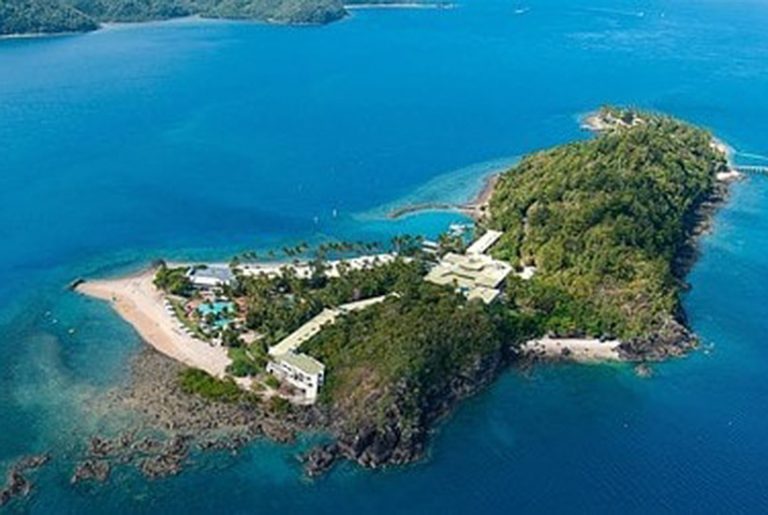

Long Island looking for love again

Increased investor interest in leisure real estate has underpinned a new sales campaign for Long Island Resort — part of the World Heritage-listed Great Barrier Reef — three years after it first hit the market.

Long Island Resort’s marketing campaign will compete with similar endeavours to sell Dunk Island, which has not been renovated since it was almost destroyed by Cyclone Debbie in 2017. Dunk Island’s vendor is former rich-lister Peter Bond, while another well known South Pacific island, Vanuatu’s Irriki Island, is also on the market.

The 8ha Long Island, owned by private investor David Kingston’s Ocean Hotels, hit the market in 2016 with a price tag of about $20 million, but failed to sell. Kingston, previously managing director of investment bank Rothschild, has owned the island for the past 25 years and has appointed CBRE Hotels’ Wayne Bunz and Hayley Manvell to sell it.

Commercial Insights: Subscribe to receive the latest news and updates

The island was popular with offshore investors, with a Middle Eastern group looking to buy it to develop a Six Senses resort just before a cyclone hit in 2017.

“Like Daydream and Hayman, we had some cleaning up and now present the 8ha prime beachfront property with multiple options,” Kingston told The Australian. “An upmarket new boutique resort can be created or the existing 140 guest rooms renovated and relaunched. Also with approvals, extra villas/units can be developed, as Hamilton Island has done.

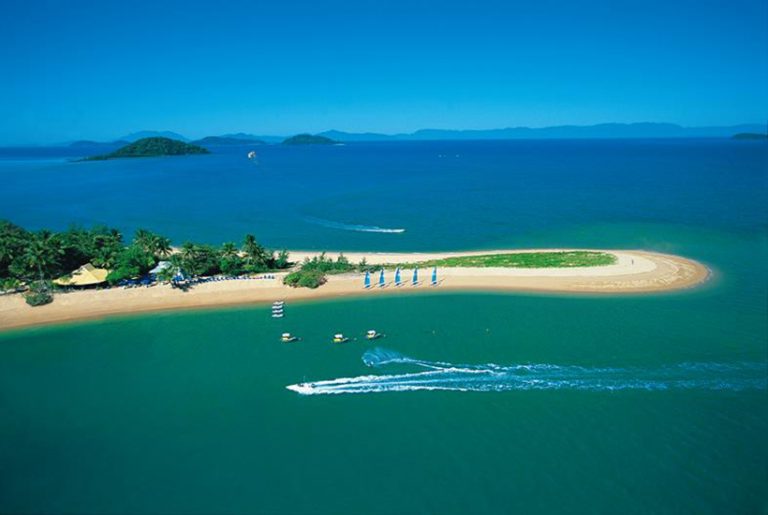

“Long Island has a super prime location between Hamilton Island and Airlie Beach and has extensive frontage to one of the Whitsundays’ best beaches. Its major infrastructure and approvals are extremely hard to replace.”

The sale plans for Long Island Resort coincide with the Queensland government investing $55 million on resort infrastructure as well as several high-profile island resort launches, including Daydream Island which has just undergone a $100 million refurbishment, and the Intercontinental Hayman Island which has had more than $100 million spent on it since it was hit by Cyclone Debbie.

However, plans for the Chinese-owned Lindeman Island remain in abeyance, with little known about its owner White Horse’s plans and no construction timetable set for the island, which once housed a Club Med.

“Queensland’s Great Barrier Reef islands are going through a period of resurgence, underpinned by $55 million in investment from the Queensland government to get the region’s resort sector back open and operating,” Manvell says.

“This investment will facilitate the delivery of critical infrastructure with innovative environmental outcomes and has led to four new or refurbished Great Barrier Reef island resorts opening in 2019.”

Kingston’s Ocean Hotels has engaged PlusArchitecture to prepare plans for Long Island which include 44 luxury villas, a spa, a restaurant, lounge bar and an infinity pool overlooking Happy Bay.

CBRE Hotels’ Bunz says the most successful Australian leisure assets were ultra-luxury, smaller developments such as Qualia, Bedarra Island and the Baillies Lodges, including Southern Ocean Lodge, Longitude 131 and Capella Lodge on Lord Howe Island.

CBRE Hotels is also marketing the Byron at Byron Resort and Spa on behalf of Gerry Harvey and Harvey Norman Holdings with an expected sale price of between $40 million and $50 million. The resort has hit the market for the first time since its 2005 opening.

This article originally appeared on www.theaustralian.com.au/property.