2024 an opportune time to buy commercial property, new report predicts

A significant reset of commercial property values could see 2024 as an opportune time to secure new assets, a new report as found, setting up investors for ‘above average returns’ over the following five years.

Knight Frank’s 2024 Australian Horizon report reveals its top seven predictions for the commercial property market over the next 12 months, anticipating 2024 will be a “better year to acquire assets”.

As the market continues to adjust to higher interest rates, Knight Frank chief economist and report author Ben Burston said the commercial market could look ahead to consolidation and the prospect of an emerging recovery in 2024.

“The sustained pressure of higher rates has naturally put pressure on asset values and this is still playing out to varying degrees,” Mr Burston said.

And while falling asset values are never welcomed by the investors who hold them, Mr Burston said the flipside is a resetting of yields for the higher interest rate environment, setting up investors who buy in now for stronger future returns.

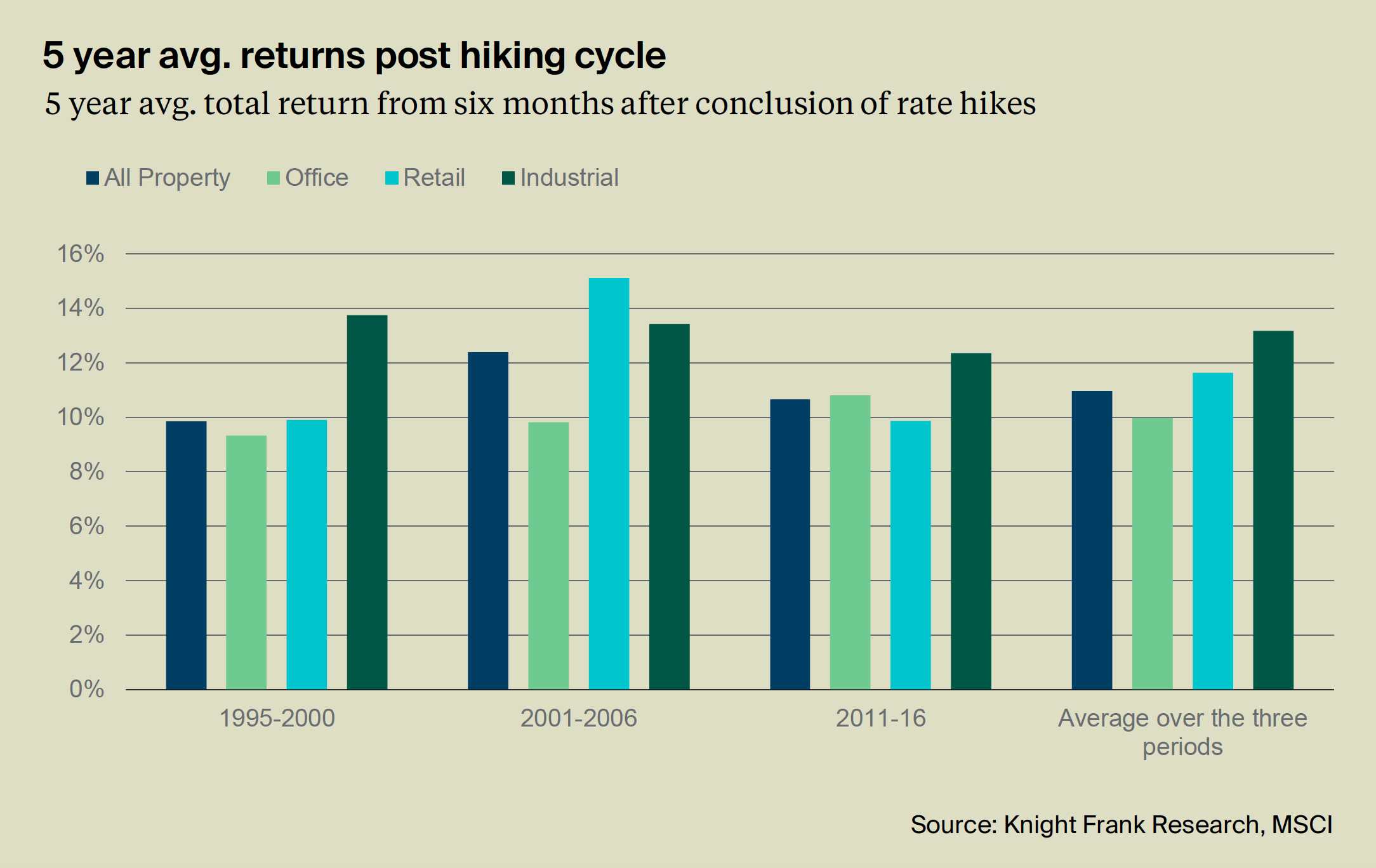

“This is clearly illustrated when we assess historic market cycles and the performance achieved after pricing is reset in the aftermath of interest rate hiking cycles,” he explained.

