Sydney a ‘Hong Kong tycoon’s party’

Hong Kong tycoons and finance houses have set a fierce pace in buying Sydney towers over the past year, and their interest is expected to flow into 2018 as a tide of fresh capital pours out of the territory.

Interests from the region have bought more than $1 billion worth of towers in the past six months and have stepped into the void created by Chinese mainland groups who had their wings clipped by stricter regulations on offshore investment.

Their continued interest in Australian property has driven the prices of ordinary office towers in Sydney into territory not seen the last property boom.

Commercial Insights: Subscribe to receive the latest news and updates

“Sydney has become a Hong Kong tycoon’s party,” says one agent. “They know each other, they talk to each other, they see what each other does.”

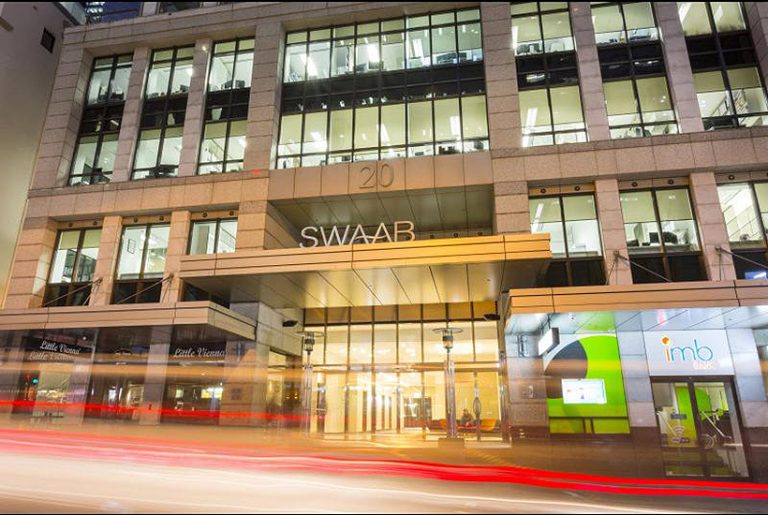

In the latest play, property fund manager CorVal Partners, acting for three investors including the Future Fund, offloaded a Hunter Street tower to finance house Ashe Morgan, which is acting with the backing of Hong Kong-based Value Partners in buying the $202 million tower.

It was sold by the Value Active Fund, which was set up five years ago by the Future Fund, Victoria Funds Management Corp and Funds SA.

The sale of 9 Hunter Street was handled by James Parry and Michael Andrews of CBRE and Rob Sewell and Paul Noonan of JLL.

While the B-grade office block will benefit from the light rail along George St and the development of skyscrapers above nearby stations, that does not fully explain the jump in the tower’s value from $79.3 million when it last sold in 2012.

Francis Choi has bought 1 Castlereagh St in Sydney for $220 million.

CorVal overhauled the tower and leased it but the market has benefited from major Hong Kong investors shifting their money on fears that Chinese authorities will eventually control, and potentially choke, capital outflows as they take the upper hand in Hong Kong.

Value Partners is certainly not alone in exporting capital.

Sydney has become a Hong Kong tycoon’s party. They know each other, they talk to each other, they see what each other does

A Hong Kong real estate magnate and a fund manager hailing from the territory signed two separate deals last month to buy Sydney office towers for a combined total of about $450 million.

The two deals — by Hong Kong billionaire Francis Choi and fund manager CLSA together with a Japanese partner — show that HK players have an undiminished appetite.

Choi, one of China’s largest toy manufacturers, purchased 1 Castlereagh St from US firm Blackstone for more than $220 million.

He has already put his stamp on the Sydney office market, snapping up the Exchange Centre in Bridge Street from Malaysia’s KWAP in April for $335 million.

Meanwhile, the unlisted Investa Commercial Property Fund sold 130 Pitt St for $229 million to PA Realty, a joint venture between CLSA Real Estate and Mitsubishi Estate Co, on a remarkable initial yield of 3.7%, or a rate of about $21,000 per square metre, in what is believed to be a city record.

Hong Kong’s wealthy Sin family picked up a nearby gentrified four-storey heritage building at 18-20 York Street for $30.7 million.

This article originally appeared on www.theaustralian.com.au/property.