A Bunnings and two Coles shopping centres sold as buyers target retail

Private investors targeting retail assets have snapped up a Bunnings and two Coles-anchored shopping centres in regional Victoria for almost $80 million in total as sales activity ramps up.

The Torquay Village shopping centre topped JLL’s recent Victorian sales at $40 million, while the Coles Morwell centre sold for $27.85 million and an offshore investor picked up Bunnings Horsham for $9.8 million.

Stuart Taylor, senior director of JLL Retail Investments, said local and offshore high-net-worth investors are targeting convenience-based retail assets.

“All three of the Victorian assets have been acquired by private capital, reflecting the incredible depth of demand for well-leased, defensive commercial property,” Mr Taylor said.

Retail investment sales activity has rebounded this year as private investors chase “pandemic-proof” supermarkets, neighbourhood shopping centres and Bunnings investments, as well as opportunities in key regional hubs.

“Supermarkets, Bunnings-leased investments and neighbourhood centres are the clear focus of the majority of active purchasers in the market, and this weight of demand is translating to yield compression and increased deal volumes,” Mr Taylor said.

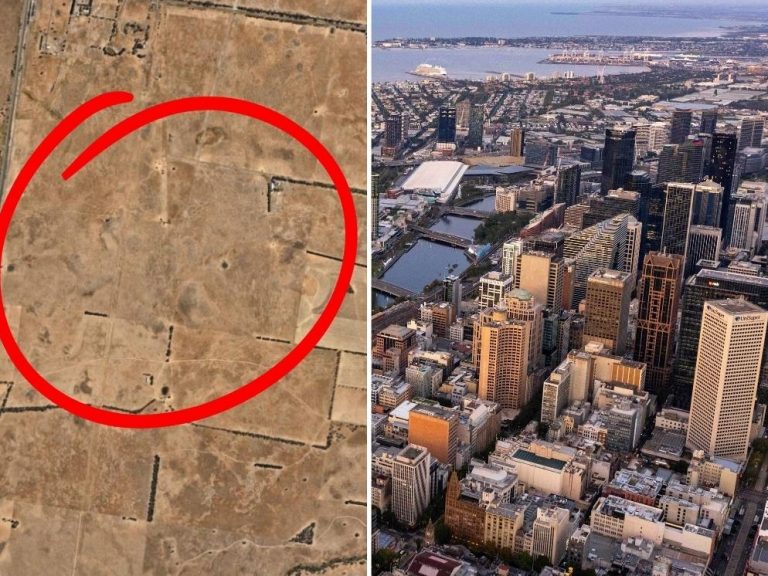

The Torquay Village shopping centre sold for $40 million. Picture: Supplied by JLL

JLL said the $40 million sale price for Torquay Village represented an initial yield of about 5%.

The neighbourhood shopping centre in the centre of the seaside town is anchored by a Coles supermarket and Liquorland, and also has 15 specialty shops.

JLL said there was a competitive expressions of interest process for the 5265sqm Coles Morwell shopping centre in the Latrobe Valley. It is anchored by the supermarket and Liquorland, and has seven non-discretionary specialty shops.

The $27.85 million sale price reflected an initial yield of 4.94%.

The Coles Morwell shopping centre sold for $27.85 million. Picture: realcommercial.com.au/sold

With the coronavirus pandemic increasing the already-strong demand for Bunnings investments from private buyers and institutional players, an offshore investor paid $9.8 million for the 7465sqm Bunnings in Horsham, 300km northwest of Melbourne.

The property, leased to Bunnings until 2025, was sold off-market on behalf of a consortium of New Zealand-based investors.

Bunnings investments are rarely offered through a public sale process; only three have been publicly marketed in Australia this year.

An offshore private investor paid $9.8 million for Bunnings Horsham. Picture: Supplied by JLL

The latest public sale is a Bunnings in Munno Para West in Adelaide that the Colliers selling agents expect to sell for about $45 million.

A number of freestanding supermarkets, supermarket-based shopping centres and neighbourhood malls have changed hands recently.

Mr Taylor said convenience-based retail assets had driven a rebound in transaction volumes in 2021, with almost $2 billion in retail investment sales recorded in Victoria during the first six months of the year – the largest first half for Victorian retail investment volumes since 2018.

“Neighbourhood centre yields are now at a new cyclical low, driven by an urgency for buyers to secure assets with defensive tenant profiles and long WALE [weighted average lease expiry],” he said.

“The proven performance of these assets combined with the record low interest rates is creating the most competitive bidding environment we have seen in Melbourne for over a decade.”

Tom Noonan, director of Victorian retail investments at JLL, said eight neighbourhood centres changed hands in Victoria in the first half of 2021, when the average number sold in the state each year was six or seven.

Mr Taylor said the buyer pool in the sub-$100 million market had expanded significantly to include multiple new sources of institutional capital such as sovereign wealth funds and real estate investment trusts, although the Melbourne market continued to be dominated by private investors.

“Local and offshore high-net-worth investors are accounting for the vast majority of retail transactions,” he said.

Mr Noonan said the 50% stamp duty concessions for commercial property in regional Victoria was also driving heightened demand for commercial assets in the state’s major regional towns.

Stonebridge Property Group agents also noted increased interest from international Asian investors in regional investments amid the COVID-driven regional population shift, after a first-time Chinese investor paid $4.5 million for the Spotlight Plaza in Sale in Victoria’s Gippsland region.