Poultry pioneers: How Red Rooster became Australia’s answer to KFC

What began as a modest family business more than half a century ago has evolved into a national fast food success story, however the ride hasn’t always been a smooth one for Red Rooster.

Weathering shifting consumer trends, numerous changes in ownership and competition from challenger brands, how, in such a volatile industry, has the business managed to endure as one of Australia’s longest serving quick service restaurant chains?

Samantha Bragg, who was appointed CEO in 2024, said the key to Red Rooster’s longevity has been an ongoing commitment to evolution, while maintaining its core brand values.

“Like any brand you need to remain clear on what I call ‘brand codes’. These are often top of mind for customers and are the things customers associate with your brand,” Ms Bragg told realcommercial.com.au.

“It’s important to ensure that these codes remain relevant to customers and you continue to evolve and modernise not only your brand codes, but also continue to evolve and modernise your menu to ensure continued appeal.”

Red Rooster, Rouse Hill. Picture: Chris Pavllich/The Photo Pitch

Ms Bragg noted Red Rooster has achieved this effectively over the years, including recent investments in refreshed brand assets and new menu offerings such as fried chicken.

“Fundamentally the joy of the QSR [quick service restaurant] is that it absolutely operates on a consumer level and works best when it sticks to what it’s known for – fast, filling and fun.”

Humble beginnings

Red Rooster was established in Western Australia by businessman Peter Kailis in the early 1970s.

The eldest of four sons to Greek migrant George Kailis – who had owned and operated a Perth fish shop since 1926 – Peter assisted his father in serving seafood to customers during the day and washing potatoes at night.

Acquiring skills in his father’s store would prove advantageous, when at 44, Peter transitioned from his seafood origins to pursue dreams of chicken fortune.

In 1972, Peter and his brother Theo, along with nine other invested partners, launched the first Red Rooster store by acquiring an existing chicken shop in the Perth suburb of Kelmscott.

The first Red Rooster Store opened in WA in 1972. Picture: australianfoodtimeline.com.au

“My brother met these two boys from Adelaide that had chicken shops over there and had opened one here in Perth on Wanneroo Road. I tasted the chicken and it was absolutely magnificent. So I said, ‘What the hell? We’ll give it a go’,” Peter Kailis recalled in a 2018 interview published on the brand’s social media.

In contrast to local restaurants, the brothers decided to go head-to-head with American fast food franchises like Kentucky Fried Chicken, which had made its debut in Australia four years earlier by launching a Sydney store in 1968.

With KFC located in the east and Red Rooster in the west, Mr Kailis sought to successfully emulate his competitor’s standardised menu, branding and marketing strategies. The main distinction was that while Kentucky Fried Chicken promoted its signature dish, Red Rooster focused on roast chicken.

“Our product was something the West Australian public hadn’t had before and I had confidence something could be done with it,” Mr Kailis said.

Red Rooster in the 1970s. Picture: Red Rooster/Facebook

The business struggled financially during its initial years until Peter Kailis acquired his partners’ shares and became the sole owner of the Kelmscott store. Red Rooster quickly grew to four locations in Perth, fuelled by positive word-of-mouth.

According to australianfoodtimeline.com.au, back in those days a whole Red Rooster roast chook would set you back just $1.95.

Other menu items included the Hawaiian Pack, developed by Peter Kailis, which featured a quarter roast chicken, chips and a pineapple and banana fritter. The popular item, now called the Tropicana Pack, remains today, with the banana fritter replaced with a second ring of deep-fried pineapple.

Red Rooster store opening in Kelmscott, WA. Picture: Red Rooster/Facebook

Naturally, Mr Kailis singled out his Hawaiian Pack creation as his favourite meal.

“I have it now regularly from one of the local stores [in Perth],” he said.

“Everything I did with Red Rooster, I was very proud [of]. I produced a product that the people wanted and we had a very good staff and we were able to expand in competition with all the American companies.”

Expansion, acquisitions and franchising

In the consumer-driven 1980s, Red Rooster had successfully expanded to 45 outlets in Western Australia and Victoria.

In 1982, Peter Kailis chose to part ways with the family business he had grown from the ground up, selling the Red Rooster chain to Coles Myer Ltd for $8.97 million. At the time, it was ranked the fourth-largest fast food group in Australia, totalling 80 locations.

In 1986, Coles Myer expanded the brand further into the east by acquiring the Big Rooster chain in NSW, taking control of 40 locations that were then rebranded as Red Rooster. The remaining Big Rooster stores in Queensland were purchased in 1992, increasing the Red Rooster store count to 230 across Australia.

Melbourne based writer and founder of australianfoodtimeline.com.au, Jan O’Connell, remarked on the popularity of Red Rooster wedges during the 1980s.

“Sadly, they are no longer on the Red Rooster menu, removed long ago in favour of ordinary chips,” she wrote on her blog.

As the new millennium approached, numerous changes began to unfold for Red Rooster.

In May 2002, Perth’s Australian Fast Foods (AFF), which also owned the competing Chicken Treat fast food franchise, took over Red Rooster from Coles Myer.

