Black Friday frenzy to support retail revival as shoppers hit the pavement

The upcoming Black Saturday-Cyber Monday sales frenzy is set to cause a spike in retail spending this month, alongside a slight uptick in bargains snapped up online.

Retail spending is expected to surge this month due to the upcoming Black Friday-Cyber sales, with the share of online purchases tipped to climb slightly.

Aussie bargain hunters are poised to pour billions into the economy during the four-day shopping event from November 28 to December 1.

Vanessa Rader, Ray White Group head of research, said the sales will drive a spike in retail trade in November, with around a fifth of transactions predicted to be online.

NAB transaction data showed more than two-thirds of Black Friday sales in 2024 were made in-store over the four-day shopping period. Picture: Getty

She noted that while historically about 20% of Black Friday purchases occur online, exact figures are difficult to verify due to limited data.

“I do think there’ll be more than 20% of it that will be online, but I don’t think it’s going to jump by a huge amount,” she said.

Online deals make up a large component of the event, driven by dominant players like Amazon and the vast volume of digital discounts.

This is expected to fuel faster growth in online activity compared with in-store sales.

Ms Rader said the abundance of products available online and the shrinking physical footprints of major retailers are contributing to the shift. Major brands have reduced physical store numbers especially over the past 18 months, she said, pushing more customers online.

“Their component of online trade continues to increase, and that’s not necessarily a Black Friday phenomenon,” she said.

Despite this, in-store shopping remains strong.

“Bricks and mortar is certainly not dead. You only have to walk through the shops and see the huge amount of activity and foot traffic in our cities,” she said.

Billions of dollars will be spent over the four-day shopping frenzy. Picture: Getty

Shoppers will splurge a record $6.8 billion at this year’s event, up 4% from 2024, forecasts the Australian Retailers Association and Roy Morgan.

Larger retailers which invest heavily in their discount strategies are expected to dominate transactions, Ms Rader predicted.

Online sales will also continue rising as increasingly savvy consumers compare deals across platforms, taking advantage of fast, free shipping and flexible returns.

“[Shoppers] are under pressure from the cost of living, so they will shop around. They’re willing to purchase from stores online they perhaps never have purchased from in the past to get a good deal.”

Last year, NAB transaction data showed more than two-thirds of Black Friday sales were made in-store over the four-day Black Friday and Cyber Monday shopping period.

Meanwhile CBRE reports e-commerce penetration has reached a record 14.3% of total retail spend as at May 2025 and is forecast to rise to 17% in 2029.

The retail market overall remains robust and is expected to perform strongly into 2026, helped by population growth and renewed interest in shopping as an experience.

“Retail has been doing really well. It’s been the best performing commercial property market in Australia this year,” Ms Rader said.

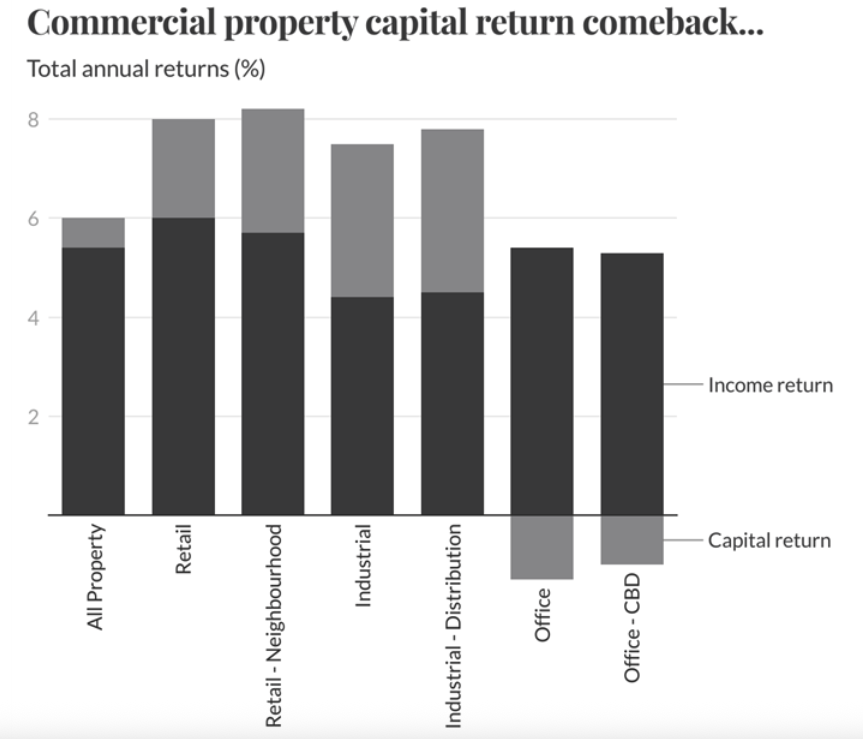

Retail is leading commercial property gains with total annual returns of 8.2%. Source: 2025 MSCI Inc / Ray White

“Occupancy continues to be pretty high, but you need a really good offering of food, and a fun meeting place for people to come and do things as well as their shopping.

“Everyone thought retail was going to be dead, and everything was going to go online. People might buy things online but they still want to go out, meet and do something fun.”

Knight Frank’s September Australian Retail Review said strong population growth, rising real incomes, and limited new supply were driving the sector. This would particularly benefit discretionary spending.

Shoppers are increasingly drawn to the experiences offered by physical stores, Ms Rader said, and retailers are getting more creative with in-store activations and competitive pricing to lure them in.

“For any retailer, you really need to have that two-pronged approach: having a really compelling online offering, but also being able to provide some point of difference in-store,” she said.

Amazon and Temu each gained 900,000 shoppers in the last year, while Shein added 600,000 according to Roy Morgan.

However, the impact of the “Temus and Sheins of the world” on the retail market cannot be underestimated, she added, with the online giants offering deals year round and not just during Black-Friday.

“We continue to see just the general uplift of online retail trade in those stores as well,” she said.

Roy Morgan September data revealed a “staggering growth” in Australian buyers purchasing from foreign online giants Amazon, Temu and Shein. Amazon and Temu each gained 900,000 shoppers in the last year, while Shein added 600,000.