The burger wars heat up as Wendy’s opens its first Aussie store

Australia’s first Wendy’s store is set to open this week, as the US burger chain joins a wave of American franchises entering the Australian market in recent years. But can it compete?

The world’s third largest burger chain announced in August 2023 its intention to roll out 200 venues across the country by 2034, with the first store to open on Cavill Avenue in Surfer’s Paradise on Wednesday.

Wendy’s says a successful Sydney pop-up event in 2021 proves fans are ready for Wendy’s to arrive in Australia.

American burger chain Wendy’s has announced plans to open 200 stores from 2025. Picture: Getty

It comes hot on the heels of other US fast food giants attempting to break into the Australian market – with varying degrees of success.

We take a look back at the rise of the quick service restaurant in Australia, and what it takes for global players to succeed.

Wendy’s, take two

This is not Wendy’s first rodeo down under.

The fast food chain opened its first Australian store in Melbourne in 1982. Eleven locations followed, before the franchise collapsed three years later with $8 million in debts.

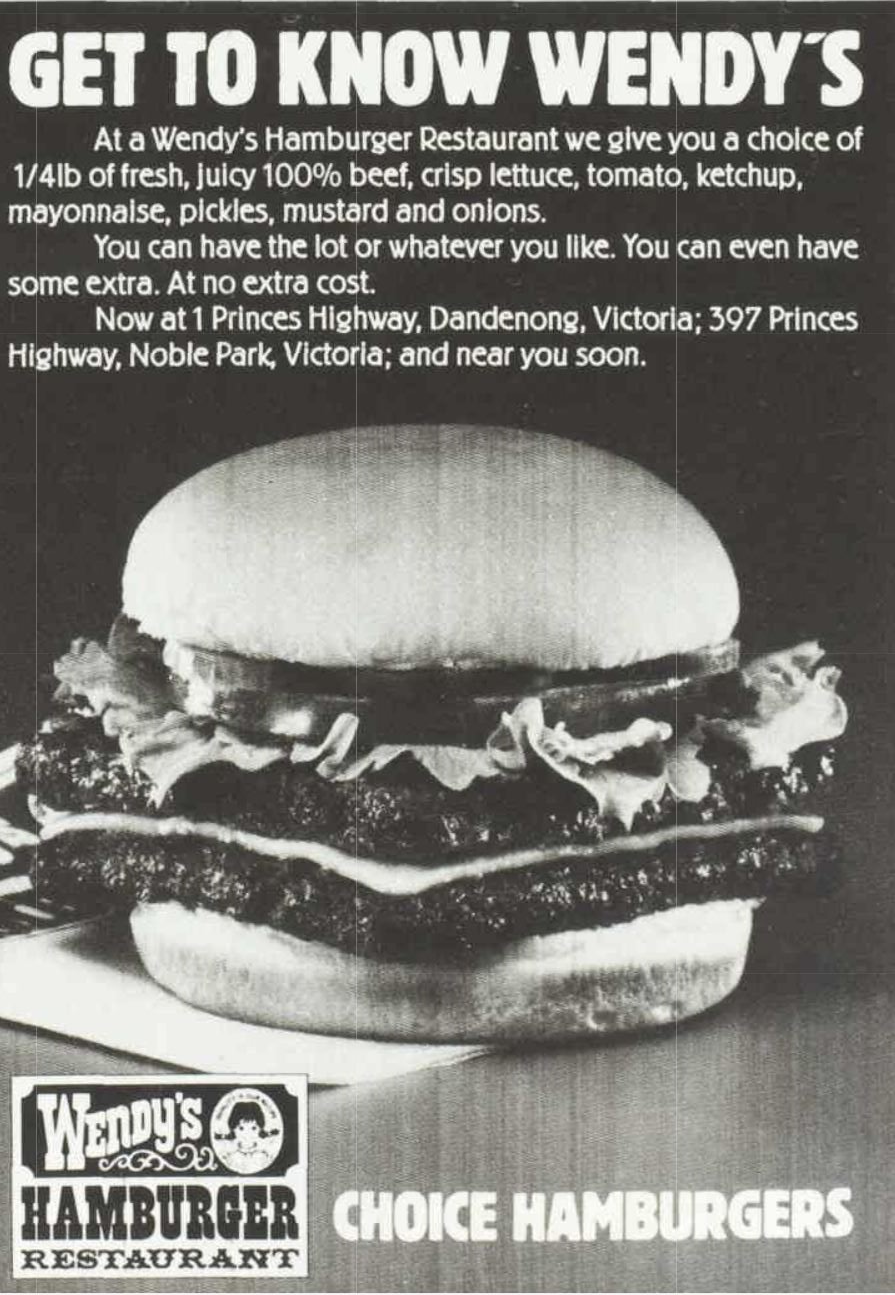

A 1982 advertisement for Wendy’s Hamburgers from the Australian Women’s Weekly. Picture: Trove collection, National Library of Australia

In a searing twist of fate, Hungry Jack’s founder Jack Cowin bought up the 11 former Wendy’s stores for just $2 million.

Mr Cowin had opened the first Burger King in Australia some 14 years earlier, but later rebranded it as Hungry Jack’s to avoid a trademark dispute with a takeaway food shop in South Australia.

Hungry Jack’s currently has 440 restaurants across Australia. Picture: Getty

Franchise law specialist, Simone Pentis, believes Wendy’s take-two could face a similar trademark dispute with the existing Wendy’s Milk Bar franchise – which has more than 120 milkshake and hot dog outlets across Australia and New Zealand.