“At that time, there were about 308 Red Rooster stores in the chain, of which about 248 were company-operated and the other 60 were franchised,” said Mark Lindsay, CEO of Quick Service Restaurant Holdings, in 2009.

“Although AFF owned Chicken Treat and Red Rooster, they were independently run but under the same holding company.”

A Red Rooster store in 2014. Picture: Getty

Red Rooster changed ownership several more times until 2010, when the business transitioned to a franchise model. This strategy included purchasing Greenfields sites for new franchise outlets and converting company-operated stores into franchises.

Mark Lindsay aimed to boost the number of stores by 100, managing to achieve about half that target.

The next year, seven Red Rooster locations on the Sunshine Coast shut down when the franchisee entered voluntary administration.

By 2018, the chain consisted of 359 stores throughout Australia, however the company was in a funk – tired, outdated and in need of a rebrand.

Brand transformation

In 2018, Red Rooster’s director of marketing, Ashley Hughes, acknowledged that the company had “lost its way”.

“For the vast majority of customers, we were positioned as sort of permissible, slightly better for you, but a little bit dated, a little bit bland and boring because it was just based on roast chicken,” Mr Hughes told NewsWeek in 2023.

“If you think who traditionally eats roast chicken, it’s the Anglo Saxons. With the changing demographic nature of Australia, we were not relevant from a food perspective.”

After struggling to engage with customers in the evolving fast-food sector, particularly as brands like El Jannah and Guzman y Gomez successfully redefined fast food for Australians, Red Rooster embarked on a brand overhaul to, as Hughes put it, “fix the food, fix the assets and fix the experience”.

Red Rooster Upper Commera. Picture: Sarah Keayes/The Photo Pitch

This new approach led to the brand refreshing its image, modernising its advertising, and adding new items to the menu, including fried chicken and burgers.

“You think of McDonald’s, Hungry Jack’s, KFC, all of their biggest products are burgers … we knew that if we wanted to significantly grow this brand we’d need to play in the burger space,” Mr Hughes said.

This revitalisation campaign saw Red Rooster achieve a 40% increase in same-store sales.

Observing from the outside, CEO of marketing agency TFM Digital, Taylor Fielding, dubbed Red Rooster’s transformation an “impressive” turnaround.

“Admitting you’ve lost your way is an honest and brave assessment and Red Rooster’s commitment to change has been no small undertaking,” Mr Fielding told realcommercial.com.au.

“The revamped menu seems to have gone down well, attracting interest from current, former and potential new customers and engaging with a new generation that may not have considered the brand before. The revamped logo has also been widely welcomed and received from what I hear. The CX [customer experience], for Red Rooster, as well as other brands, is also something that needs continual attention, to ensure you’re meeting the changing needs of customers.”

The Red Rooster Line

Around the time Red Rooster was beginning its transformation journey, the chain inadvertently found itself at the centre of a unique cultural moment.

