Aussie retail the most traded real estate asset class for the third consecutive year

It was the pinnacle of teen entertainment in the 1990s, exemplified by films such as Clueless and Mallrats, but the suburban shopping mall is having a dramatic comeback.

After decades of falling foot traffic amid online sales and a shift to boutique shopping, the humble suburban shopping mall is beginning to attract more investment.

And it’s largely down to the work from home trend.

A report by commercial property giant Colliers has revealed Australian retail property assets accounted for $13.16 billion in sales over the past year.

The group’s Retail Capital Markets Investment Review revealed this made retail property assets the most actively traded real estate estate class in the country for the third straight year.

Total retail investment in 2025 saw a 48 per cent increase year-on-year, a figure behind only 2021, with the sector positioned as a standout investment destination for 2026.

But property experts dissecting the figures have revealed much of the spending has come from investors targeting retail spaces in suburban shopping strips.

MORE: Axed: Albo orders $3bn ADF sell off of 64 sites

Australia retail was the most traded asset class for the third consecutive year. Picture: NCA NewsWire / Dan Peled

Property expert Steve Palise, founder of Palise Property, said foot traffic may be down in some of the bigger centres, but not in suburban retail.

“Neighbourhood shopping centres are thriving at the moment,” he said.

“There’s a couple of reasons for that, obviously the post-covid world of people working from home more often.”

Mr Palise said many do their shopping on working from home days in their locales.

“The CBD type retails necessarily don’t have the same foot traffic as the suburban, where they go to their hairdressers, barber shop and butcher shop,” he said.

Colliers, reporting on the wider retail property, landscape revealed there were 159 retail property transactions over the past year, up 16 per cent annually.

Buyer competition was revealed to have intensified, driving a substantial pricing uplift, particularly across regional and neighbourhood centres, where average deal sizes surged 66 per cent and 34 per cent.

MORE: Suburbs where homeowners are getting $200k richer each year

Source: Colliers

Lachlan MacGillivray

“We expect to see heightened levels of transactional activity this year, with investors returning to Core retail and strongly pursuing high quality retail centres with robust cash flows,” said Colliers retail capital markets managing director Lachlan MacGillivray.

Private capital once concentrated below the $30m range and is now pushing into the $30-$100m segment after years of being outbid by institutions.

Australian shopping centres had average occupancy of 98.9 per cent, compared to 94.6 per cent in the US, reinforcing an ongoing strength of local bricks-and-mortar retail.

MORE: Channel 9 star’s $3.2m coup

Colliers revealed Australian shopping centres average occupancy of 98.9 per cent vs. 94.6 per cent in the U.S. Picture: NCA NewsWire / John Gass

According to Colliers, lower borrowing costs and improved liquidity enabled private capital to target larger neighbourhood centres, freestanding supermarkets, hardware and large format retail, assets that offer secure income and redevelopment optionality.

“Looking to 2026, improved liquidity is expected to broaden capital flows as investors embrace current pricing and target opportunities across more diverse locations and asset profiles,” said Colliers senior research analyst Sam Ryan.

MORE: Sydney’s pub scene in huge $60m shake-up

Sam Ryan

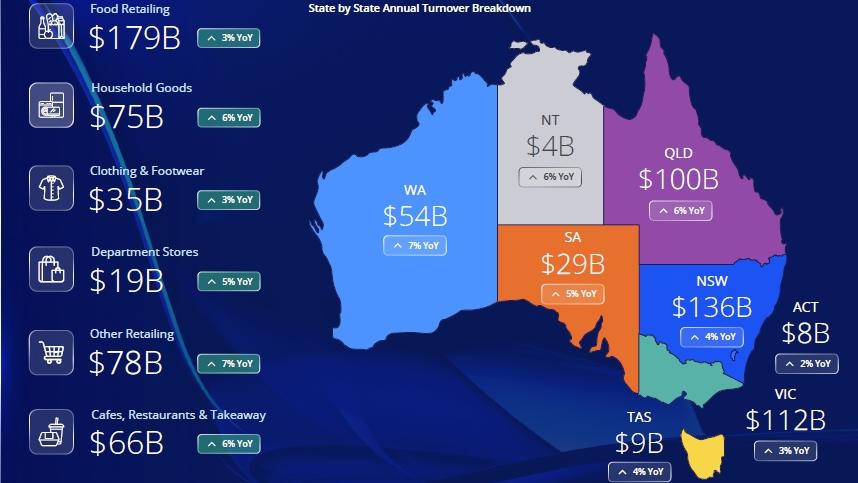

Retail Trade Annual Turnover. Source: ABS, Colliers Research

Head of retail middle markets Australia James Wilson said investors were actively reallocating to essential service retail.

Regional shopping centres led transaction activity in 2025 accounting for $6bn in sales, neighbourhood centres also attracted strong demand with $2.9bn in sales, supported by exposure and limited new supply.

MORE: Rate hike threat weighs on Sydney home prices

James Wilson

According to Colliers, competition for prime assets is expected to intensify influenced by no new regional shopping centres delivered since 2018 and elevated construction costs limiting future supply.

“No one’s going out and building an entire shopping centre, but there’s more buyers so the whole thing is supply and demand,” Mr Palise said.

“There’s more bang for your buck and better net return.

“It’s become much more awareness around that actual asset class.”

MORE: ‘Insta-worthy’: Aus retail fights back against ‘Temu effect’

Steve Palise

Mr Palise said individual retail can also be considered high risk whereas buying a retail shop or regional centre is lower.

“If you buy in a little shopping centre with 10 or 20 tenants, losing one or two is much lower risk than buying one warehouse,” he said.

“I bought in Regents Park which is in the Logan Council of Brisbane, an entire shopping centre on is three and a half thousand sqm that has eight tenants, that was $3.175m.

“You can’t barely buy a warehouse for that price – so that’s actually a really low risk asset because you have eight tenants for a small spend.

MORE: ‘Killing the patient’: Builders slam RBA rate decision

Regional shopping centres led transaction activity in 2025 accounting for $6bn in sales

“I actually think it’s going to be the best performing asset class in the next 12 months.

“The demand is there and there’s more investors looking than ever before.”

MORE: ‘Kick everybody out’: the pub baron now taking over radio