The subregional shopping centre surge could be about to kick off again

JLL says asset prices have shifted due to the escalating cost of capital and changing investor appetite. Picture: Supplied by JLL

Retail property investors have been grappling with the big shift in subregional shopping centres values but recent deals are showing the best assets will perform.

A fresh analysis by JLL’s retail investments team has shown a split has emerged in yields between core and non-core assets in the sector.

Put simply, investors are going after the subregional assets that they believe will outperform in the current, tougher environment, as retail spending comes under pressure.

Subregional centres stand out as the highest-yielding component of the retail landscape and JLL says asset prices have shifted due to the escalating cost of capital and changing investor appetite.

JLL retail investments, senior director, Nick Willis, said that in the past decade, the subregional market had transformed as new capital chase centres.

“Institutional investors held the majority share of acquisitions from 2013 to 2018,” he said. “However, in the last five years, there has been a significant shift, with syndicators and private investors emerging as the dominant buyer group.”

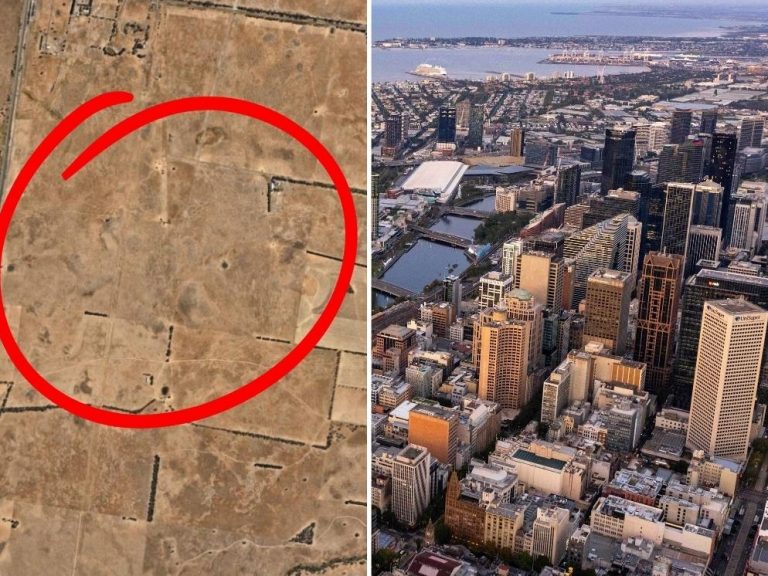

Brickworks Marketplace – Corner of South Rd and Ashwin Parade, Torrensville. Picture: Supplied by JLL

This shift has been a key factor driving the divergence in the pricing of subregional centres. Syndicators and private investors have increasingly dominated buying over the past five years and their share of subregional acquisitions has hit about 84 per cent since 2022.

Active players include Elanor Investors Group, Fawkner, Haben Property Group and IP Generation.

On the other side, sellers include US private equity firm Blackstone and listed companies Stockland and Vicinity Centres. The new wave of buyers rely on a mix of debt and equity funding, particularly when buying larger assets. This has not slowed their appetite but the rising cost of debt has played a significant role in driving these yield changes. The market slowed as it was hit with a 400-plus basis points hike in debt costs.

But the active syndicators are still out buying, albeit at prices which allow them to present viable investments to their clients.

JLL analysis of recent syndicates show that most aim for distributions of at least 8 per cent and target internal rates of return of 15 per cent.

This has prompted a shift in strategies with higher yielding, “non-core” subregional assets now on the agenda for syndicators, as they offer better metrics. They may be securing assets ahead of a coming rush, with JLL detecting a resurgence of local and offshore institutions assessing a move back into the area as offshore markets are also picking up.

Mr Willis cited the robust performance of US and European markets as driving a resurgence in offshore players chasing their traditional core retail strategies.

“However, this capital is discerning with a focus on best-in-class assets that provide strong underlying fundamentals including land and mixed-use potential,” he said.

Pricing disparities of up to 300 basis points between core and non-core assets have been picked up by the firm, largely due to the changing capital sources.

With syndicators chasing non-core subregional assets, liquidity in core assets in metropolitan Sydney and Melbourne remains limited as they are targeted mainly by the largest institutions.

JLL head of retail investments Sam Hatcher said there was a clear contrast between core and non-core assets. “Amid this trend, syndicators and private investors have emerged as the dominant players, navigating the hurdles presented by increasing capital costs,” he said.

Non-core subregional assets are hot due to the potential to deliver attractive returns, while institutions focusing on core assets that are underpinned by strong land components and mixed-use potential.

“We expect a steady level of transaction volume towards the end of 2023, increasing with market transparency and improving investor confidence,” Mr Hatcher said.