Leader emerges in race for Geelong TAC building

Property funds manager Centuria Capital is again looking to expand its property empire and is heading the field for the Transport Accident Commission building in Geelong that the Impact Investment Group is looking to offload for about $115 million.

Centuria is putting its credentials as a major investor on display with a complex takeover play for the listed Propertylink Group, which has also drawn interest from Asian logistics property group ESR. The Warburg Pincus-backed ESR has also picked up a stake in Centuria, but that is not slowing the pace at which it is growing its empire.

Centuria this week also snapped up two properties in NSW worth just over $200 million as it bolsters its listed and unlisted funds businesses. Centuria’s listed office fund took the bulk of the properties and tapped investment banks UBS and Moelis to raise $60 million.

Commercial Insights: Subscribe to receive the latest news and updates

The trust, Centuria Metropolitan REIT, acquired a 50% interest in the office building at 201 Pacific Highway, St Leonards, in Sydney’s north, for $85.8m with Centuria’s unlisted arm taking the other half of the complex.

The listed office fund also bought an office building in Wollongong from Medibank Private for $33.3 million via a sale and leaseback deal.

Centuria chief executive John McBain declined to comment on the Geelong deal, but says the group’s expanded balance sheet capability allows for a step change in the style of assets it was targeting “as we look to pivot our exposure to larger, more modern assets that still retain the potential for capital upside”.

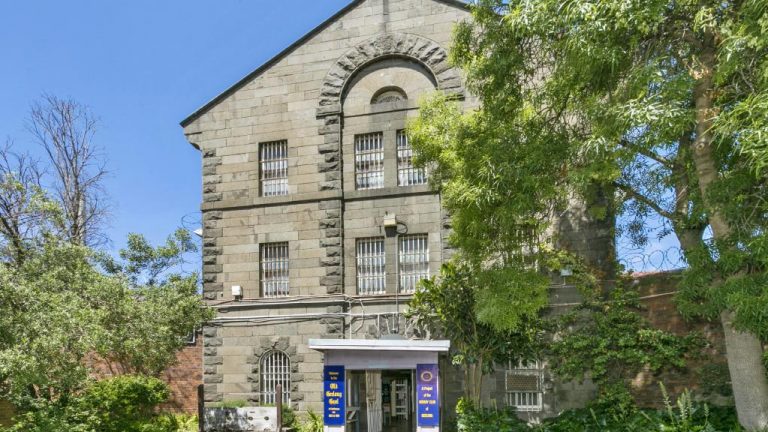

Geelong’s TAC headquarters.

McBain says: “There is tremendous momentum in our business as reflected in our share price, and this continues as we look to 2018. Our funds under management continues to grow and the pipeline of opportunity remains exceptionally strong.”

Centuria says revaluations across its property empire have also increased its funds under management by $115 million.

The TAC building sits on a prime island site of 5475sqm and has uninterrupted views over Corio Bay and the Geelong CBD. But the real drawcard is the 10.76-year weighted average lease expiry.

Impact’s tower was marketed by Knight Frank’s Justin Bond, Neil Brookes and Martin O’Sullivan, but they declined to comment. Impact, led by Danny Almagor, who also heads Small Giants with his wife Berry Liberman, picked up the complex in the Victorian city for $95.8 million in 2014.

The area is winning new tenants. TAC moved from the Melbourne CBD to Geelong in 2009. Victoria’s Worksafe is moving from Melbourne to Geelong to Quintessential’s new office development.

This article originally appeared on www.theaustralian.com.au/property.