Vicinity Centres takes $570m mall hit as CBDs suffer

Shopping centre owner Vicinity Centres has taken a $570m hit to the value of its mall portfolio, with most of the pain coming at its CBD complexes.

The company, which owns Melbourne‘s landmark Chadstone Shopping Centre with billionaire John Gandel, was hit by a net valuation decline over the last half of 4%, on its 60 directly-owned retail properties.

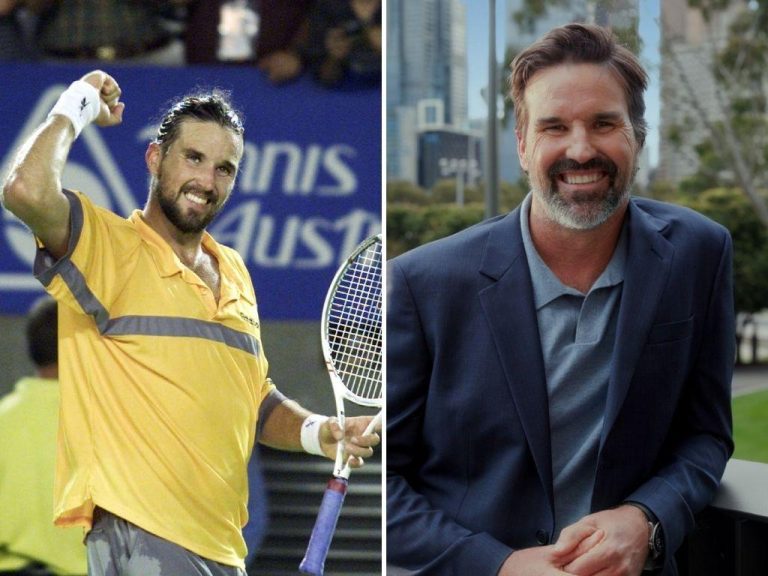

Vicinity CEO Grant Kelley blamed the pandemic and warned that its effects were ongoing for shopping centres, given the risk of more coronavirus outbreaks.

“COVID-19 impacted the global economy materially in 2020, the effects of which continue to be felt into 2021,“ he said. “Our CBD centres in Brisbane, Sydney and Melbourne … continued to be impacted by the current low levels of tourism and office occupancy,” Mr Kelley said.

But the more non-discretionary retail-focused neighbourhoods and sub regional centres had more resilient valuations generally, while providing a higher income yield.

Melbourne mall Chadstone’s valuation was down by just 2% while the CBD centres were down by 8.6%.

The company said across the portfolio, outside CBD locations, customer activity was returning to near pre-COVID levels. In December, centre visitation across Vicinity’s portfolio averaged 88.4%of the prior year.

Mr Kelley expressed caution over the impact of potential future outbreaks of COVID-19 on retail trade, and the challenges of the evolving retail environment, but said the country had handled it well.

“Australia has been highly successful in containing COVID-19 outbreaks, which puts our economy in a relatively strong position globally. Australians have also shown that they are excited to return to their favourite retail destinations with customer visitation bouncing back strongly over the Black Friday and Christmas periods,“ he said.

The company is also expecting the COVID-19 recovery to be further boosted by the rollout of a vaccine anticipated in the first half of this year.

Visitation and retail trade have picked up at the company‘s Victorian assets, following the lifting of the Andrews government’s stage four restrictions last October.

UBS analysts warned that re-leasing spreads would deteriorate to a negative 15-20% in 2021. They said pricing power between retailers and landlords had been shifting in retailers’ favour for three years with COVID-19 accelerating this trend.

Vicinity‘s exposure to CBD retail assets, which make up 16%of the portfolio, would likely see the company’s performance subdued against rivals like local Westfield owner the Scentre Group.

But Vicinity has an exposure to convenience retail which has emerged as the steady performer of the crisis.

UBS forecasts rents will rebase down 15-20%over the next three years and there will be a structural vacancy of 1.5%, as it downgraded Vicinity to a sell rating this week.

“CBD retail to remain under pressure as a result of border restrictions, domestic and international, and return to offices are delayed,” UBS said.

Macquarie analysts said they expect pressure to remain on retail valuations, driven by a shift to e-commerce and store network rationalisation. They added that data was pointing towards soft footfall in January.

This article originally appeared on www.theaustralian.com.au/property