AI and e-commerce: The dual challenges hitting Aussie property market

Australia’s commercial property sector is facing an unprecedented crisis, caught in the crosshairs of two relentless forces: the job-slashing march of artificial intelligence and the retail-killing surge of e-commerce giants like Temu and Shein.

With over 202,000 global tech jobs already lost this year – more than 64,000 directly linked to AI – and iconic Australian retailers crumbling under the weight of online competition, the question isn’t if the landscape will change, but how quickly it will crumble under this ‘dual apocalypse’.

The AI avalanche: Robots in the boardroom, empty desks on the horizon

The global tech industry has been a grim harbinger, with mass lay-offs becoming a chilling norm.

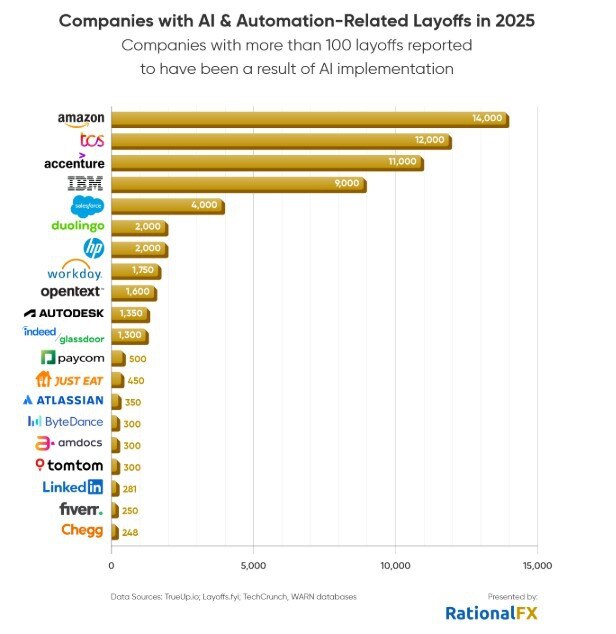

So far in 2025, a staggering 202,093 employees globally have lost their jobs, according to finance and trading education platform RationalFX, with more than 64,000 directly attributed to automation and AI adoption.

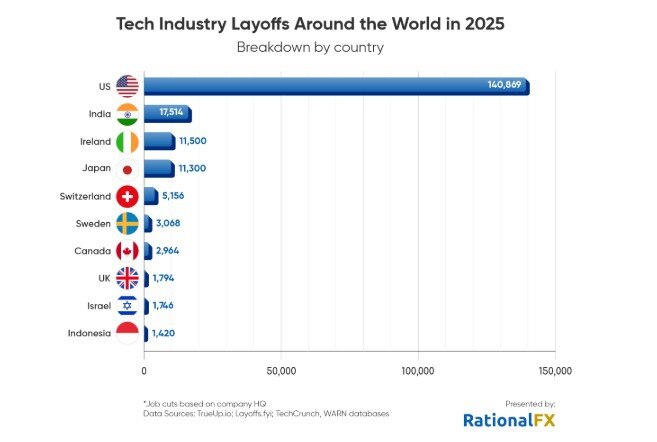

Nearly 70 per cent of these cuts, or 140,869 job losses, have been in U.S.-based companies, but the ripple effect is undeniable.

Intel, for instance, plans to slash over 33,000 positions, reducing its headcount from 109,000 to 75,000 by year’s end.

Other tech titans like Amazon (19,555 lay-offs), Microsoft (19,215), TCS in India (12,000), and Accenture in Ireland (11,000) have also made significant cuts.

RELATED

Aus retail under siege: Temu, Shein’s brutal impact

Retail crisis: How Temu, Shein are forcing Aussie store closures

$4 T-shirt brand that could flip Aussie malls

Source: RationalFX

While Australia hasn’t ranked in the top 10 for tech lay-offs, the local impact is growing. News.com.au recently revealed Uber’s audacious plan to replace its drivers with AI-powered self-driving cars, a move that could impact a staggering 150,000 Australian livelihoods. Locally, major players like Telstra, Commonwealth Bank of Australia (CBA), and Atlassian have already seen AI and automation implicated in job cuts or redeployments.

RationalFX analyst Alan Cohen underscores the scale of this shift, noting that between January 1 and October 30, 2025, over 202,000 tech sector employees were laid off globally. “We estimate that every day, 669 workers have lost their jobs on average since the start of the year,” Mr Cohen stated, projecting total tech lay-offs to exceed 244,000 by year’s end.

Source: RationalFX

He adds that hiring managers are now placing greater emphasis on AI development as a core skill when evaluating candidates, a clear sign of the changing workforce.

While historically companies might re-skill staff, some executives, like TCS’s K. Krithivasan, argue that “redeployment and finding new positions for current employees simply to avoid lay-offs do not work.”

The e-commerce tsunami: Temu and Shein’s retail reckoning

As AI hollows out the office sector, a different, yet equally destructive, force is sweeping through retail property: the aggressive expansion of Chinese e-commerce giants like Temu and Shein.

Since its Australian debut in 2023, Temu has been an unstoppable force, crowned the fastest-growing digital brand in the country by Similarweb’s 2025 Digital 100 Australia report – even outstripping AI powerhouse ChatGPT.

Its own data boasts a staggering 72 per cent increase in unique website visits in 2024, and it reigned as the most downloaded app on iPhones that same year.

While this is great news for Temu, it spells disaster for the Australian brands that form the backbone of our shopping centres and main streets.

The past two years have seen a litany of iconic Australian retailers either closing stores or entering administration.

Chinese e-commerce is taking over Australia’s retail landscape.

In 2024, retail giant Mosaic Brands, owner of beloved labels like Millers and Rivers, spectacularly collapsed, owing $318 million and impacting over 4000 staff.

This year, Ally Fashion was placed into administration, owing $58m, leading to a raft of store closures. Just last month, Rip Curl and Kathmandu announced they would shutter 14 stores after parent company KMD suffered an annual loss of $105m.

Sky News Australia’s New South Wales Political Reporter Julia Bradley points to a lack of regulation and the “just how cheap these goods are” as major concerns.

“We’re seeing massive growth from these two sites, in particular,” she told Sky News.

With Temu’s annual Australian sales estimated at $3b, capturing around 5 per cent of all e-commerce spending, and Shein close behind at $1.3n, accounting for 2 per cent, these platforms are capturing a significant slice of the e-commerce pie, directly at the expense of local businesses.

Queensland University of Technology Business School retail expert Professor Gary Mortimer notes that consumers are increasingly “willing to maybe forgo high-end quality for just the look at a lower price,” a trend that bypasses the need for physical retail spaces entirely.

A perfect storm: The future of Australian commercial property

The confluence of AI-driven job displacement and the e-commerce onslaught presents a perfect storm for Australia’s commercial property market.

The traditional models that underpinned our urban development are crumbling under the weight of technological advancement and shifting consumer behaviour.

As offices empty and retail precincts struggle, the long-term implications for property values, investment, and urban planning are profound.

While some hope that advancements in AI might create new roles and opportunities, the immediate outlook for commercial property remains uncertain.

As Alan Cohen aptly puts it, “Only time will tell whether tech companies will continue to focus on cost-cutting and downsizing throughout 2025, or whether advancements in AI will lead to the creation of new roles and opportunities in the technology market.”