, the organisation valued 78 per cent of 254 unsold memberships between $15,000 and $30,000.

Seven Springs, Westchester County

A Trump Organization subsidiary bought a 212-acre spread in the northern suburbs in 1995 that ran across three towns. More than 10 years later, son Eric Trump had planned to construct residences on 24 luxury lots on the grounds. In 2014, a hired appraiser pegged the value of the lots at some $30 million. That same year, per the suit, the company had a $23 million valuation for each lot in just one of those three towns, Bedford. Financial statements reported the values if those 24 luxe homes had been constructed, whereas in reality there was a legal challenge from the Nature Conservancy seeking restrictions on what could rise there.

Trump owns several golf clubs including in Westchester and Hudson Valley. Picture: Getty

Trump National Golf Club Westchester, Briarcliff Manor

As for this golf course, the suit charges that the organisation inflated its value by including hopeful income it would earn from new members. A valuation in 2011 reportedly relied on an assumption that 67 new members would each pay $200,000 in entry fees. In reality, many didn’t pay a cent.

MORE: Disney boss cuts home sale price by $235m

Is this Sydney’s most epic home extension?

Hermit faces eviction from 50yo cave home

Part of this article originally appeared in the New York Post and are republished here with permission.