Melbourne investment trust snags Gold Coast logistics property for $65.52m

Property giant GPT Group has offloaded a Woolworths-anchored logistics property south of Brisbane to a growing real estate investment trust.

Melbourne-based APN Industria REIT paid $65.52m for the multi-tenanted property at 16-28 Quarry Road, Stapylton, in the Yatala Enterprise Area, halfway between Brisbane and the Gold Coast.

According to CoreLogic GPT bought the two-lot asset in 2013 for $44.5m. The latest deal reflected a net yield of 5.75 per cent.

Colliers International’s Simon Beirne, who marketed the property with colleague Gavin Bishop and JLL’s Tony Iuliano and Gary Hyland, said Stapylton was one of Queensland’s strongest growth markets which has been earmarked for significant rental and capital growth prospects

“We are seeing industrial and logistics increasingly being seen as a defensive asset class which are being sought by traditional and new buyers,” he said.

“I believe industrial cap rates should tighten further given the weight of capital which is seeking assets.”

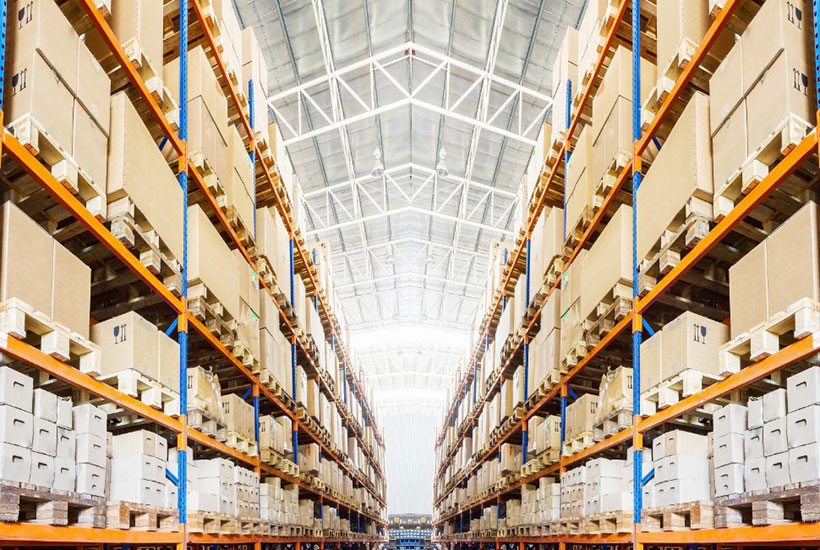

On an 8.15ha site the modern office/warehouses were built in 2007 and have a gross lettable area of 40,970sq m.

They are fully occupied with 55 per cent leased to Woolworths (Endeavour Drinks), 30 per cent to AMES Australasia which is a key supplier to Bunnings while Gilders Transport takes up the remaining 15 per cent.

The property was sold with a 3.2 year weighted average lease expiry.

The acquisition was in conjunction with the purchase of three warehouses at Adelaide Airport for $29.5m which will settle this month and increase the REIT’s portfolio to 37 assets worth $952m.

It was funded by $35m in equity provided by the institutional placement, with the balance drawn from existing and new debt facilities.

The acquisitions are anticipated to result in 5 per cent to 6 per cent annual Funds From Operation accretion.

APN Industria REIT fund manager Alex Abell said: ”The equity raising and acquisitions have been well supported by existing and new investors attracted by the 7.2 per cent initial yield and APN’s track record of consistently delivering on its stated commitments.”

The REIT remains on track to deliver a 17.3 cent distribution per stapled security in 2020-21.

This article originally appeared on www.theaustralian.com.au/property