Accor hotels in Melbourne close to full during Australian Open

Alex de Minaur and Accor CEO Adrian Williams.

The Australian Open has once again proven to be a powerful drawcard for Melbourne’s tourism sector, enabling a strong start to the year for Australia’s largest hotel operator, Accor, which owns 33 hotels across the Victorian capital.

Momentum built even earlier than usual this year, with increased accommodation demand recorded in the week leading into the official start of the Australian Open.

Accor said its Melbourne hotels, including the Sofitel Melbourne on Collins, were close to full from the first week of the competition.

The biggest off-court rally took place from January 19 to 21, with Accor hotels up an average of 12 per cent compared to the same period of the tournament last year.

Consistent bookings continued throughout the remainder of the tournament, contributing to a stronger overall performance year-on-year.

“The Australian Open always gives Melbourne’s tourism economy a strong opening serve,” said Adrian Williams, Accor’s chief operating officer for the Pacific region. “The uplift we saw during the first week, particularly the double-digit increase compared to last year, reflects how quickly demand intensifies when the city hosts events of this scale.

“It reinforces Melbourne’s position as a destination that consistently performs on the global stage.”

Looking ahead, Melbourne’s major events calendar includes the Formula 1 Australian Grand Prix from March 5.

Accor is already recording strong forward demand for the four-day event, with holdings tracking ahead year-on-year.

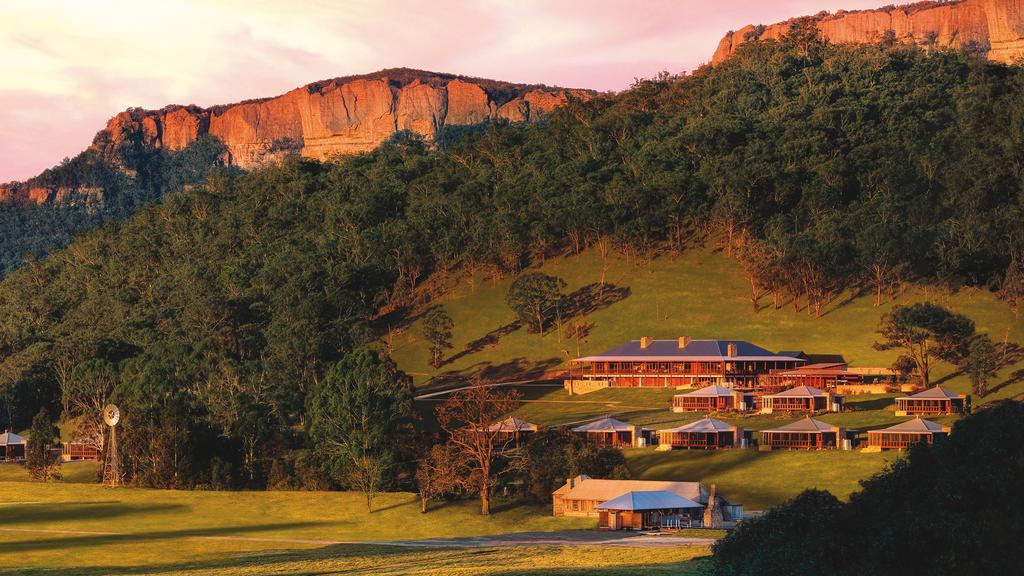

Emirates Wolgan Valley, a Ritz-Carlton Lodge will re-open after a three year closure by mid year.

Nationally, agent Colliers reckons 2026 will be a strong year for capital investment in hotels, given transaction volumes climbed to $2.7bn last year, an 80 per cent increase on 2024, and 58 per cent above the long-term average.

The 75 per cent increase in transaction volumes came as 67 hotels changed hands in 2025, with the average deal size rising to $40m, according to the agency’s Capital Markets Investment Review.

Premium assets dominated activity, with 13 transactions above $50m accounting for 67 per cent of total deal flow, more than double the level recorded in 2024.

The major sales included Ayers Rock Resort in the Northern Territory, Park Hyatt Melbourne, and a 50 per cent stake in Ritz-Carlton Perth. The announcement of Blackstone’s acquisition of Hamilton Island provides a strong footing for deal flow in 2026.

Adding more confidence to the sector is the decision last week by Emirates to reopen the six-star Wolgan Valley resort, with new operators The Ritz-Carlton Lodge.

Offshore capital re-engaged strongly, representing 49 per cent of total deal flow, led by Thai, US and Singaporean investors.

Colliers head of hotels, transaction services, Karen Wales, said family offices and high-net-worth individuals accounted for a third of total deal flow, reflecting a growing appetite for long-term, legacy assets.

“Elevated replacement costs and constrained development pipelines mean existing assets are trading below replacement cost, a rare arbitrage opportunity for investors,“ she said.

Ms Wales said 2026 transaction volumes are forecast to average $3bn.

“We expect heightened bid activity in 2026 as investors capitalise on limited new supply and robust tourism fundamentals.”

Assets with unique positions, heritage landmarks, lifestyle hotels and properties catering to wellness experiences will continue to command premium interest, she said.

Tourism Research Australia forecasts international visitor arrivals to increase by 5.2 per cent this year and 5.2 per cent in 2027.

Luxury and upper-upscale segments led growth, with average daily rate premiums of more than 30 per cent in major markets.

With only 7300 rooms under construction across Australia’s 10 major markets and openings expected to peak in 2026, supply constraints will further support pricing power, Colliers said.