“It will be interesting to see how Wendy’s plan to deal with this intellectual property issue and how it might affect their expansion plans,” she said.

Founded in 1979, Wendy’s Milk Bar has more than 120 stores across Australia and New Zealand. Picture: Instagram @wendysmilkbar

Ms Pentis also pointed out the same barriers that impacted Wendy’s success in the 1980s could hinder its second crack at the market four decades later.

“You can’t just pick up what you had in America and drop it here without adapting to Australian realities and cultural differences, like our higher wage costs and considerably higher property prices,” she said.

Lyndall Spooner, CEO of Australia’s leading strategic data agency, Fifth Dimension, argues Wendy’s making good a second time around will come down to savvy marketing and quality of product.

“Good advertising is going to be key to cut through a highly competitive market and American brands are exceedingly good at marketing to Australian youth and promoting similar values,” Ms Spooner said.

“Also, recent research from EatClub shows that Aussies are eating more burgers and with Wendy’s focusing on fresh local ingredients, this will surely help their launch into the local market,” she added.

The world’s largest restaurant franchiser, Flynn Restaurant Group, has been tasked with the hyper-scaling of Wendy’s down under.

Taco Bell has paused Australian expansion plans due to disappointing earnings. Picture: Getty

The company operates hundreds of Wendy’s, Taco Bell, Arby’s and Applebee’s venues in the United States as a franchisee. They also took over all 260 Pizza Hut restaurants in Australia in June.

Flynn’s Chief Operating Officer, Ron Bellamy, sees Wendy’s as “an especially great fit” for Australia, given our rapidly growing population and the “savvy nature of the Australian consumer.”

The sweet taste of success

The first wave of US fast food chains down under came with the arrival of Kentucky Fried Chicken in 1968, followed by Pizza Hut in 1970, then McDonald’s and Burger King in 1971.

Today, three of those brands continue to enjoy success and huge profits. Hungry Jack’s currently has 440 restaurants across Australia, while Macca’s has 970 stores.

The first McDonalds store in Australia opened in Sydney’s Yagoona in 1971. Picture: McDonalds

KFC – with its 753 stores in Australia as of August 2023 – also remains one of the most successful US brands to enter the local market, which Ms Spooner attributes to canny brand awareness.

“KFC has been exceptionally strong in weaving its brand into youth culture – think the bucket hat at the cricket, or the saying ‘Did someone say KFC?’” she explained.

“They also regularly bring out new product variants and have good value deals. Their consistent advertising linked to key occasions means they are a top-of-mind consideration for multiple occasions.”

Coincidentally, the Sydney site where Australia’s first KFC was opened in 1968 has been put up for sale, although it has since been developed it into a service centre.

After a highly successful 30-year run in Australia, Pizza Hut has dwindled significantly over the past two decades.

Pizza Hut’s first Australian restaurant opened in Sydney’s Belfield in 1970, offering all-you-can-eat pizza slices, salads and desserts. Picture: Pizza Hut Australia

According to Ms Spooner, brands fail when they lose relevance.

“Pizza Hut failed because they played the middle ground,” she explained. “They couldn’t compete with the speed and affordability of Dominos, nor with the growing high-end, hand-made pizza market. Their brand messaging was mixed and product innovations were weak.”

The second American fast food wave broke in Australia during the mid-80s when new players such as Domino’s and Subway entered the market. Both have enjoyed incredible success in Australia.

The final wave?

The last decade has seen a so-called third wave sweep across the country, with Taco Bell, Carl’s Jr and Five Guys all trying their hand at the Australian market and all to varying degrees of success.

Californian burger chain Carl’s Jr launched in 2016 with the intention of franchising 300 stores by 2026. So far, it has opened just 40.

American burger chain Carl’s Jr is also attempting a massive Australian expansion. Picture: Getty

In November 2022, Collins Foods, the franchisee of Taco Bell in Australia, paused any future Taco Bell openings due to disappointing earnings.

And while it’s still early days for Five Guys – which opened the first of three Australian locations in late 2021 – the last US chain to really triumph in Australia was Subway during the late ’80s.

“We are no longer as sycophantic to American brands as we used to be in the ’80s and the average Australian is now far more adventurous in their food choices,” Ms Spooner said.

Australian brands, like Mexican-style fast food chain Guzman Y Gomez, have been popular with consumers. Picture: Getty

Ms Spooner also pointed to the emergence of Australian brands like Betty’s Burgers (50 stores since 2014) and Guzman Y Gomez (179 stores since 2006) as one of the reasons for the lacklustre response to recent US launches.

“If local brands can provide the same value, level of quality and relevance as their American competitors, consumers are more likely to opt for them.”

Fast food investment

Despite the relatively modest success of recent US chains entering the Australian market, the hunger for fast food assets continues to dominate the commercial industry.

According to Burgess Rawson, the annual revenue of takeaway food services in Australia amounted to approximately $22 billion in 2022.

Burgers from McDonald’s, Burger King and Wendy’s. Picture: Getty

PropTrack Economist Anne Flaherty says fast food outlets will generally always be highly sought after by commercial real estate investors.

“These assets typically offer appealing lease terms to landlords. Plus, long-established fast food brands are particularly attractive to investors as they are already well known by consumers,” she said.

Ms Pentis agrees.

“Fast food remains a popular investment and franchise opportunity because people love to eat and will always need to eat. It’s as simple as that.”