“The period immediately after the conclusion of the rate hike cycle ending in 1994, 2000 and 2010 was in each case a very attractive time to buy, achieving above average returns over the following five years.

“This is not to say that history will repeat, and investors cannot take for granted that interest rates will fall exactly as anticipated. But careful asset selection will maximise the chances of strong performance whether it is achieved through income growth or boosted by a return to yield compression as interest rates revert in 2024-26.”

Buyers and seller expectations to better align

Ultra-low interest rates and the pandemic-fuelled commercial property boom through 2021 saw buyers accept much lower yields across most asset types, raising the prices they were willing to pay. But soaring debt costs through 2022 has created a disconnect between buyer and seller expectations.

PropTrack economist Anne Flaherty said it now appears the market is close to hitting the bottom of the cycle as far as values were concerned.

“I definitely think that one of the reasons why there’s been so few transactions in 2023 is that there has been a really big disconnect between what buyers are willing to pay, and what sellers are willing to accept,” Ms Flaherty said.

A reset in the commercial market will set investors up for strong returns. Picture: Getty

Mr Burston said deal evidence now coming through signals the gap between sentiment – or what sellers perceive their assets are worth – and formal valuations, will continue to erode over the next six months.

By mid-2024 he said the picture will be clearer for buyers and sellers alike, “helping to restore confidence and liquidity”.

Prediction: Riskier assets to command a higher premium

With ‘risk-free’ 10-year government bond yields currently sitting at around 4.5%, Mr Burston said financial assets across the spectrum – including commercial property – are having to adjust to offer a suitable return for taking on more risk.

“Core assets that are perceived to offer better income security will trade at tighter internal rates of return (IRR), and for those that also come with strong income growth prospects this will imply that a given return target can be achieved with a lower yield,” Mr Burston said.

“On the other hand, weaker quality stock is likely to be perceived as higher risk and offering less income growth potential, so yields will need to be significantly higher to achieve a given return target.

Growing rents and strong demand will continue to support industrial asset valuations. Picture: Getty

It’s here that industrial assets will continue to benefit, he said.

“This plays relatively well for industrial assets, which are benefitting from strong rental growth and tight supply that is starting to appear structural rather than purely cyclical.”

“For office and retail assets, there will be a sharp divergence depending on asset quality and perceived growth potential.

For example, Mr Burston said assets facing heightened vacancy risk and without the prospect of meaningful rents rises in the near term will see investors demand a higher premium for risk.

Commercial assets with low rental growth and vacancy risks will command higher yields. Picture: Getty

Ms Flaherty said yields will likely soften further as investors demand more of this risk premium.

“What we’re seeing is that the risk premium currently available on a lot of commercial assets is quite low, which would suggest we’re likely to see yields soften further,” she said.

Strong rental growth in the industrial sector will be factored in to future returns, she added.

“So, for investors who are trying to establish how much they are willing to pay for an asset, they will factor in that rent growth and if they do anticipate strong rent growth, that’s going to mean they’re willing to buy in at a lower yield.”

Prediction: Office set for recovery as development pipeline slows

Several factors are working against new commencements for office developments in 2024, with rising construction and funding costs, higher vacancy rates and lower valuations lowering the feasibility of new projects.

“However, a slowdown in commencements will impact the pipeline in 2027 and beyond, and even at this early stage it is possible to identify a risk of a shortage of prime space later in the decade,” Mr Burston said.

Office assets have been hit by higher vacancies, but that could change as the development pipeline dries up. Picture: Getty

Colliers International chief executive officer Malcom Tyson said premium office rents and investor appetite will continue to elevate this asset class above the rest of the sector, with the yield spread between Premium and A Grade assets set to expand by as much as 28 basis points over the 12 months prior to September 2024.

“Similarly, the spread between Premium and B Grade office asset yields is likely to expand by as much as 44 basis points over the same period,” he said.

