Big-time investors eye a 2026 comeback in Aussie commercial property

Australia’s commercial property market may be nearing a major shift, with new momentum building behind the idea that big-time investors could return in force in 2026.

Analysts say stabilising interest rates, price discovery and improving performance across key sectors were rebuilding confidence among institutional investors such as superannuation funds, banks and investment firms.

Institutional investors can provide large-scale, long-term investment that drives property development, supports liquidity and underpins the stability of the market.

These investments can influence jobs, new developments, local business activity, and the overall strength of the economy.

Ray White head of research Vanessa Rader said larger investors had predominantly been sellers over the past two years, but those capital flows were reversing.

Ray White head of research Vanessa Rader said retail property had shown the fastest change in institutional capital flows. Picture: Supplied

“Australian commercial property is approaching a turning point as institutional capital prepares to return in meaningful volume,” she said.

“This shift, combined with sector recovery evident in recent performance data, suggests 2026 will mark substantial institutional investment re-entry across commercial property, alternative assets, and living sectors.”

Benjamin Martin-Henry, head of private assets research, Pacific, at MSCI, said improving clarity around pricing was an important signal for institutions.

“We’re starting to see a clearer path to price discovery, and that typically draws institutions back in,” he said.

“As interest rates stabilise and valuations adjust, Australia’s relative transparency, liquidity, and yield spread to government bonds will look more compelling again. Global capital still views Australia as a core defensive market in the Asia-Pacific region.”

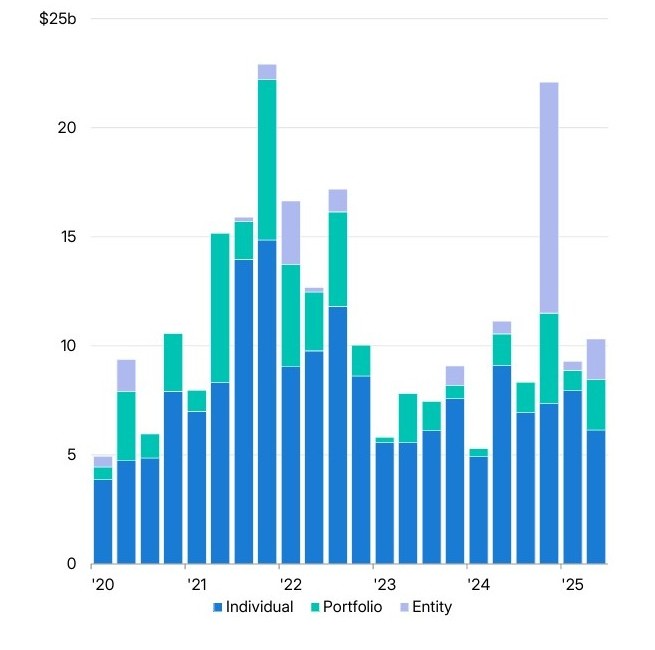

Australian commercial property quarterly transaction volumes

Source: MSCI

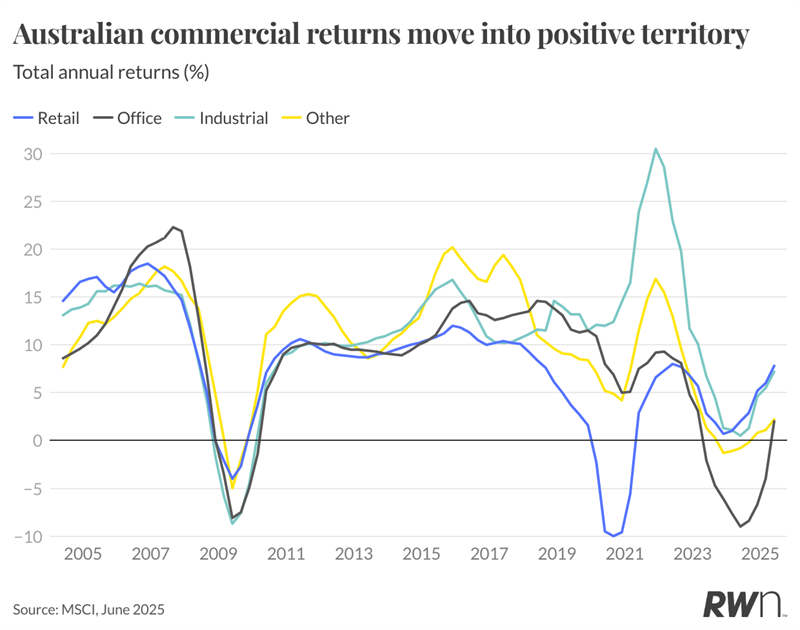

Ms Rader said retail property had shown the fastest change in capital flows, with institutional capital now representing 38% of retail acquisitions, reversing from 55.8% of disposals.

“Retail has seen the most pronounced shift, with institutional investors moving from net sellers in 2023 and 2024 to active buyers in 2025,” she said.

Industrial property saw institutional selling activity drop from 30.1% to just 12.7%, while the office market saw institutional capital represent 28.1% of buyers compared to 45.9% of sellers.

Ms Rader said the renewed interest was being driven by several factors, including growing property values, stable yields and limited supply of high-quality buildings.

Additionally, larger investors that had made defensive sales during the downturn had more capacity to buy again now, while super funds continue to increase their exposure to the commercial property market.

But challenges lie ahead, with Mr Martin-Henry highlighting financing costs and confidence in rental growth assumptions as some of the biggest areas to watch.

“Even as inflation moderates, refinancing pressures and valuation uncertainty will keep investors cautious,” Mr Martin-Henry said.

“Additionally, sector bifurcation is widening, prime assets are holding firm, while secondary stock faces more pronounced value risk and liquidity constraints.”

Ms Rader said there would also be competition for quality assets where development pipelines remained constrained.

“Premium assets with strong environmental credentials, modern specifications, and quality covenants face intense bidding as institutional buyers and offshore capital compete for limited stock,” she said.

Institutional investors will likely focus on logistics real estate, among other asset classes. Picture: Getty

“This supports continued yield compression in prime segments while maintaining wider spreads to secondary assets, creating bifurcated markets where institutional capital concentrates in quality.”

Mr Martin-Henry said logistics and living sectors continued to attract institutional focus given structural demand drivers.

“Industrial assets in the eastern seaboard corridors remain top of the list, while build-to-rent and alternative residential formats are gaining traction as supply-demand imbalances persist,” he said.

“Select prime office and convenience retail may also see renewed interest where repricing has created value opportunities.”

Looking to 2026, Ms Rader said the return of institutional capital validated recovery fundamentals and confidence in forward performance.

“The transition from institutional selling to buying marks a fundamental shift, suggesting Australian commercial property is moving from adjustment to growth phase, with 2026 positioned as the year institutional capital deployment becomes the dominant market narrative,” she said.