Amart Furniture founder John Van Lieshout sells Southport mall for $152m

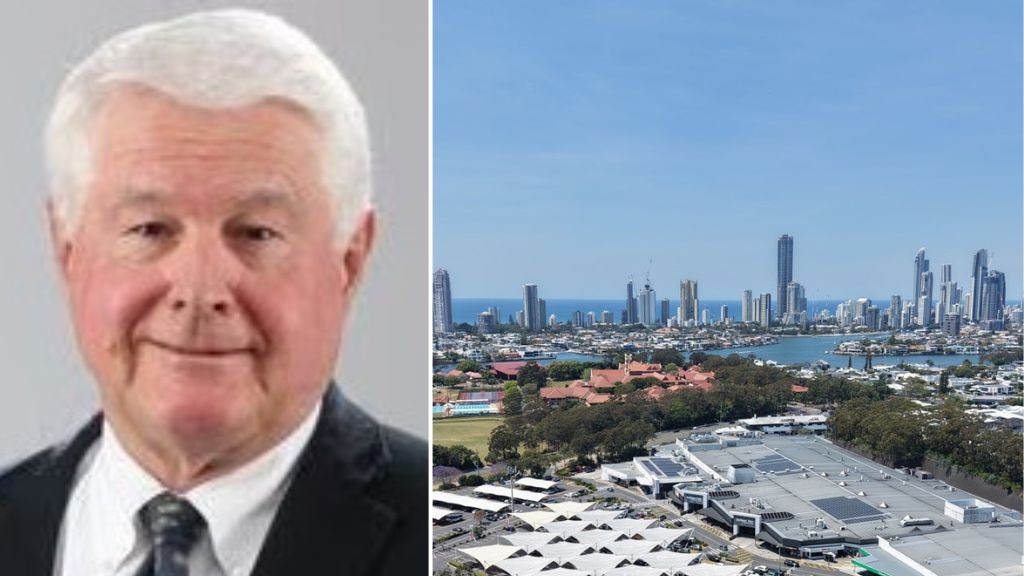

Billionaire John Van Lieshout has sold a shopping centre in Queensland’s Southport for $152.5m.

Billionaire John Van Lieshout has sold a shopping centre in Queensland’s Southport for $152.5m after picking it up for a song in the wake of the global financial crisis.

Southport Park has been bought by the listed Charter Hall as it continues to snap up convenience complexes around the country, using its heft as the country’s largest commercial property player to lock down off-market deals.

The acquisition, negotiated via JLL’s Jacob Swan and Ned McKendry, is for Charter Hall’s new fund targeting consumers shopping for their daily needs, which is seen as the most resilient area even as the Reserve Bank readies to lift rates to rein in consumer spending. Other groups, including Aware Super and Barings, have also been buying in the sector.

Van Lieshout, the founder of the Amart Furniture chain, has shown the benefits of buying low after picking it up from Centro Properties Group in 2009 as it battled to survive. The Dutch-born billionaire John van Lieshout paid $68m for what was Centro Southport. The price was reported to be 10 per cent less than Centro’s book value and also short of a $75m deal proposed by Sydney liquor baron Greg Karedis.

Billionaire John Van Lieshout has offloaded a shopping centre in Queensland’s Southport for $152.5m.

Mr van Lieshout is a regular on The List, and has an estimated fortune of $2.8bn. He started the Super A-Mart furniture chain 50 years ago, selling the business to private equity in 2006 for more than $500m and then pouring much of his fortune into property at a time when the market was at a low point.

He already owned much of the land that Super A-Mart outlets sat on, and he now has about $1.5bn worth of real estate assets in his JVL Investment Group. It also includes other retail centres, as well as commercial and industrial holdings and Noosa’s Seahaven Resort.

The tycoon’s Unison Projects is a property development firm that has subdivision projects in southeast Queensland and Byron Bay and apartment projects in inner-city Brisbane.

Charter Hall’s purchase also displays the return of retail property as one of the most sought after asset classes. The market is essentially back to the state it was in before the pandemic, as both buyers and sellers are highly active.

Values, which were crunched during the coronavirus crisis, have stabilised and are starting to increase for well-located assets. A small group of property syndicators led the way in buying up centres early, but now large institutions are making the running.

Mr van Lieshout’s property operation refurbished the complex as a “super convenient” asset with an emphasis on food, fashion and convenience. The 19,900sq m shopping centre sits on a 6.5ha mixed-use zoned corner site fronts Benowa and Ferry Roads, giving it the potential for further development in coming years.

Southport Park is one of only ten triple supermarket anchored neighbourhood shopping centres nationally, with Coles, Woolworths and ALDI, along with three mini majors, 40 specialities and a separate centre with 17 office and retail tenancies.

One focus of Charter Hall’s buying of retail centres is on triple supermarket anchored neighbourhood shopping centres and it now owns 40 per cent of them nationally.

Charter Hall Retail CEO, Ben Ellis, said Southport Park was a “high-quality asset” in the heart of the growing Gold Coast. “The convenience centre benefits from its triple supermarket anchors and offers future value add opportunities given low site coverage. With strong majors trading performance and attractive net lease structures, it’s expected to deliver accretive returns,” he said.

“This acquisition continues the successful growth of our $2.5bn Charter Hall Convenience Retail Fund, focused on high-performing neighbourhood shopping centres anchored by non-discretionary retailers,” he said.

Charter Hall is the largest owner of convenience retail in Australia with a $16bn portfolio and sees them as continuing to outperform larger, discretionary retail malls.