Pallas Group puts Double Bay site up for $45m sale

Guilfoyle Avenue in Double Bay.

A venture associated with Sydney property player Pallas Group has put a flagship site in up-market Double Bay on the block, in a move some industry sources said signalled a need for cash.

Sales documents were sent to industry contacts last week promoting the sale of the site at 2 Guilfoyle Ave, which is adjacent to Pallas House the headquarters of the Pallas Group, and features celebrity chef Neil Perry and Baker Bleu as anchor tenants.

The building is slated for a $45m sale being handled through CBRE, after Pallas Group acquired the site in 2019 spruiking plans to redevelop and occupy “the additional top two levels as its Sydney office”.

A company linked to Pallas development unit Fortis purchased the site for $14m in 2021, touting a $47m final value. CBRE associate directors Harry George and Angus Windred and IB Property associate director Dimitrios Franze are handling the sale.

Industry sources said it was unusual for the venture to be selling the site, given the building’s rooftop had been conjoined with Pallas House to use as overspill space for events.

But a Pallas Group spokeswoman said “it was always our intention to sell this property once it was 100 per cent tenanted”. “We expect around $45m, reflecting its premium position and quality,” she said.

The group has rapidly grown both its fundraising and lending business Pallas Capital alongside its development arm Fortis. But the property player has heavily extended itself, with Fortis chewing up large chunks of the total funds raised by Pallas Capital and now saddled with a swath of sites in Sydney and Melbourne.

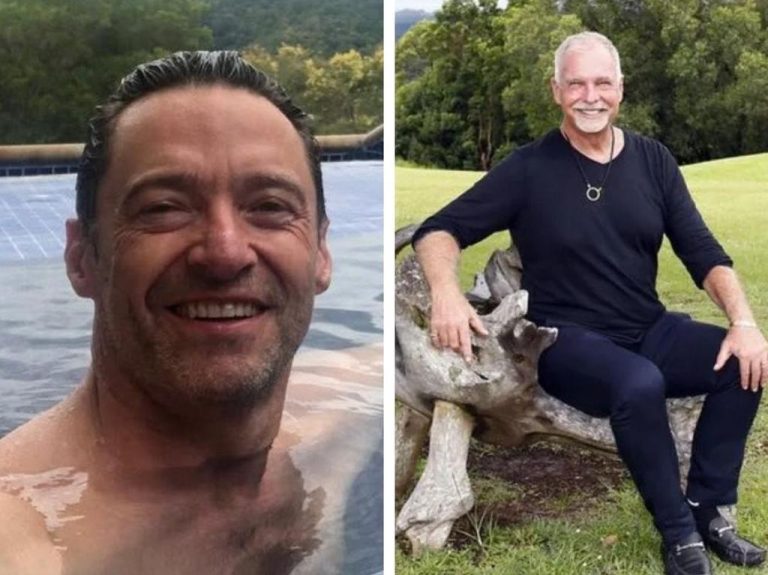

Neil Perry with Mia and Mike Russell at Baker Bleu in Double Bay. Picture: Tim Hunter

Fortis was forced to turn to Harvey Norman boss Gerry Harvey to cover a $50m loan on 2-10 Bay St, Double Bay, after it was unable to secure backing from other investors.

Earlier this year, Pallas Capital reported a $1.63bn loan book across 213 facilities. Fortis is sitting on almost $2.25bn in projects, split almost evenly between Sydney and Melbourne.

Pallas Capital has locked up millions from a bevy of some of Australia’s richest families and business people, with the firm confirming it had more than 800 wealthy backers.

But Pallas has struggled to balance its finance commitments and paying out funds to investors, attracted by the double-digit returns offered by the property player during the doldrums of the Covid-19 pandemic.

Pallas warned noteholders in its Warehouse Trust 3 in December that despite the fund expiring, it would only seek to make 25 per cent capital distributions over coming months.

“During this period, the fund cannot make new loan investments and will progressively redeem notes as loan investments are repaid,” Pallas Funds director Dan Gallen said.

Pallas boss Patrick Keenan has confirmed there had been delays on redemptions on Fortis’ Chambers St project in Melbourne’s inner city suburb South Yarra, with funds intended to be returned to investors in May 2022 not being repaid until August.

“The loan was extended to give time to sell the remaining apartments in the development, with all investors agreeing to the extension,” he said.

Fortis has been looking to sell several sites it locked up in recent years, despite picking several more, including its recent purchase of a 3500sq m site in Woollahra in March. Fortis tried to exit its site in Melbourne’s Clifton Hill for $50m, but failed after investors refused to pay the price.