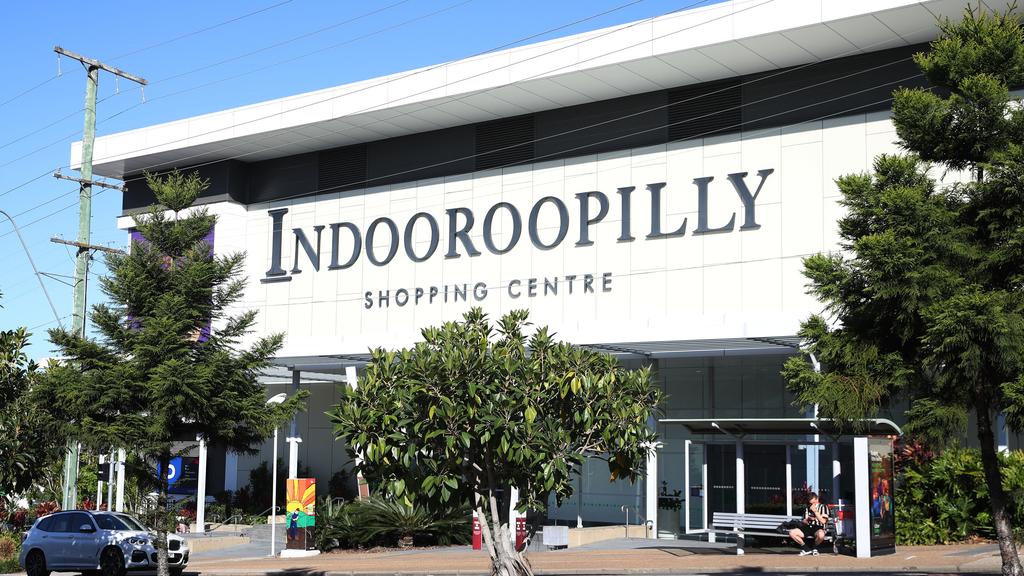

Scentre, which runs Westfield malls, and Vicinity Centres jostle for $1.2bn Indooroopilly shopping centre

Indooroopilly Shopping Centre is set be hotly contest in this year’s biggest mall listing.

The race for one of the country’s largest shopping centres, which sits in the Brisbane suburb of Indooroopilly has kicked off, with listed groups vying with international players for stakes in the $1.2bn property.

The Indooroopilly Shopping Centre is a linchpin of the AMP Capital property funds empire but rival players are now circling the half interest in the landmark asset still owned by the Commonwealth Superannuation Corporation.

It had sold a half stake to two AMP Capital funds for $800m in 2017 and the funds group also took on management of the super-regional centre.

Now superannuation fund CSC, advised by Colliers’ Lachlan MacGillivray, has fielded approaches from local operators, putting rivals like local Westfield owner, the Scentre Group, and Vicinity Centres, in the frame to take it over.

But they will face stiff competition from international groups which are keen to back Australian retail as it recovers from the pandemic, with trading at Indooroopilly now running at levels above prior to the coronavirus crisis.

A further 25 per cent stake in the mall is being offered by a fund run by listed group Dexus. It picked up the interest when it merged with an AMP Capital-run vehicle last year and has been selling off assets to give investors liquidity.

It is separately advised by real estate agencies JLL’s Nick Willis and Sam Hatcher and CBRE’s Simon Rooney.

The two sale processes are effectively running at the same time with the race on to see which stake sells first. Either chunk could go to a group keen to have a say in the centre’s future and the Dexus interest was formally listed this week.

The centre is still managed by AMP Capital and one of its funds still has a 25 per cent interest. But if another group buys in its position could come up for review in future, though any change must made with the consent of all owners.

AMP Capital’s purchase of the half interest in the centre for $800m five years ago was at the peak of the retail property market and was struck on a crisp yield of about 4.25 per cent.

The purchase was subject to an internal report by AMP Capital which found deficiencies in its approach to buying the interest in the centre.

But with the mall already written down there is an opportunity for incoming investors to drive the turnaround in its performance and to pursue longer term mixed use strategies, as the owners have already explored adding apartments to the site.

AMP Capital last month joined forces with automotive retail group Eagers Automotive to set up an AutoMall in the centre, in a sign of the changing uses of major malls.

It also has significant development upside and could accommodate an additional 90,000sq m of space. It will likely draw similar buyers to groups which chased Sydney’s Macquarie Centre and Pacific Fair on the Gold Coast.

Last year’s sale of a half share of Macquarie Centre and an 80 per cent stake in Pacific Fair in a $2.2bn transaction to Cbus Property and UniSuper helped reset the market and provided confidence that investors still wanted big centres after the crisis.

AMP Capital then locked in its control of those two malls by buying out further stakes in separate deals totalling about $760m.

Indooroopilly is a 110,000sq m super regional shopping centre anchored by David Jones and Myer, including Woolworths, Coles, Aldi, Target and Kmart. The centre, which sits just 7km from the Brisbane CBD in the western corridor, has about 250 speciality shops.

AMP Capital’s management agreement for the asset expires in 2027 but the fund manager and CSC declined to comment. AMP Capital’s shopping centre fund, which holds the 25 per cent interest in the Brisbane mall, had previously waived its right to acquire the Dexus stake but is thought to be again weighing its options.