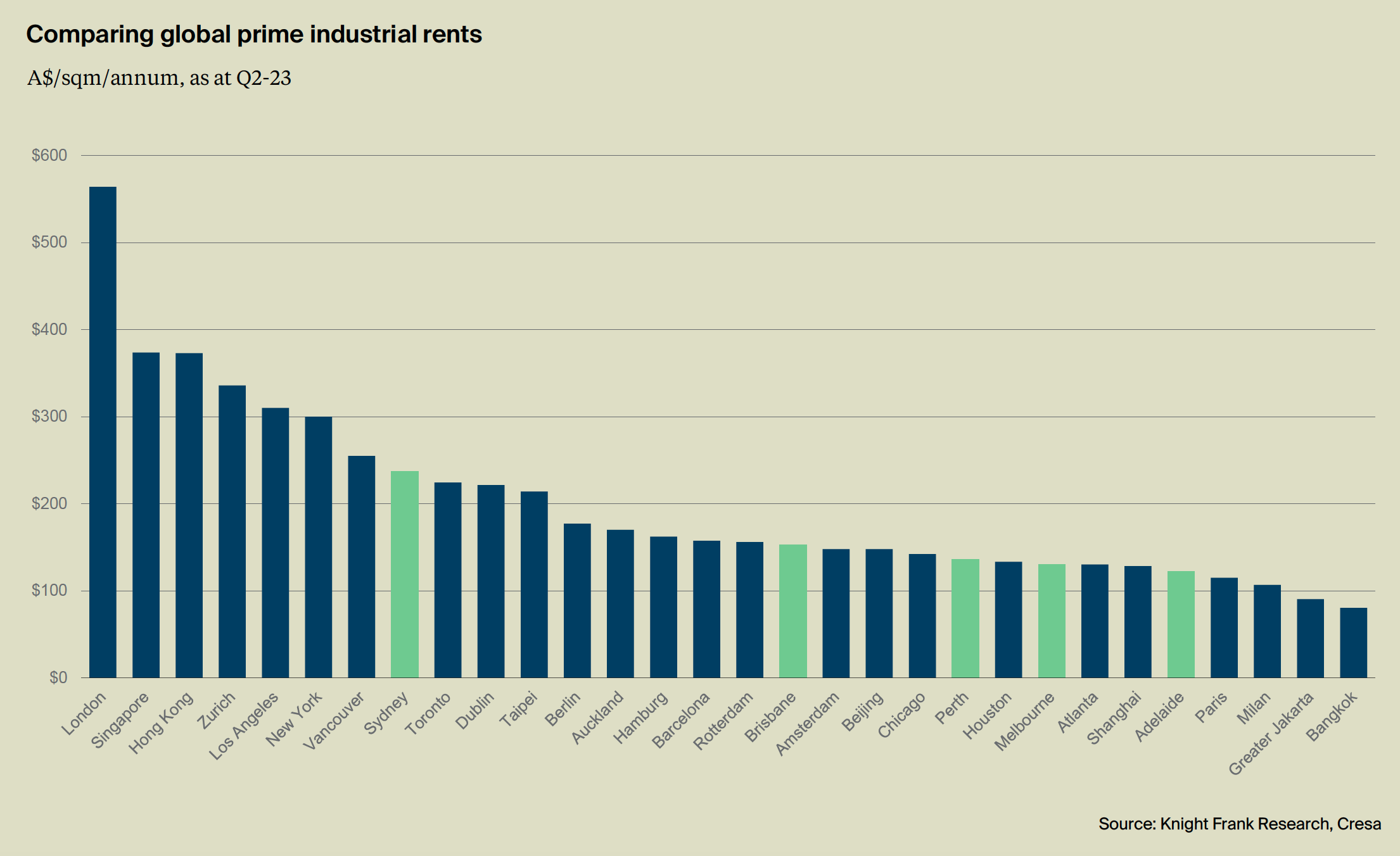

Prediction: Industrial rents have further to rise

Industrial rents grew at the fastest rate on record over 2022, Ms Flaherty said, and are still rising in 2023. The key question investors are asking is – can it continue?

The Knight Frank report found that the answer is yes.

“The first reason for this is that an assessment of rental costs as a proportion of total operational costs suggests that rents are not presenting an unmanageable burden, representing even less than 5% to up to 10% for most occupiers,” the report said.

“Secondly, rents in Australia are by no means out of line with the level of rents in comparable cities globally, most of which have also seen a sharp rise in recent years.”