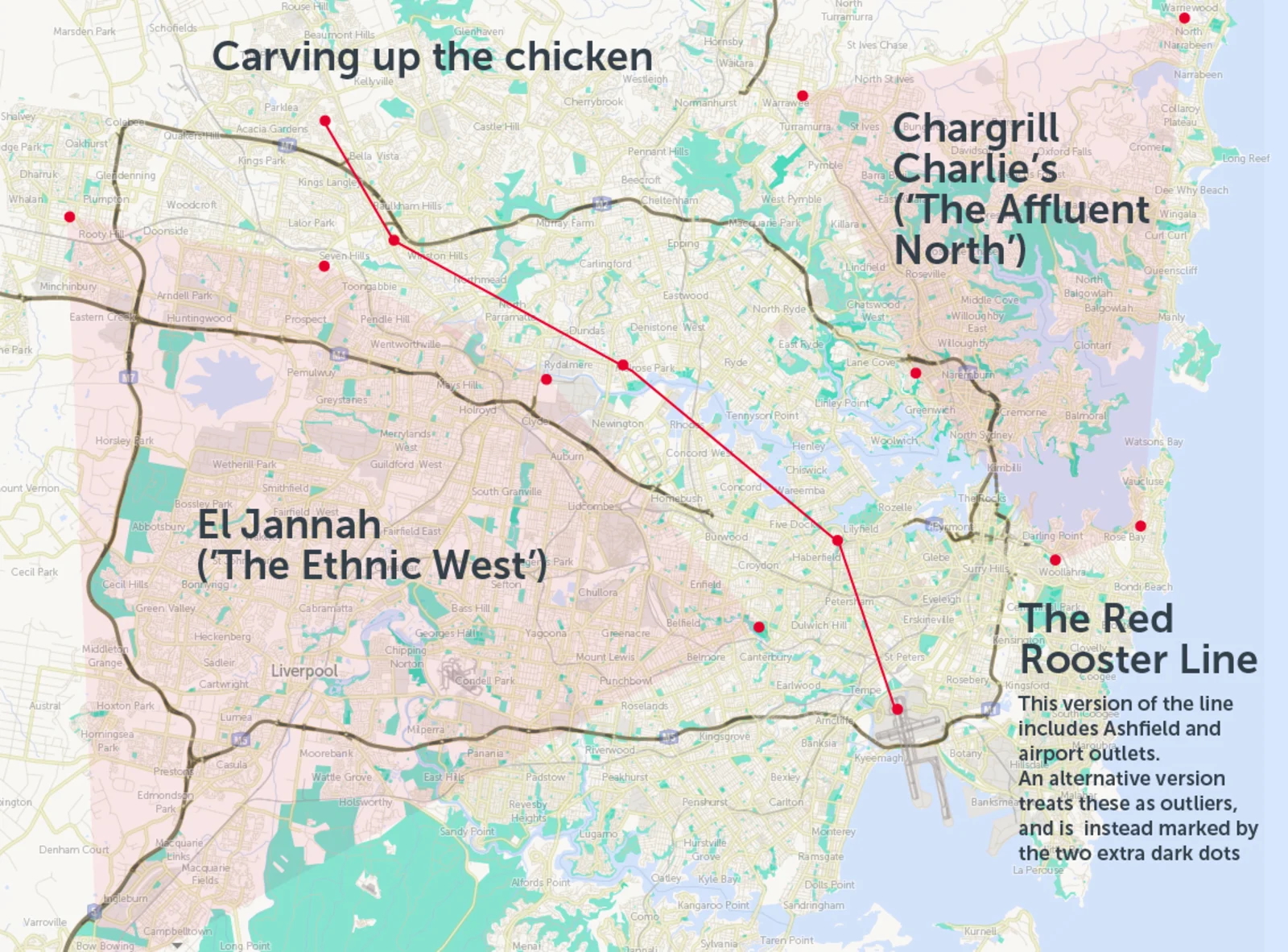

In an article for the Sydney University publication, Honi Soit, student reporters Natassia Chrysanthos and Ann Ding created a ‘food fault lines’ map that traced the locations of all Red Rooster stores across Sydney.

This visual representation highlighted the clustering and segregation of Red Rooster outlets in working-class western suburbs compared with Sydney’s more affluent east and north.

While several Red Rooster locations had once existed in Sydney’s northern beaches suburbs of Dee Why and Mona Vale, they had largely vanished by the 2010s.

The map subsequently went viral on Reddit and Twitter and became known as the ‘Red Rooster Line’.

Although the phenomenon highlighted Red Rooster’s challenges in expanding its presence in Sydney, Ashley Hughes noted that it also brought the brand back into the public eye.

Map originally via Honi Soit and adapted by realestate.com.au.

“I think those things allow us to punch above our weight in cultural conversations that otherwise wouldn’t be heard about the brand. It actually keeps us top of mind to a degree,” Mr Hughes said.

Taylor Fielding agrees, suggesting the Red Rooster Line illustrates the brand’s awareness of its target demographic and strategic planning.

“Understanding your customer is paramount, no matter your industry, and there’s a clear strategy here from Red Rooster to position stores close to its base-clientele,” Mr Fielding told realcommercial.com.au.

“The chance to be part of the culture discourse and be front-of-mind is what many brands chase. I feel the positives far outweigh any negative connotations.”

When asked whether Red Rooster were once again looking to pursue franchise opportunities in the northern suburbs of Sydney, chief development officer of property, Clint Ault, told realcommercial.com.au the company is “always looking for and considering different areas and opportunities, however it essentially depends on site availability”.

Challenger brands and future growth prospects

Longevity and renewed success aside, a 50-year-old brand like Red Rooster faces stiffer competition in 2025 than it did two decades ago.

Fellow longstanding U.S. chain KFC continues to pose a challenge, alongside the rise of newer local brands like Betty’s Burgers, Guzman y Gomez, and popular charcoal chicken establishments such as El Jannah and Frangos.

El Jannah has become a strong competitor of Red Rooster. Picture: Getty

“Differentiation as a brand is becoming harder given more entrants into the market, along with Australians’ fondness for trying something new. We love a good challenger brand, tall poppy syndrome and all,” remarked Taylor Fielding.

“Right now, I’d categorise RR as a Tier 3 brand, so there’s some work to do to be positioned as a direct competitor to the likes of KFC, which spends significant marketing budget on family-focused sports sponsorship with Cricket Australia. I think Red Rooster should lean into its nostalgia as a true Australian brand – that’s a strong card to hold.”

Despite the competition, Mr. Fielding maintains there are ample growth opportunities within the Australian market for a legacy brand like Red Rooster.

Red Rooster Logan City, Queensland. Picture: Sarah Keayes/The Photo Pitch

“Aussies love food and we’re primed for more QSRs. In 2024 alone, we saw 178 new QSRs and fast food stores open on our shores,” he said. “Brands that succeed over time understand their audience. It comes back to the dynamics of this category: taste, value and convenience. We love a well-positioned brand like Red Rooster paired with a good story.”

“There appear to be signs that Red Rooster’s new CEO is looking to compete better at a national level. If she can focus on taste, new menu items and greater visibility within the franchise community, the brand will continue to thrive no matter how overcooked the market may seem.”