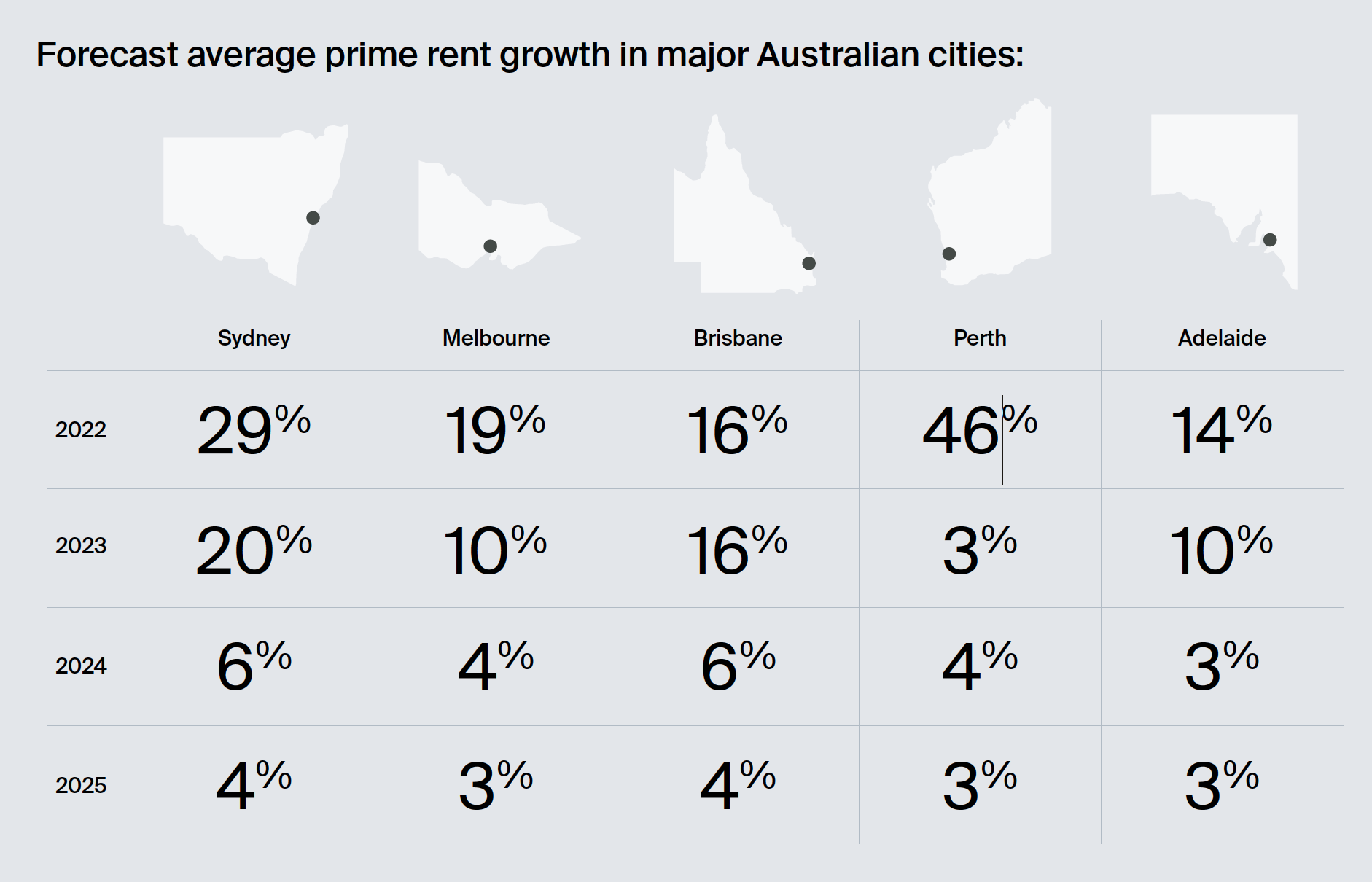

However, after the report noted a more modest pace of growth than seen in 2022 and 2023, with a greater differentiation between between the pace of growth for prime and secondary assets.

Source: Knight Frank Australian Horizon 2024 report

Ms Flaherty agreed the pace of rental increases wouldn’t be on par with that seen in recent years.

“They are going to continue growing but the speed at which they grow is likely to moderate slightly from the peak rent growth that we were seeing over the 2023 financial year,” she said.

Mr Tyson said he expected the strong value proposition and resilience of the industrial market to continue to be underpinned by tight incentives, low vacancy and rental growth.

“While rents moderated slightly over Q3 2023, the prime national weighted average rental growth rate (4%) was still significantly higher than the previous decade’s average quarterly growth rate (1.3%),” he said.

“Rents continued to offset yields to ensure average national prime values increased by 2.1% over Q3 2023.”